MINIMUM AGE OF ADMISSION INTO SCHOOL

- The updated NEP proposes a structure labeled as "5+3+3+4" for the formal education system, corresponding to specific age groups: 3-8 years (referred to as the foundational stage), 8-11 years (known as the preparatory stage), 11-14 years (referred to as the middle stage), and 14-18 years (designated as the secondary stage).

- This reform integrates early childhood education, typically considered as preschool education for children aged 3 to 5 years, into the formal schooling system. Consequently, a child is expected to be 6 years old to qualify for admission into Class 1 after completing a three-year early childhood education program

- Since the introduction of NEP 2020, the Union Education Ministry has been urging States and Union Territories to standardize the age for enrollment in Class 1 to six years, aligning with the new national education policy.

- Across states, the age of entry into Class 1 varies—some enroll students at 5 years old, while others wait until they turn 6. Whenever the Central government reiterates this alignment requirement according to NEP guidelines, it often becomes newsworthy.

- For instance, there was a legal challenge last year when Kendriya Vidyalayas adjusted their admission age from five to six years for Class 1, aiming to comply with NEP 2020 recommendations.

- Some parents contested this change in court, arguing that it was abrupt, just before the February 2022 admission process. Despite their plea, the Delhi High Court dismissed the challenge, a decision later upheld by the Supreme Court.

- Subsequently, after another reminder from the Education Ministry to synchronize entry ages, the Delhi government decided, at least for the ongoing academic year, to follow its existing guidelines based on the Delhi School Education Rules (DSEAR 1973), allowing admission to Class 1 for children below 6 years old.

- The Right to Education (RTE) Act ensures education for children between the ages of 6 and 14. This implies that a child is anticipated to commence primary education, specifically Class 1, at the age of 6.

- Academics involved in formulating the Right to Education legislation indicated that the age of 6 was chosen, aligning with the common global practice in most countries to enroll children in grade one at ages 6 or 7.

- RTE Act had to specify the entry age for enforcement of formal compulsory education which has been ignored even now by many States leading to the confusion of the actual age for admitting students grade1

- David Whitebread, an academic from the Faculty of Education at Cambridge University, in his paper titled ‘School starting age: the evidence,’ discussed the potential need for children to have more time for development before embarking on formal education.

- Whitebread's research highlighted that when comparing groups of children in New Zealand who commenced formal literacy lessons at ages 5 and 7, the outcomes revealed that initiating formal learning approaches to literacy early did not enhance children’s reading development and could even have negative effects.

- By the age of 11, there was no discernible difference in reading ability between the two groups. However, those who started at 5 exhibited less favorable attitudes toward reading and displayed weaker text comprehension compared to those who commenced later.

- Additionally, in a separate study examining reading achievement in 15-year-olds across 55 countries, researchers found no significant correlation between reading proficiency and the age at which students entered school

MOUNT ETNA

Mount Etna is Europe’s most active volcano and one of the largest in the world. Its recorded volcanic activity dates back to 1500 B.C. Since then, it has erupted more than 200 times.

The current eruptions at Etna have led to flight cancellations at nearby Catania airport.

The use of cars and motorbikes has also been banned for 48 hours due to high amounts of ash on the roads. Ash can be slippery and increases the risk of accidents.

3. Other Volcanos

One of the most famous long-term eruptions was Kilauea volcano on Hawaii. Its spewing spree in 1983 continued — almost nonstop — for 35 years until 2018, only to start again in 2021. The eruption is still ongoing

Dukono in Indonesia started erupting in August 1933 and is still continuing. Santa Maria in Guatemala began erupting in June 1922 and continues to this day.

And Yasur in Vanuatu first rumbled to life in about 1270 (± 110 years) and as of June 9, 2023, was still erupting

4. What is a Volcano?

- Volcanoes represent openings or vents through which substances like lava, small rocks (tephra), and steam are expelled onto the Earth's surface. These formations exist both on land and in the ocean and are a consequence of their own eruptions as well as the broader processes shaping our planet, particularly the movement of tectonic plates.

- Mountain ranges such as the Andes in South America and the Rockies in North America, along with volcanoes, came into existence due to the movement and collision of these tectonic plates.

- There exist four primary categories of volcanoes: cinder cones, composite (stratovolcanoes), shield volcanoes, and lava domes. The classification of a volcano is determined by the manner in which the erupted lava flows and how this flow influences the volcano itself, consequently impacting its surrounding environment.

- In essence, it involves magma, the molten rock beneath the Earth's surface, moving upward and overflowing, similar to how boiling milk spills out of a pot on a stove.

- This molten rock, known as magma, travels through openings in the volcano and is expelled onto the land and into the atmosphere. The term used for magma when it erupts from a volcano is "lava."

Scientists are capable of predicting volcanic eruptions hours, or sometimes several days, in advance. This isn’t the case with earthquakes, which are much harder to predict.

Scientists use seismographic data from earthquakes and other tremors, because those can be a precursor to volcanic eruptions.

6. Way forward

Volcanic activity is a critical part of the Earth's natural processes, contributing to the formation of new land, the recycling of elements and minerals, and even influencing Earth's climate over time. However, volcanic eruptions can also pose risks to nearby populations and ecosystems, making the study and monitoring of volcanoes crucial for hazard assessment and mitigation efforts.

|

Previous Year Questions 1.Consider the following statements: (UPSC CSE 2018) 1. The Barren Island volcano is an active volcano located in the Indian territory. 2. Barren Island lies about 140 km east of Great Nicobar. 3. The last time the Barren Island volcano erupted was in 1991 and it has remained inactive since then. Which of the statements given above is/are correct? A.1 only B.2 and 3 C.3 only D.1 and 3 Answer (A) |

Source: Indianexpress

1. Context

2. CCPA observations

- Following the release of results for competitive exams, such as the UPSC Civil Services, coaching institutes often engage in an advertising blitz.

- They utilize the names and images of top rankers to imply that these individuals were enrolled in their courses.

- However, this is often not the case. In many instances, the top rankers only took mock interviews from the institutes.

- The CCPA has observed that the coaching institutes are deliberately concealing important information about the nature of the top rankers' enrolments.

- This information, such as whether they enrolled in a test series, a learning course, or a revision course, should be clearly disclosed in the advertisements.

- Failure to do so constitutes a violation of Section 2(28) of the Consumer Protection Act, 2019.

- First-time violations of the act can result in penalties of up to Rs 10 lakh. Subsequent violations may attract penalties of up to Rs 50 lakh, along with potential legal action.

3. Ecosystem of UPSC coaching

- UPSC recommended a total of 933 candidates post its CSE examinations in 2022.

- However, as observed by CCPA, the total selections claimed by the institutes being

probed exceeded the recommendations significantly the cumulative count was over

3,500. This could also be because of multiple enrolments among students. - At present, four institutes have been fined Chahal Academy, IQRA IAS, Rau’s IAS

Study Circle and IAS Baba. - While IAS Baba has received a stay on the probe from the Karnataka High Court, Rau’s IAS has appealed against the order in the National Consumer Disputes Redressal Commission (NCRDC).

- Other coaching institutes currently being probed include Vajirao and Reddy Institute, KSG- Khan Study Group IAS, Drishti IAS, Sriram IAS, NEXT IAS and Vision IAS, among others.

- During the probe, the institutes were allowed to make their submissions against the allegations of exaggerated claims.

- Their submissions reveal some of the same concerns raised by the CCPA. For example, Khan Study Group claimed that 682 of the 933 selected belonged to their institute.

- However, their submission indicated that 673 students took mock interviews, and 9 students were enrolled in test series and general studies programmes.

- Vajirao and Reddy also professed about 617 selections all of whom took the interview guidance programme.

- Drishti IAS claimed more than 216 selections in their interviews. All of them had taken the interview guidance and mentorship programme.

4. Size and Growth of the Coaching Class Market in India

- Education has become one of the most violated sectors in advertising, with over 3,300 education ads, including those by coaching classes, being processed by the self-regulatory body in the past two years.

- Most violations involve claims of leadership, placement in top colleges, and success guarantees.

- Misleading ads in this category exacerbate the problem and target vulnerable students and parents.

- The coaching class market in India is expected to reach Rs 1.79 lakh crore by 2030, growing at a CAGR of 14.07% from 2023 to 2030.

- Higher education holds the largest market share, accounting for 32.75% in 2022, which is expected to increase to 34.75% over the forecast period.

Factors contributing to the growth and expansion of the coaching classes industry in India:

- Intense competition in the education sector, particularly for entrance and board examinations

- Students and parents turning to coaching classes to gain a competitive edge and improve academic performance

- Early initiation of coaching, typically from 10 years of age, which continues for up to two decades

Delhi is considered the hub of UPSC CSE coaching, while Kota attracts approximately two lakh students annually for IIT-JEE coaching. The demand for associated services, such as rented accommodation and local tiffin services, has increased due to the migration of students to coaching centres. This has led to a surge in demand for rented accommodation, creating a thriving real estate market in these areas.

5. About The Central Consumer Protection Authority

- It is constituted under Section 10(1) of The Consumer Protection Act, 2019.

- It replaces the previous Consumer Protection Act of 1986.

- It aims to address consumer concerns and protect consumer rights and Targets unfair trade practices and false/misleading advertisements.

5.1. Powers of the CCPA

- It is an Authority to investigate violations of consumer rights and unfair trade practices.

- it can initiate investigations suo motu, based on complaints or directives from the central government.

- Ministry of Consumer Affairs, Food, and Public Distribution finalizing rules for CCPA's composition and functioning.

5.2. Structure of the CCPA

- It is a lean body with a Chief Commissioner as the head and Two other commissioners, one responsible for goods and the other for services.

- It is Headquartered in the National Capital Region of Delhi, with the possibility of regional offices.

5.3. Dealing with Dangerous, Hazardous, or Unsafe Goods

- The specific classification of such goods is not mentioned in the Act.

- CCPA ensures adherence to standards set by regulators like the Food Safety and Standards Authority of India (FSSAI).

5.4. Actions against Non-compliant Goods or Services

- Recall goods or withdraw services deemed dangerous, hazardous, or unsafe.

- Order refunds for purchasers of recalled goods or services.

- Discontinue unfair practices prejudicial to consumer interests.

5.5. Penalties for Adulterated Products

- No consumer injury: Fine of up to Rs 1 lakh with imprisonment of up to six months.

- Injury caused: Fine of up to Rs 3 lakh with imprisonment of up to one year.

- Grievous hurt caused: Fine of up to Rs 5 lakh with imprisonment of up to 7 years.

- Death caused: Fine of Rs 10 lakh or more with a minimum imprisonment of 7 years, extendable to life imprisonment.

5.6. Addressing False or Misleading Advertisements

- Section 21 of the Act empowers CCPA to take action against such advertisements.

- CCPA can issue directions to discontinue or modify misleading ads.

- Penalties for manufacturers or endorsers range from fines up to Rs 10 lakh and imprisonment of up to two years.

- Subsequent offences can lead to higher penalties of up to Rs 50 lakh and imprisonment of up to five years.

- CCPA may ban endorsers from making endorsements for up to one year, extending to three years for subsequent violations.

5.7. Additional Powers of the CCPA

- Investigation Wing headed by a Director General.

- Officers can conduct preliminary inquiries, enter premises, and seize relevant documents or articles.

- CCPA can file complaints before Consumer Disputes Redressal Commissions.

- Issuance of safety notices to alert consumers against dangerous or unsafe goods/services.

|

For Prelims: UPSC, Coaching Institutes, Central Consumer Protection Authority, consumer rights, unfair trade, consumer Disputes Redressal Commissions, The Consumer Protection Act, 2019, Consumer Protection Act of 1986, Ministry of Consumer Affairs,

For Mains:

1. Evaluate the implications of coaching institutes engaging in unfair trade practices and making exaggerated claims on the aspirations of students and parents. (250 Words)

|

|

Previous Year Questions

1. With reference to consumer's rights/privileges under the provisions of the law in India, which of the following statements is/are correct? (UPSC 2012)

1. Consumers are empowered to take samples for food testing.

2. When a consumer files a complaint in any consumer forum, no fee is required to be paid.

3. In case of the death of a consumer, his/her legal heir can file a complaint in the consumer forum on his/her behalf.

Select the correct answer using the codes given below:

A. 1 only B. 2 and 3 only C. 1 and 3 only D. 1, 2 and 3

Answer: C

2. With reference to the Consumer Disputes Redressal at district level in India, which one of the following statements is not correct? (UPSC 2010)

A. A State Government can establish more than one District Forum in a district if it deems fit B. One of the members of the District Forum shall be a woman

C. The District Forum entertains the complaints where the value of goods or services does not exceed rupees fifty lakhs

D. A complaint in relation to any goods sold or any service provided may be filed with a District Forum by the State Government as a representative of the interests of the consumers in general

Answer: C 3. Provisions of the Consumer Protection Act, 2019 has come into force since ________. (SSC MTS 2021)

A. 12 March 2020 B. 23 June 2020 C. 30 April 2020 D. 20 July 2020

Answer: D

|

TAX HEAVEN

- Cyprus Confidential involves an extensive examination of 3.6 million documents available in English and Greek.

- This investigation exposes the detailed records of companies established in Cyprus, known for its status as a tax haven, by influential individuals worldwide.

- Conducted in collaboration with the International Consortium of Investigative Journalists (ICIJ), the investigation engaged over 270 journalists from more than 60 media outlets across 55 countries and territories.

- The amassed data originates from six offshore service providers in Cyprus. In addition to details about Indian investors who gained Cypriot citizenship through the Golden Passport program, the documents also encompass information about enterprises formed by prominent business entities to capitalize on the favourable tax system in this Eastern Mediterranean nation

A tax haven refers to a country or jurisdiction with favorable tax laws and regulations, often offering low or no taxes on certain types of income or business activities. These locations attract individuals, businesses, and organizations seeking to minimize their tax liabilities.

Characteristics of a tax haven include:

Low or Zero Tax Rates: Tax havens typically impose very low or zero taxes on specific types of income, such as corporate profits, capital gains, or personal income earned outside the jurisdiction.

Financial Secrecy: They often have strict banking secrecy laws, allowing individuals and entities to keep their financial information private and confidential.

Ease of Doing Business: Tax havens usually offer streamlined business registration processes and minimal regulatory requirements, making it easy for businesses to establish themselves.

Lack of Transparency: Some tax havens lack transparency in financial reporting, making it challenging for authorities in other countries to track money flows and enforce tax laws.

Stable Political and Economic Environment: Generally, tax havens have stable political and economic conditions, attracting individuals and businesses seeking a safe haven for their assets.

Tax havens can be used for legitimate purposes such as international business operations and investment, but they can also be exploited for tax evasion, money laundering, and other illicit financial activities. Many countries and international organizations have been working to increase transparency and reduce tax evasion through agreements and regulations to combat the misuse of tax havens.

3.1.Advantages of Tax Heavens

- Tax havens often impose minimal or zero taxes on specific types of income, such as corporate profits, capital gains, or foreign-derived income, leading to substantial tax reductions for individuals and businesses.

- Tax havens typically have strict banking and financial secrecy laws, ensuring confidentiality and privacy for account holders. This level of privacy can be appealing for individuals and businesses aiming to keep their financial information confidential

- These jurisdictions often provide robust legal structures that can safeguard assets from legal claims, creditors, or other risks. Trusts, foundations, and other legal entities available in tax havens can offer asset protection benefits

- Tax havens usually have simplified regulatory and business registration processes, making it easier and faster for companies to establish themselves. This streamlined process can save time and resources

- Tax havens can serve as strategic locations for managing global operations, facilitating international trade, and reducing tax burdens associated with cross-border transactions

- Many tax havens offer political and economic stability, making them attractive for investments and asset protection purposes. These stable environments can be valuable for individuals seeking a safe haven for their wealth

Offshore tax havens can offer various advantages:

Reduced Taxes: They often impose low or no taxes on income like capital gains, corporate profits, or certain types of personal income, allowing individuals and businesses to reduce their tax burden.

Financial Privacy: Offshore tax havens have strict banking and financial secrecy laws, providing confidentiality and privacy for account holders. This secrecy can shield financial information from scrutiny in the account holder's home country.

Asset Protection: These jurisdictions may provide legal structures that shield assets from legal claims, creditors, or other risks, offering a level of protection for individuals' and businesses' wealth.

Global Business Operations: For multinational corporations, offshore tax havens can be strategic for managing international operations, easing cross-border transactions, and reducing taxes associated with global business activities.

However, offshore tax havens have also faced criticism and scrutiny for their potential role in facilitating tax evasion, money laundering, and other illicit activities. Many countries and international organizations have been working to increase transparency and reduce the misuse of offshore tax havens by implementing regulations, agreements, and measures to combat tax evasion and financial crimes.

5. Way forward

The use of tax havens is subject to international scrutiny due to concerns about tax evasion, money laundering, and their impact on global tax systems. Many countries and international bodies are working to promote transparency and reduce the misuse of tax havens for illegal activities.

|

For Prelims: Current events of national and international importance For Mains: General Studies II: Bilateral, regional and global groupings and agreements involving India and/or affecting India’s Interest |

|

Previous Year Questions 1. Which country is Tax Haven? (Maharashtra Police Constable 2017) A.America B.England C.Canada D.Mauritius Answer (D) |

Source: indianexpress

GENERAL RELATIVITY

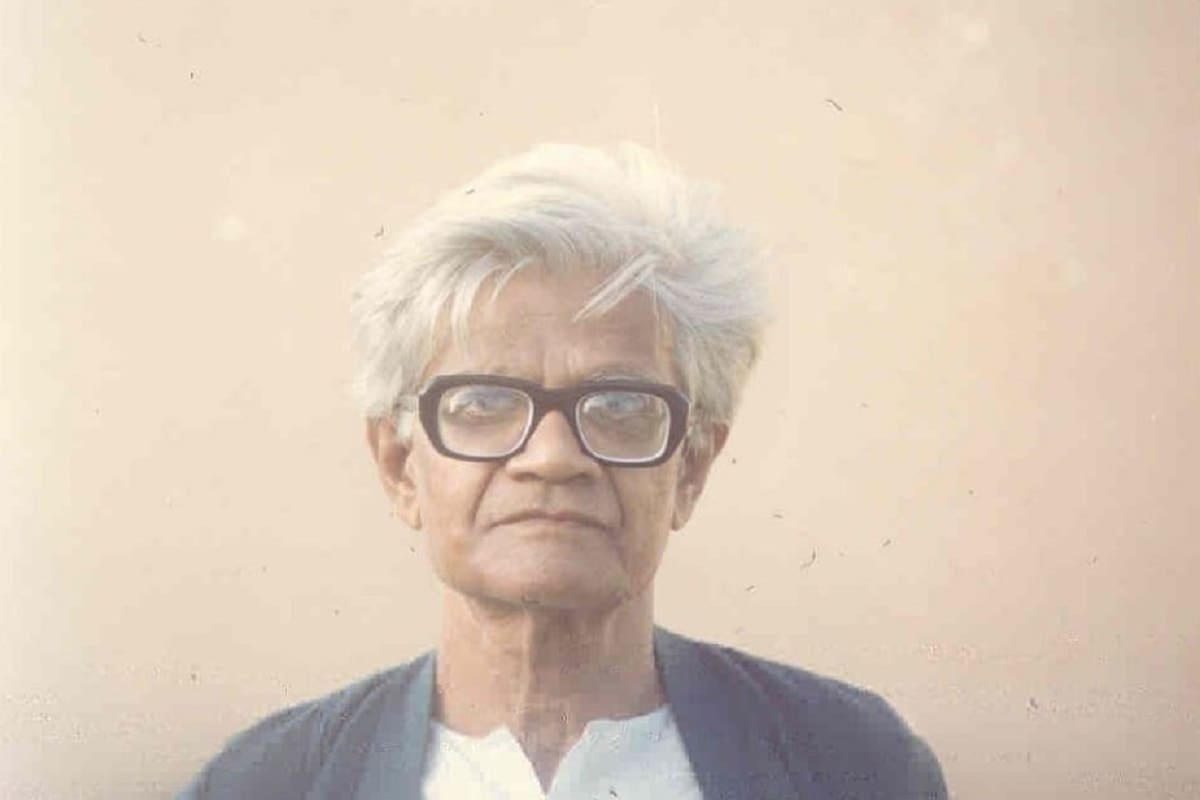

- Amal Kumar Raychaudhuri was an Indian physicist known for his significant contributions to general relativity and theoretical astrophysics. Born in 1923, Raychaudhuri made substantial advancements in the study of gravitational physics.

- His most famous contribution is the Raychaudhuri equation, a crucial result in general relativity that describes how neighboring trajectories of a congruence of geodesics (representing the motion of particles or light rays) in a spacetime converge or diverge under the influence of gravity.

- This equation plays a fundamental role in understanding the behavior of matter and light in gravitational fields, particularly in contexts like black hole physics and the cosmic expansion.

- Raychaudhuri's work had a lasting impact on gravitational physics and cosmology. He made important contributions to the understanding of singularities in general relativity, black hole dynamics, and the cosmic censorship hypothesis, among other areas.

- Throughout his career, Raychaudhuri received recognition for his contributions, including various awards and honors for his groundbreaking work in theoretical physics. He passed away in 2005, leaving behind a legacy that continues to influence our understanding of gravity and the cosmos

- General relativity, formulated by Albert Einstein between 1907 and 1915, is a physics concept explaining gravity through the curvature of space-time. This theory unites space and time as a single entity known as space-time, attributing gravity to this curvature. Analogously, walking on a ball's surface illustrates this curvature, causing a downward curve.

- Einstein's theory relies on equations defining the connection between space-time's geometry and the energy-momentum within it. The solutions to these equations, represented by metric tensors, dictate the space-time's topology and the inertial movement of objects within it.

- However, a fundamental disparity arises between general relativity and quantum mechanics. While quantum mechanics considers time's flow as universal and fixed, general relativity interprets time's passage as flexible and relative

General relativity is described by a set of complex mathematical equations known as Einstein's field equations. These equations are a system of ten interrelated differential equations that describe how matter and energy in spacetime curve it, resulting in gravitational effects.

The full set of Einstein's field equations is quite complex, but in a simplified form, they can be written as:

Here's a brief explanation of the terms:

- represents the Einstein tensor, which describes the curvature of spacetime due to the distribution of matter and energy.

- Λ is the cosmological constant, associated with the energy density of the vacuum and the overall geometry of the universe.

- is the metric tensor, defining the geometry of spacetime.

- is the gravitational constant, determining the strength of gravity.

- is the speed of light in a vacuum.

- represents the stress-energy tensor, which describes the distribution and flow of energy and momentum in spacetime due to matter and other sources.

Quantum theory and general relativity are two pillars of modern physics that describe the behavior of the universe at different scales, yet they present fundamental challenges when combined.

Quantum theory deals with the physics of the very small—particles like electrons, photons, and quarks—governing their behavior through principles like superposition, uncertainty, and wave-particle duality. It's incredibly successful in explaining phenomena at the atomic and subatomic levels.

Source: The Hindu

FEDERAL FRICTIONS

1. Context

2. Changing Economic Landscape

- The economic context of Centre-State relations has evolved significantly since the 1980s and 1990s.

- Ongoing economic reforms since 1991 have relaxed controls on investments, granting some autonomy to States.

- However, the dependency of State governments on the Centre for revenue receipts has limited their absolute autonomy, leading to a more hardened stance on both sides and eroding the foundations of cooperative federalism.

- Beyond resource sharing, conflicts have emerged in areas such as the homogenization of social sector policies, regulatory institutions' functioning, and the powers of central agencies.

- While these policy domains ideally fall under the discretion of States, central bodies often attempt to exert influence, creating tension.

3. Central Dominance

- Crowding Out of States in Investments: The Centre's dominance in investments has led to underinvestment by States. For instance, the Centre's capex on roads has increased at a CAGR of 32.3% since 2015-16, while States' growth has been just 11.2%.

- Peculiar Form of Fiscal Competition: The enhanced fiscal space of the Centre has led to a form of fiscal competition between the Centre and States. This competition diverts focus from regional competition and challenges welfare provisioning.

- Inefficiencies of Parallel Policies: Federal abrasions lead to duplication of policies, as exemplified by pension reforms. The emergence of parallel schemes stems from a trust deficit in the federal system, with long-term economic consequences.

4. Implications of Central Dominance

- The Centre's expanding span of activities has led to crowding out States in terms of investments. Infrastructure development, exemplified by PM Gati Shakti, centralizes planning, limiting State flexibility and resulting in underinvestment.

- Fiscal competition between the Centre and States has emerged, diverting focus from regional competition. The Centre, with enhanced fiscal space, outspends States, leading to challenges in welfare provisioning.

- Federal abrasions contribute to inefficiencies as either the Centre or States duplicate each other's policies. The example of pension reforms illustrates how parallel schemes emerge due to a trust deficit in the federal system, with long-term consequences for the economy.

Interdependence between the Centre and States is crucial for the implementation of laws and policies, particularly in concurrent spheres. Preserving this interdependence is essential for managing the diverse, developing society of India.

5. Conclusion

Addressing the growing frictions in Centre-State relations is vital for fostering cooperative federalism, ensuring efficient policy implementation, and promoting balanced economic development across regions. Finding common ground and building trust between the Centre and States is crucial for the sustainable growth of the Indian economy.

|

For Prelims: Fedreal system, Centre-State Relations, Concurrent list, GDP, economic reforms of 1991, cooperative federalism, PM Gati Shakti, For Mains:

1. Discuss the factors that have contributed to the increase in frequency and intensity of disputes between the Centre and States regarding economic policies in India. (250 Words)

2. Explain the concept of 'cooperative federalism' and discuss its significance in the context of India's federal structure. (250 Words)

|

|

Previous Year Questions

1. In the context of India, which one of the following is the characteristic appropriate for bureaucracy? (UPSC 2020) A. An agency for widening the scope of parliamentary democracy

B. An agency for strengthening the structure of federalism

C. An agency for facilitating political stability and economic growth

D. An agency for the implementation of public policy

Answer: D

2. Which one of the following in Indian Polity is an essential feature that indicates that it is federal in character? (UPSC 2021)

A. The independence of judiciary is safeguarded

B. The Union Legislature has elected representatives from constituent units

C. The Union Cabinet can have elected representatives from regional parties

D. The Fundamental Rights are enforceable by Courts of Law

Answer: A

3. Constitutional government means (UPSC 2021) (a) a representative government of a nation with federal structure

(b) a government whose Head enjoys nominal powers

(c) a government whose Head enjoys real powers

(d) a government limited by the terms of the Constitution

Answer: D

4. Which one of the following is not a feature of Indian federalism? (UPSC 2015) (a) There is an independent judiciary in India.

(b) Powers have been clearly divided between the Centre and the States,

(c) The federating units have been given unequal representation in the Rajya Sabha.

(d) It is the result of an agreement among the federating units.

Answer: D

5. Local self-government can be best explained as an exercise in (UPSC 2015) (a) Federalism

(b) Democratic decentralization

(c) Administrative delegation

(d) Direct democracy

Answer: B 6. The power of the Supreme Court of India to decide disputes between the Centre and the States falls under its (UPSC 2012) (a) advisory jurisdiction

(b) appellate jurisdiction

(c) original jurisdiction

(d) writ jurisdiction

Answer: C 7. The distribution of powers between the Centre and the States in the Indian Constitution is based on the scheme provided in the (UPSC 2012) (a) Morley-Minto Reforms, 1909

(b) Montagu-Chelmsford Act, 1919

(c) Government of India Act, 1935

(d) Indian Independence Act, 1947

Answer: C

8. Consider the following statements

Which of the statements given above is/are correct? (a) 1 only (b) 2 and 3 only (c) 1 and 3 only (d) 1, 2 and 3

Answer: B 9. The Prime Minister ‘Gati Shakti’ scheme is launched by the Government of India for which type of infrastructure development from the following? (SSC CPO 2022) A. Schools and education B. Hospitals C. Agricultural production D. Transport Answer: D 10. Read the following statements related to PM Gati Shakti Yojana and select the correct statement from the given options. (Rajasthan Police Constable 2022) A. It is a national scheme for multi-modal connectivity.

B. It brings 16 ministries under a single digital platform.

C. This program will integrate rail, inland waterways, and ports apart from economic sectors.

D. This program will use ISRO imagery developed by the Bhaskaracharya National Institute of Space Applications and Geo-informatics.

1. A, B, C and D only 2. A and B only 3. A, B and D only 4. A, C and D only Answer: A 11. "Cooperative Federalism" in Centre - State relations is recommended for the first time by (APPSC Group 1 2017) A. Sarkaria Commission

B. Rajamannar Commisson

C. Venkatachaliah Commission

D. M.M. Punchhi Commission

Answer: A 12. With reference to the Indian economy after the 1991 economic liberalization, consider the following statements: (UPSC 2020) 1. Worker productivity (Rs. per worker at 2004-05 prices) increased in urban areas while it decreased in rural areas.

2. The percentage share of rural areas in the workforce steadily increased.

3. In rural areas, the growth in the non-farm economy increased.

4. The growth rate in rural employment decreased.

Which of the statements given above is/are correct?

A. 1 and 2 only B. 3 and 4 only C. 3 only D. 1, 2 and 4 only Answer: C Mains 1. Explain the significance of the 101st Constitutional Amendment Act. To what extent does it reflect the accommodative spirit of federalism? (UPSC 2023)

2. From the resolution of contentious issues regarding the distribution of legislative powers by the courts, ‘Principle of Federal Supremacy’ and ‘Harmonious Construction’ have emerged. Explain. (UPSC 2019)

3. Did the Government of India Act, 1935 lay down a federal constitution? Discuss. (UPSC 2016)

4. The concept of cooperative federalism has been increasingly emphasized in recent years. Highlight the drawbacks in the existing structure and the extent to which cooperative federalism would answer the shortcomings. (UPSC 2015)

|

Source: The Hindu