SPECIAL INTENSIVE REVISION (SIR)

- The Special Intensive Revision (SIR) of the Electoral Rolls is an important exercise undertaken by the Election Commission of India (ECI) to ensure that the voter lists (electoral rolls) are accurate, updated, and inclusive before any major election or as part of the annual revision cycle.

- In simpler terms, the SIR is a comprehensive verification and correction process of the electoral rolls — aimed at including eligible voters, removing ineligible ones, and rectifying errors in the existing list.

- It is called “special” because it involves an intensified, house-to-house verification and greater public participation compared to the routine annual summary revision

- The purpose of the Special Intensive Revision is to maintain the purity, accuracy, and inclusiveness of India’s democratic process. Clean and updated voter rolls are essential for free, fair, and credible elections, as they prevent issues like bogus voting, disenfranchisement, and duplication.

- In summary, the Special Intensive Revision (SIR) is a focused, large-scale voter verification campaign conducted by the Election Commission to ensure that the electoral rolls are error-free, inclusive, and reflective of the current eligible voting population. It plays a crucial role in strengthening the integrity and transparency of India’s electoral system

|

During the Special Intensive Revision, Booth Level Officers (BLOs) visit households to verify voter details such as name, address, age, and photo identity. This exercise helps identify:

|

- Article 324(1) of the Indian Constitution empowers the Election Commission of India (ECI) with the authority to oversee, guide, and manage the preparation of electoral rolls as well as the conduct of elections for both Parliament and the State Legislatures.

- As per Section 21(3) of the Representation of the People Act, 1950, the ECI holds the right to order a special revision of the electoral roll for any constituency, or part of it, at any time and in a manner it considers appropriate.

- According to the Registration of Electors’ Rules, 1960, the revision of electoral rolls may be carried out intensively, summarily, or through a combination of both methods, as directed by the ECI.

- An intensive revision involves preparing an entirely new roll, while a summary revision deals with updating or modifying the existing one

| Aspect | Special Intensive Revision (SIR) | National Register of Citizens (NRC) |

| Purpose | To verify, update, and correct the electoral rolls so that all eligible voters are included and ineligible names are removed | To identify legal citizens of India and detect illegal immigrants |

| Authority / Governing Body | Conducted by the Election Commission of India (ECI) | Conducted under the Ministry of Home Affairs (MHA) |

| Legal Basis | Based on Article 324(1) of the Constitution, Section 21(3) of the Representation of the People Act, 1950, and the Registration of Electors' Rules, 1960. | Governed by the Citizenship Act, 1955 and the Citizenship (Registration of Citizens and Issue of National Identity Cards) Rules, 2003 |

| Scope | Focuses only on Indian citizens aged 18 years and above who are eligible to vote | Covers all residents of India (or a particular state) to determine their citizenship status |

| Nature of the Exercise | A regular, recurring administrative exercise carried out to maintain accurate voter lists | A special, large-scale verification exercise conducted under specific legal or political mandates. |

| Relation to Citizenship | Does not determine citizenship — only eligibility to vote | Directly determines citizenship status |

One of the major concerns is the erroneous deletion of eligible voters from the rolls.

-

Mistakes during house-to-house verification or data entry may lead to legitimate voters—especially migrants, daily-wage workers, and marginalized communities—being left out.

-

Such exclusions can directly affect voter participation and undermine the democratic process.

Despite the intensive verification, fake or duplicate names often remain due to poor coordination or outdated records.

-

Deaths, migrations, or multiple registrations in different constituencies are not always updated accurately.

-

This raises questions about the accuracy and credibility of the electoral rolls.

The SIR is a large-scale field operation requiring trained personnel, coordination among departments, and robust data systems.

-

Booth Level Officers (BLOs) are often overburdened with multiple duties and may not have sufficient time or training for thorough verification.

-

Limited digital infrastructure in rural areas can also hamper real-time data updates.

Electoral roll revisions, especially when conducted close to elections, can spark political allegations of bias or manipulation.

-

Parties may accuse each other or the Election Commission of targeting specific communities or constituencies.

-

Even unintentional errors can lead to trust deficits in the electoral process.

Addressing these concerns is vital to maintain trust in the Election Commission and uphold the credibility of India’s democratic system

|

For Prelims: Special Intensive Revision (SIR), National Register of Citizens (NRC), Election Commission of India (ECI)

For Mains: GS II - Indian Polity

|

Previous year Question1. Consider the following statements: (UPSC 2017)

1. The Election Commission of India is a five-member body.

2. Union Ministry of Home Affairs decides the election schedule for the conduct of both general elections and bye-elections.

3. Election Commission resolves the disputes relating to splits/mergers of recognized political parties.

Which of the statements given above is/are correct?

A. 1 and 2 only

B. 2 only

C. 2 and 3 only

D. 3 only

Answer: D

2. Consider the following statements : (UPSC 2021)

1. In India, there is no law restricting the candidates from contesting in one Lok Sabha election from three constituencies.

2. In the 1991 Lok Sabha Election, Shri Devi Lal contested from three Lok Sabha constituencies.

3. As per the- existing rules, if a candidate contests in one Lok Sabha election from many constituencies, his/her party should bear the cost of bye-elections to the constituencies vacated by him/her in the event of him/her winning in all the constituencies.

Which of the statements given above is/are correct?

A. 1 only

B. 2 only

C. 1 and 3

D. 2 and 3

Answer: B

Mains

1.To enhance the quality of democracy in India the Election Commission of India has proposed electoral reforms in 2016. What are the suggested reforms and how far are they significant to make democracy successful? (UPSC CSE 2017)

|

FREEBIES TO WELFARE

1. Context

2. About Freebies

- Freebies in politics are goods or services that are given away for free by political parties or candidates to win votes.

- They can be anything from free food and drinks to free laptops and smartphones.

- Freebies have become increasingly common in political campaigns in recent years.

- The freebie culture is not new to India. It has been around for many years, but it has become more prevalent in recent years.

- There are several different reasons why the freebie culture has become so popular. Some people believe that freebies are a way to help the poor, while others believe that they are a way to buy votes.

- The freebie culture has several negative consequences. It can lead to unsustainable debt levels, it can distort the economy, and it can harm the poor.

- The prime minister is not the only one who has spoken out against the freebie culture. Several economists and policymakers have also expressed concerns about the dangers of this culture.

- There are several different ways to address the freebie culture. The government could focus on providing essential services, it could use technology to target welfare programs more effectively, or it could simply raise taxes.

3. The Perils of the Freebie Culture

- They can lead to unsustainable debt levels. When governments give away free stuff, they have to find a way to pay for it. This often means increasing taxes or borrowing money. In the long run, this can lead to a debt crisis.

- Freebies can distort the economy. When people get free stuff, they have less incentive to work and save. This can lead to lower economic growth.

- Freebies can harm the poor. Often, freebies are not targeted at the people who need them the most. Instead, they are given to everyone, regardless of their income level. This means that the poor may not benefit from freebies at all, while the rich may benefit disproportionately.

4. Types of Freebies and Welfare Schemes

- Political parties in India often promise a range of freebies and welfare schemes, such as free healthcare services, subsidized or free education, subsidized housing, free electricity or water, and distribution of essential commodities.

- These schemes are designed to directly benefit certain sections of society, such as farmers, women, students, or low-income households.

5. Impact on Election Outcomes

- Freebies and welfare schemes can have a significant impact on election outcomes, as they appeal to voters who may see immediate benefits from such promises.

- Parties strategically target specific voter groups based on their needs and interests, aiming to secure their support and votes.

6. Criticism and Concerns

- Critics argue that the distribution of freebies and welfare schemes can create a culture of dependency on the government, hinder economic growth, and lead to unsustainable fiscal policies.

- There are concerns about the long-term impact on the economy, such as increased fiscal deficits, inflationary pressures, and a potential burden on future generations.

7. Effectiveness and Implementation

- The effectiveness of freebies and welfare schemes varies. While some schemes have successfully reached their intended beneficiaries and improved their well-being, others have faced challenges in implementation, including corruption, mismanagement, and targeting issues.

- Evaluating the implementation and impact of these schemes is crucial to assess their effectiveness.

8. Role of the Election Commission

- The Election Commission of India plays a crucial role in monitoring election campaigns and enforcing the Model Code of Conduct.

- It aims to ensure a level playing field for all political parties, including monitoring the distribution of freebies during elections and taking action against any violations.

9. Conclusion

For freebies and welfare in Indian elections, it is essential to analyze the potential benefits and drawbacks of such initiatives, their impact on the economy and society, and the role of responsible governance in ensuring their effective implementation while maintaining long-term sustainability.

|

For Prelims: freebies, Election Commission of India, Political Parties

For Mains:

1. Discuss the impact of the freebies culture and welfare schemes on Indian elections. How do these promises influence voter behaviour and election outcomes? (250 Words)

|

IMPEACHMENT OF A JUDGE

- The impeachment of a judge is a formal process by which a judge is removed from office for misconduct or incapacity. It is a serious matter that requires a high degree of evidence and a rigorous legal process.

- In India, the impeachment process is governed by the Judges Inquiry Act, 1968. The process can be initiated by either the Lok Sabha (lower house of Parliament) or the Rajya Sabha (upper house of Parliament). To initiate the process, a minimum of 100 members of the Lok Sabha or 50 members of the Rajya Sabha must sign a notice.

- Once the notice is received, a motion for impeachment is moved in the respective house. If the motion is passed by a special majority (two-thirds of the members present and voting), the matter is referred to a committee of inquiry. The committee investigates the allegations against the judge and submits a report to the respective house.

- If the committee finds the allegations to be true, the house can pass a resolution for the removal of the judge. The resolution must also be passed by a special majority in the other house. Finally, the President of India issues an order removing the judge from office.

- The impeachment process is a complex and lengthy one. It is designed to ensure that judges are held accountable for their actions, but also to protect them from frivolous or politically motivated attacks

-

Initiation:

- A motion must be signed by:

- 100 Members of Lok Sabha, or

- 50 Members of Rajya Sabha.

- The motion is submitted to the Speaker (Lok Sabha) or the Chairman (Rajya Sabha).

- A motion must be signed by:

-

Preliminary Inquiry:

- The Speaker/Chairman decides whether to admit the motion.

- If admitted, a three-member committee is constituted to investigate. This committee consists of:

- A Supreme Court judge.

- A High Court Chief Justice.

- A distinguished jurist.

-

Investigation by the Committee:

- The committee examines evidence and determines whether the charges are valid.

- If charges are proven, the process continues in Parliament.

-

Parliamentary Approval:

- Both Houses of Parliament must approve the motion with a special majority:

- A majority of the total membership of the House.

- A majority of not less than two-thirds of members present and voting.

- Both Houses of Parliament must approve the motion with a special majority:

-

Presidential Assent:

- Once both Houses approve, the motion is sent to the President.

- The President orders the judge's removal.

Justice V. Ramaswami (Supreme Court Judge, 1993)

- Allegations:

Misuse of office, including extravagant spending on official residence and irregularities in financial matters. - Process:

- An inquiry committee was set up, which found him guilty of several charges.

- However, the impeachment motion in the Lok Sabha failed as the Congress Party abstained from voting, preventing the required special majority.

- Outcome:

Justice Ramaswami was not removed but became the first judge against whom impeachment proceedings were initiated.

Justice Soumitra Sen (Calcutta High Court, 2011)

- Allegations:

Misappropriation of funds while acting as a court-appointed receiver in 1993, prior to his appointment as a judge. - Process:

- An impeachment motion was passed in the Rajya Sabha with a majority.

- Before the Lok Sabha could vote, Justice Sen resigned, making the impeachment process moot.

- Outcome:

Justice Sen avoided impeachment by resigning.

Justice Dipak Misra (Chief Justice of India, 2018)

- Allegations:

Misuse of authority, including irregularities in assigning cases and other charges. - Process:

- An impeachment motion was signed by 71 members of the Rajya Sabha and submitted to the Chairman.

- The Rajya Sabha Chairman, Venkaiah Naidu, rejected the motion, stating it lacked substantial merit.

- Outcome:

The impeachment did not proceed

Types of Majority Rules in Indian Parliament:

- Most common voting procedure

- Requires more than half of the members present and voting

- Used for:

- Passing ordinary legislation

- Routine parliamentary decisions

- No-confidence motions

- Most day-to-day parliamentary proceedings

- Requires support of more than 50% of the total membership of the house

- Includes members not just present, but the entire strength of the house

- Used for:

- Passing money bills

- Confidence motions

- Electing the Speaker of Lok Sabha

- Removing the Speaker from office

- Requires support of two-thirds of members present and voting

- Used for:

- Constitutional amendments

- Impeachment of President

- Declaring a national emergency

- Passing certain critical resolutions

- Requires a special majority for certain constitutional amendments

- Needs majority of total membership AND two-thirds of members present and voting

- Specific percentage of total membership required

- Often used in specific constitutional provisions

- Typically ranges between 50-66% depending on the specific constitutional requirement

- Considers actual voting strength after subtracting abstentions

- Relevant in scenarios with multiple parties and complex parliamentary dynamics

- Less common, but used in some specific parliamentary procedures

- Gives different weights to votes based on certain predefined criteria

Important Considerations:

- Quorum requirements must be met for voting

- Voting can be by voice vote, division (counted vote), or ballot

- Electronic voting has been introduced in recent years

- Presiding officer has significant discretion in interpreting majority rules

|

For Prelims: Article 368 (most amendments, except for a few requiring ratification by states)

For Mains: GS Paper II - Governance, Constitution, and Judiciary

|

RUPEE EXCHANGE RATE

Exchange rate for 1 Indian Rupee (INR) is as follows:

- United States Dollar (USD): 0.012011 INR

- Euro (EUR): 0.011223 INR

- British Pound (GBP): 0.009784 INR

- Australian Dollar (AUD): 0.018827 INR

- Singapore Dollar (SGD): 0.016343 INR

- Swiss Franc (CHF): 0.010845 INR

- Malaysian Ringgit (MYR): 0.056619 INR

- Japanese Yen (JPY): 1.824210 INR

- If the rupee experiences a faster depreciation rate than its long-term average, it surpasses the dotted line, and vice versa.

- Over the past couple of years, the rupee has demonstrated greater resilience than the long-term trend, but the current decline indicates a correction.

- When considering a diverse range of currencies, data indicates that the rupee has strengthened or appreciated against this basket.

- To clarify, while the US dollar has strengthened against various major currencies, including the rupee, the rupee, in contrast, has strengthened compared to many other currencies like the euro. For example, forex reserves have decreased by over $50 billion between September 2021 and now. Over these 10 months, the rupee's exchange rate with the dollar has declined by 8.7%, from 73.6 to 80.

- To provide context, historically, the rupee typically depreciates by around 3% to 3.5% in a year. Moreover, many experts anticipate further weakening of the rupee in the next 3-4 months, potentially falling to as low as 82 to a dollar.

When the rupee depreciates, it has several implications:

Import Costs: Imported goods and services become more expensive, as it takes more rupees to buy the same amount of foreign currency needed for these transactions. This can contribute to inflationary pressures in the economy.

Export Competitiveness: On the positive side, a depreciated rupee can make the country's exports more competitive in the global market. Foreign buyers find the country's products and services relatively cheaper, potentially boosting export volumes.

External Debt: Countries with significant external debt denominated in foreign currencies may face increased repayment burdens when their domestic currency depreciates. Servicing debt in stronger foreign currencies becomes more expensive.

Inflation: Depreciation can contribute to inflationary pressures by increasing the cost of imported goods and raw materials.

5. Effects on the Indian economy

- Due to a substantial portion of India's imports being priced in dollars, these imports will become more expensive.

- An illustrative example is the higher cost associated with the crude oil import bill. The increased expense of imports, in turn, will contribute to the expansion of the trade deficit and the current account deficit.

- This, in consequence, will exert pressure on the exchange rate. On the export side, the situation is more complex, as noted by Sen.

- In bilateral trade, the rupee has strengthened against many currencies. In exports conducted in dollars, the impact is contingent on factors such as how much other currencies have depreciated against the dollar.

- If the depreciation of other currencies against the dollar is greater than that of the rupee, the overall effect could be negative.

|

For Prelims: Inflation, Deflation, Depreciation, Appreciation

For Mains: General Studies III: How does Depreciation of rupee affect Indian economy

|

|

Previous Year Questions

1. Which one of the following groups of items is included in India's foreign exchange reserves? (UPSC CSE 2013)

A.Foreign-currency assets, Special Drawing Rights (SDRs) and loans from foreign countries B.Foreign-currency assets, gold holdings of the RBI and SDRs

C.Foreign-currency assets, loans from the World Bank and SDRs

D.Foreign-currency assets, gold holdings of the RBI and loans from the World Bank

Answer (B)

2.Which one of the following is not the most likely measure the Government/RBI takes to stop the slide of Indian rupee? (UPSC CSE 2019)

A.Curbing imports of non-essential goods and promoting exports

B.Encouraging Indian borrowers to issue rupee-denominated Masala Bonds

C.Easing conditions relating to external commercial borrowing

D.Following an expansionary monetary policy

Answer (D)

|

CRITICAL MINERALS

- Rare Earth Elements (REEs): neodymium, dysprosium, terbium

- Lithium

- Cobalt

- Graphite

- Gallium

- Indium

- Tungsten

- Platinum Group Metals (PGMs)

.jpg)

- Minerals such as copper, lithium, nickel, and cobalt, along with certain rare earth elements, are considered critical due to their essential role in the global transition to greener and cleaner energy sources.

- According to the International Energy Agency (IEA), the demand for lithium surged by 30% in 2023, with nickel, cobalt, graphite, and rare earth elements experiencing growth between 8% and 15%, collectively valued at $325 billion.

- The IEA's Global Critical Minerals Outlook 2024 report indicates that achieving the world's goal of limiting global warming to 1.5 degrees Celsius within a net-zero emissions framework will necessitate a significant increase in demand for these minerals.

- By 2040, copper demand is projected to rise by 50%, nickel, cobalt, and rare earth elements by 100%, graphite by 300%, and lithium by 800%, which is vital for battery production.

- Developing sustainable supply chains for these minerals is therefore crucial. In India, the absence of readily available reserves has led to complete import dependence for minerals such as lithium, cobalt, and nickel.

- Although India possesses natural reserves of several critical minerals, they remain largely unexplored and untapped. For example, despite holding 11% of the world's ilmenite deposits, which is the primary source of titanium dioxide used in numerous applications, India still imports a billion dollars' worth of titanium dioxide annually, as noted by former Mines Secretary Vivek Bharadwaj.

- Additionally, the "lucky" discovery of lithium reserves in the Union Territory of Jammu and Kashmir (J&K) by the Geological Survey of India (GSI) while exploring for limestone has raised hopes for achieving some level of self-sufficiency in lithium. Announced in February as India's first lithium find, these reserves are estimated at 5.9 million tonnes, prompting the government to expedite their extraction.

- Recognizing the risks of relying on a limited number of countries for these minerals and their processing, the central government amended the Mines and Minerals (Development and Regulation) Act, 1957 in August 2023 to allow mining concessions for 24 critical and strategic minerals.

|

For Prelims: Critical minerals, Ministry of Mines, carbon emissions, cleaner energy, lithium, cobalt, nickel, graphite, tin, copper, Selenium, Cadmium, Centre of Excellence on critical minerals, Australia's CSIRO, Geological Survey of India,

For Mains:

1. What are critical minerals? Discuss their significance for a country's economic development and national security. Explain how the identification of critical minerals helps in reducing import dependency and ensuring resource security. (250 Words)

|

|

Previous Year Questions

1. With reference to the mineral resources of India, consider the following pairs: (UPSC 2010)

Mineral 90%Natural sources in

1. Copper Jharkhand

2. Nickel Orissa

3. Tungsten Kerala

Which of the pairs given above is/are correctly matched?

A. 1 and 2 only B. 2 only C. 1 and 3 only D. 1, 2 and 3

Answer: B

2. Recently, there has been a concern over the short supply of a group of elements called 'rare earth metals.' Why? (UPSC 2012)

1. China, which is the largest producer of these elements, has imposed some restrictions on their export.

2. Other than China, Australia, Canada and Chile, these elements are not found in any country. 3. Rare earth metals are essential for the manufacture of various kinds of electronic items and there is a growing demand for these elements.

Which of the statements given above is/are correct?

A. 1 only B. 2 and 3 only C. 1 and 3 only D. 1, 2 and 3

Answer: C

3. In India, what is the role of the Coal Controller's Organization (CCO)? (UPSC 2022)

1. CCO is the major source of Coal Statistics in Government of India.

2. It monitors progress of development of Captive Coal/Lignite blocks.

3. It hears any objection to the Government's notification relating to acquisition of coal-bearing areas.

4. It ensures that coal mining companies deliver the coal to end users in the prescribed time. Select the correct answer using the code given below:

A. 1, 2 and 3 B. 3 and 4 only C. 1 and 2 only D. 1, 2 and 4

Answer: A

4. Which of the following statements best describes the term 'Social Cost of Carbon'? It is a measure, in monetary value, of the (UPSC 2020)

A. long-term damage done by a tonne of CO2 emission in a given year.

B. requirement of fossil fuels for a country to provide goods and services to its citizens, based on the burning of those fuels.

C. efforts put in by a climate refugee to adapt to live in a new place.

D. contribution of an individual person to the carbon footprint on the planet Earth.

Answer: A

5. Direction: It consists of two statements, one labelled as ‘Statement (I)’ and the others as ‘Statement (II)’. You are to examine these two statements carefully and select the answer using the codes given below: (UPSC ESE 2018)

Statement (I): Green energy refers to one which does not harm the ecosystem of planet earth. Statement (II): All renewable energy is green energy.

A. Both Statement (I) and Statement (II) individually true and Statement (II) is the correct explanation of Statement (I)

B. Both statement (I) and Statement (II) are individually true, but Statement (II) is not the correct explanation of Statement (I)

C. Statement (I) is true, but Statement (II) is false

D. Statement (I) is false, but Statement (II) is true

Answer: C

6. Which type of battery is used in the recently launched world's first fully electric cargo ship by change? (Delhi Police Constable 2017)

A. Lead Acid B. Manganese C. Lithium ion D. Nickel metal hydride

Answer: C

7. White gold is an alloy of (UPSC CAPF 2022)

A. gold, nickel and palladium

B. gold, cobalt and palladium

C. gold, titanium and platinum

D. gold, magnesium and palladium

Answer: A

8. Graphene is frequently in news recently. What is its importance? (UPSC 2012)

1. It is a two-dimensional material and has good electrical conductivity.

2. It is one of the thinnest but strongest materials tested so far.

3. It is entirely made of silicon and has high optical transparency.

4. It can be used as 'conducting electrodes' required for touch screens, LCDs and organic LEDs. Which of the statements given above are correct?

A. 1 and 2 only B. 3 and 4 only C. 1, 2 and 4 only D. 1, 2, 3 and 4

Answer: C

9. Graphite and diamonds are__________. (WBCS Prelims 2020)

A. isotopes B. isomers C. isotones D. allotropes

Answer: D

10. Consider the following statements: (UPSC 2020)

1. Coal ash contains arsenic, lead and mercury.

2. Coal-fired power plants release sulphur dioxide and oxides of nitrogen into the environment. 3. High ash content is observed in Indian coal.

Which of the statements given above is/are correct?

A. 1 only B. 2 and 3 only C. 3 only D. 1, 2 and 3

Answer: D

11. Which of the following can be found as pollutants in the drinking water in some parts of India? (UPSC 2013)

1. Arsenic

2. Sorbitol

3. Fluoride

4. Formaldehyde

5. Uranium

Select the correct answer using the codes given below.

A. 1 and 3 only B. 2, 4 and 5 only C. 1, 3 and 5 only D. 1, 2, 3, 4 and 5

Answer: C

12. In the context of solving pollution problems, what is/are the advantage/advantages of the bioremediation technique? (UPSC 2017)

1. It is a technique for cleaning up pollution by enhancing the same biodegradation process that occurs in nature.

2. Any contaminant with heavy metals such as cadmium and lead can be readily and completely treated by bioremediation using microorganisms.

3. Genetic engineering can be used to create microorganisms specifically designed for bioremediation.

Select the correct answer using the code given below:

A. 1 only B. 2 and 3 only C. 1 and 3 only D. 1, 2 and 3

Answer: C

13. Due to improper/indiscriminate disposal of old and used computers or their parts, which of the following are released into the environment as e-waste? (UPSC 2013)

1. Beryllium

2. Cadmium

3. Chromium

4. Heptachlor

5. Mercury

6. Lead

7. Plutonium

Select the correct answer using the codes given below.

A. 1, 3, 4, 6 and 7 only B. 1, 2, 3, 5 and 6 only

C. 2, 4, 5 and 7 only D. 1, 2, 3, 4, 5, 6 and 7

Answer: B

14. When was the Geological Survey of India (GSI) of India founded? (UPRVUNL Staff Nurse 2021)

A. 1851 B. 1951 C. 1871 D. 1931

Answer: A

|

FREE TRADE AGREEMENT

1. Context

2. About the Free Trade Agreement

- A Free Trade Agreement (FTA) is an agreement between two or more countries to reduce or eliminate barriers to trade, such as tariffs, quotas, and subsidies.

- FTAs can also include provisions on other issues, such as investment, intellectual property, and labour standards.

- The goal of an FTA is to promote trade and economic growth between the signatory countries.

- By reducing or eliminating trade barriers, FTAs can make it easier for businesses to export their goods and services to other countries, which can lead to increased production, employment, and innovation.

3. Types of Free Trade Agreement

- Bilateral Free Trade Agreement (BFTA) involves two countries, aiming to promote trade and eliminate tariffs on goods and services between them. It establishes a direct trade relationship, allowing for a more focused and tailored agreement between the two nations.

- Multilateral Free Trade Agreement (MFTA) Involving three or more countries, an MFTA seeks to create a comprehensive trade bloc, promoting economic integration on a larger scale. It requires coordination among multiple parties, addressing diverse economic interests and fostering a broader regional economic landscape.

- Regional Free Trade Agreement (RFTA) involves countries within a specific geographic region, aiming to enhance economic cooperation and integration within that particular area. It focuses on addressing regional economic challenges and fostering collaboration among neighbouring nations.

- Preferential Trade Agreement (PTA) involves a reciprocal reduction of tariffs and trade barriers between participating countries, granting preferential treatment to each other's goods and services. It allows countries to enjoy trading advantages with specific partners while maintaining autonomy in their trade policies with non-participating nations.

- Comprehensive Economic Partnership Agreement (CEPA) is a broad and advanced form of FTA that goes beyond traditional trade barriers, encompassing various economic aspects such as investment, intellectual property, and services. It aims for a more comprehensive economic partnership, encouraging deeper integration and collaboration between participating countries.

- Customs Union While not strictly an FTA, a Customs Union involves the elimination of tariffs among member countries and the establishment of a common external tariff against non-member nations. It goes beyond standard FTAs by harmonizing external trade policies, creating a unified approach to trade with the rest of the world.

- Free Trade Area (FTA) with Trade in Goods (TIG) and Trade in Services (TIS): Some FTAs specifically emphasize either trade in goods or trade in services, tailoring the agreement to the specific economic strengths and priorities of the participating countries. This approach allows nations to focus on areas where they have a comparative advantage, fostering specialization and efficiency.

4. India's Free Trade Agreements

India is a member of several free trade agreements (FTAs) and is currently negotiating others. India's FTAs have helped to reduce trade barriers and promote trade and economic growth. They have also helped to attract foreign investment and create jobs.

- The South Asian Free Trade Agreement (SAFTA) was signed in 1995 by the seven countries of the South Asian Association for Regional Cooperation (SAARC). SAFTA aims to reduce or eliminate tariffs on trade between the member countries.

- The India-Bangladesh FTA was signed in 2010 and came into force in 2011. It is a comprehensive FTA that covers goods, services, and investments.

- The India-Sri Lanka FTA was signed in 1999 and came into force in 2000. It is a comprehensive FTA that covers goods, services, and investments.

- The India-ASEAN Free Trade Agreement was signed in 2002 and came into force in 2010. It is a comprehensive FTA that covers goods, services, and investments.

- The India-Korea Comprehensive Economic Partnership Agreement (CEPA) was signed in 2010 and came into force in 2011. It is a comprehensive FTA that covers goods, services, and investments.

- The India-Japan Comprehensive Economic Partnership Agreement(CEPA) was signed in 2022 and came into effect in 2023. It is a comprehensive FTA that covers goods, services, and investments.

- The India-UAE Comprehensive Partnership Agreement (CEPA) was signed in 2022 and came into effect in 2022. It is a comprehensive FTA that covers goods, services, and investments.

- The India-Australia Economic Cooperation and Trade Agreement (ECTA) was signed in 2022 and came into effect in 2022. It is a comprehensive FTA that covers goods, services, and investments.

- The India-Malaysia Comprehensive Economic Cooperation Agreement (CECA) was signed in 2010 and aims to enhance economic ties by addressing trade in goods and services, as well as investment and other areas of economic cooperation.

- The India-Thailand Free Trade Agreement was signed in 2003 and focuses on reducing tariffs and promoting trade in goods and services between India and Thailand.

- The India-Singapore Comprehensive Economic Cooperation Agreement (CECA) has been operational since 2005, this agreement covers trade in goods and services, as well as investment and intellectual property.

- The India-Nepal Trade Treaty While not a comprehensive FTA, India and Nepal have a trade treaty that facilitates the exchange of goods between the two countries.

- The India-Chile Preferential Trade Agreement was signed in 2006 and aims to enhance economic cooperation and reduce tariffs on certain products traded between India and Chile.

5. India - UK Free Trade Agreement

5.1. Background

- Both countries have agreed to avoid sensitive issues in the negotiations.

- The interim (early harvest agreement) aims to achieve up to 65 per cent coverage for goods and up to 40 per cent coverage for services.

- By the time the final agreement is inked, the coverage for goods is expected to go up to "90 plus a percentage" of goods.

- India is also negotiating a similar early harvest agreement with Australia, which is supposed to set the stage for a long-pending Comprehensive Economic Cooperation Agreement that both countries have been pursuing for nearly a decade.

- While the commencement of negotiations does mark a step forward in the otherwise rigid stance adopted and when it comes to trade liberalisation, experts point to impediments and the potential for legal challenges going ahead.

5.2. GATT (General Agreement on Trade and Tariffs)

- The exception to the rule is full-scale FTAs, subject to some conditions.

- One rider, incorporated in Article XXIV.8 (b) of GATT, stipulates that a deal should aim to eliminate customs duties and other trade barriers on "Substantially all the trade" between the WTO member countries that are signatories to an FTA.

- For this Agreement, a free-trade area shall be understood to mean a group of two or more customs territories in which the duties and other restrictive regulations of commerce are eliminated on substantially all the trade between the constituent territories in products originating in such territories.

- It is often beneficial to negotiate the entire deal together, as an early harvest deal may reduce the incentive for one side to work towards a full FTA.

- These agreements are not just about goods and services but also issues like investment.

- If you are trying to weigh the costs and benefits, it is always better to have the larger picture in front of you.

- In the case of the early harvest agreement inked with Thailand, automobile industry associations had complained that relaxations extended to Bangkok in the early harvest had reduced the incentive for Thailand to work towards a full FTA.

- Early harvest agreements may serve the function of keeping trading partners interested as they promise some benefits without long delays, as India becomes known for long-drawn negotiations for FTAs.

- Government emphasis on interim agreements may be tactical so that a deal may be achieved with minimum commitments and would allow for contentious issues to be resolved later.

|

For Prelims: Free Trade Agreement, India-U.K, Bilateral Free Trade Agreement, G-20 Summit, Agenda 2030, Covid-19 Pandemic, SAARC, General Agreement on Trade and Tariffs, Comprehensive Economic Partnership Agreement, Multilateral Free Trade Agreement, Regional Free Trade Agreement, Preferential Trade Agreement, Customs Union,

For Mains:

1. Evaluate the potential impact of the India-UK FTA on the Indian economy, considering both positive and negative aspects (250 Words)

2. Critically evaluate the significance of Free Trade Agreements (FTAs) in promoting trade and economic growth, considering their potential benefits and drawbacks. (250 Words)

|

|

Previous Year Questions

1. Consider the following countries:

1. Australia

2. Canada

3. China

4. India

5. Japan

6. USA

Which of the above are among the free-trade partners' of ASEAN? (UPSC 2018)

A. 1, 2, 4 and 5 B. 3, 4, 5 and 6 C. 1, 3, 4 and 5 D. 2, 3, 4 and 6

Answer: C

2. Increase in absolute and per capita real GNP do not connote a higher level of economic development, if (UPSC 2018) (a) Industrial output fails to keep pace with agricultural output. Answer: C 3. The SEZ Act, 2005 which came into effect in February 2006 has certain objectives. In this context, consider the following: (2010)

Which of the above are the objectives of this Act? (a) 1 and 2 only (b) 3 only (c) 2 and 3 only (d) 1, 2 and 3 Answer: A 4. A “closed economy” is an economy in which (UPSC 2011) (a) the money supply is fully controlled Answer: D 5. With reference to the “G20 Common Framework”, consider the following statements: (UPSC 2022)

1. It is an initiative endorsed by the G20 together with the Paris Club. 2. It is an initiative to support Low Income Countries with unsustainable debt. Which of the statements given above is/are correct? (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 Answer: C

|

CYBER CRIME

2. About cybercrime

Cybercrime is essentially any illegal activity that involves computers, networks, or digital devices. Criminals can use these tools to steal data, commit fraud, disrupt computer systems, or cause other harm. Some common types of cybercrime include:

- Stealing someone's personal information like their name, Social Security number, or credit card details to impersonate them and commit fraud.

- Tricking people into giving up their personal information or clicking on malicious links by disguising emails or websites as legitimate ones.

- Malicious software that can be installed on a computer to steal data, damage files, or disrupt operations.

- Gaining unauthorized access to a computer system or network to steal data, install malware, or cause damage.

3. What is NCRP?

The National Cybercrime Reporting Portal is an online platform established by the government of India to facilitate the reporting of cybercrimes by citizens. The portal allows individuals to report incidents of cybercrime in a streamlined and accessible manner.

Key features and functions of the National Cybercrime Reporting Portal include

- Individuals can report various types of cybercrimes such as online harassment, financial fraud, ransomware attacks, and identity theft. The portal provides specific categories for different types of cyber incidents to ensure proper documentation and handling.

- The portal places a special emphasis on crimes related to women and children, providing a dedicated section to report cases of online harassment, child pornography, and other related offences.

- The portal allows users to report crimes anonymously if they choose, ensuring the confidentiality and privacy of the complainant.

- Once a complaint is filed, the portal provides a tracking number which can be used to follow up on the status of the complaint.

- The portal offers resources and guidelines on how to protect oneself from cybercrime, as well as information on legal recourse and support available for victims.

The Indian Cyber Crime Coordination Centre (I4C), established by the Ministry of Home Affairs (MHA), is essentially India's central command centre for combating cybercrime.

Functions

- The I4C serves as a focal point for coordinating efforts between various Law Enforcement Agencies (LEAs) across the country to tackle cybercrime effectively.

- It facilitates the exchange of information on cybercrime investigations, cyber threat intelligence, and best practices among LEAs. This allows for a more unified approach to combating cyber threats.

- The I4C is citizen-centric. It played a role in launching the National Cybercrime Reporting Portal (NCRP) which allows people to report cybercrime complaints online. There's also a National Cybercrime Helpline (1930) to report incidents and get assistance.

- The I4C identifies the need for adapting cyber laws to keep pace with evolving technology. They recommend amendments to existing laws and suggest the creation of new ones if necessary.

- The I4C works with academia and research institutes to develop new technologies and forensic tools to aid in cybercrime investigations.

- They promote collaboration between the government, industry, and academia to raise awareness about cybercrime and develop standard operating procedures (SOPs) for containing and responding to cyberattacks.

5. What is the Budapest Convention?

The Budapest Convention, also known as the Council of Europe Convention on Cybercrime, is the world's first international treaty specifically designed to address cybercrime. It came into effect in 2004 with three main objectives:

- The convention aims to improve how countries investigate cybercrime by setting standards for collecting electronic evidence and fostering cooperation between law enforcement agencies.

- It facilitates cooperation among member states in tackling cybercrime. This includes sharing information, assisting with investigations, and extraditing cybercriminals.

- The convention encourages member countries to harmonize their national laws related to cybercrime. This creates a more unified approach to defining and prosecuting cyber offences.

India's Stand: India is not currently a party to the Budapest Convention. There are concerns that some provisions, like data sharing with foreign law enforcement agencies, might infringe on India's national sovereignty. India has also argued that it wasn't involved in drafting the initial convention.

6. What is the Global Cybersecurity Index?

The Global Cybersecurity Index (GCI) is an initiative by the International Telecommunication Union (ITU) to measure and rank the cybersecurity capabilities of countries around the world. The index provides insights into the commitment of countries to cybersecurity at a global level, assessing their strengths and identifying areas for improvement. The key aspects of the Global Cybersecurity Index

Purpose

- To promote cybersecurity awareness and foster a global culture of cybersecurity.

- To encourage countries to enhance their cybersecurity infrastructure and strategies.

- To facilitate knowledge sharing and cooperation among nations.

Assessment Criteria

The GCI evaluates countries based on five main pillars:

- Examines the existence of cybersecurity legislation and regulatory frameworks.

- Assesses the implementation of cybersecurity technologies and technical institutions.

- Looks at national cybersecurity strategies, policies, and dedicated agencies.

- Evaluate the availability of cybersecurity education, training, and awareness programs.

- Measures the extent of international and national cooperation in cybersecurity efforts.

Impact

The GCI serves several important functions:

- Provides a benchmarking tool for countries to assess their cybersecurity maturity.

- Helps policymakers identify gaps and prioritize areas for improvement.

- Encourages international cooperation and collaboration to tackle global cyber threats.

7. The challenges related to cyber security in India

India faces numerous challenges related to cybersecurity, reflecting its rapidly growing digital economy and increasing reliance on technology.

Increasing Cyber Threats:

- India has seen a significant rise in cybercrimes, including hacking, phishing, ransomware attacks, and identity theft. Sophisticated, state-sponsored attacks targeting critical infrastructure and sensitive data are becoming more common.

- Many public and private sector systems rely on outdated technology, making them vulnerable to attacks. Inadequate implementation of robust cybersecurity measures and protocols leaves systems exposed.

- There is a significant gap in the number of trained cybersecurity experts needed to protect against and respond to cyber threats. Ongoing education and training programs are insufficient to keep pace with evolving cyber threats.

- The absence of a unified regulatory framework complicates cybersecurity management. While laws like the IT Act 2000 exist, enforcement and implementation remain inconsistent and weak.

- Many individuals and small businesses lack awareness of basic cybersecurity practices. Practices like using weak passwords, not updating software, and falling for phishing scams are common.

- The absence of robust data protection legislation makes it difficult to safeguard personal and sensitive data. Ensuring privacy and protection of personal information remains a significant challenge.

- Effective cybersecurity often requires international cooperation, which is currently limited and inconsistent. Cross-border cyber threats and geopolitical tensions complicate collaboration and response efforts.

- The rapid adoption of IoT devices, often with minimal security features, increases vulnerabilities. While AI can enhance security, it also introduces new risks and attack vectors.

- Sectors like banking, healthcare, and energy are increasingly targeted, requiring enhanced protection measures. Ensuring coordinated efforts among various governmental and private entities involved in critical infrastructure protection is challenging.

- Limited financial resources allocated for cybersecurity initiatives hinder the development and implementation of comprehensive security measures.

- Staying abreast of the latest cybersecurity technologies and tools is difficult due to financial and logistical constraints.

|

For Prelims: Cyber Crime, Artificial Intelligence, Internet of Things, Indian Cyber Crime Coordination Centre, National Cybercrime Reporting Portal, Budapest Convention, Global Cybersecurity Index, International Telecommunication union

For Mains:

1. India witnesses a high number of cybercrimes originating from Southeast Asia. Analyze the challenges this poses for Indian Law Enforcement Agencies and suggest measures to improve cross-border cooperation in tackling cybercrime. (250 words)

2. What are the key functions of the Indian Cyber Crime Coordination Centre (I4C)? Critically evaluate its effectiveness in combating cybercrime in India. (250 words)

3. The rise of Internet of Things (IoT) devices introduces new vulnerabilities in cyberspace. Analyze the cybersecurity challenges posed by IoT and suggest measures to mitigate these risks. (250 words)

|

|

Previous Year Questions

1. In India, under cyber insurance for individuals, which of the following benefits are generally covered, in addition to payment for the loss of funds and other benefits? (UPSC 2020)

1. Cost of restoration of the computer system in case of malware disrupting access to one's computer

2. Cost of a new computer if some miscreant wilfully damages it, if proved so

3. Cost of hiring a specialized consultant to minimize the loss in case of cyber extortion

4. Cost of defence in the Court of Law if any third party files a suit

Select the correct answer using the code given below:

A.1, 2 and 4 only B.1, 3 and 4 only C.2 and 3 only D.1, 2, 3 and 4

2. Global Cyber Security Index (GCI) 2020 is released by which of the following organizations? (RRB Clerk Mains 2021)

A. World Bank

B. United Nations Development Programme

C. International Telecommunication Union

D. World Economic Forum

E. None of these

Answers: 1-D, 2-C

|

HOUSEHOLD CONSUMPTION EXPENDITURE SURVEY (HCES)

- The Ministry of Statistics and Programme Implementation (MoSPI) initiated two consecutive surveys on household consumption expenditure for 2022-23 and 2023-24, following the normalization of conditions after the COVID-19 pandemic.

- The first survey, conducted from August 2022 to July 2023, had its summary results published as a factsheet in February 2024, with the detailed report and unit-level data released in June 2024.

- The Household Consumption Expenditure Survey (HCES) gathers data on household spending on goods and services, offering insights into economic trends, poverty, inequality, and social exclusion.

- It also updates the basket of goods and weights for the Consumer Price Index. The Monthly Per Capita Consumption Expenditure (MPCE) derived from the HCES serves as a crucial indicator for analytical purposes

- The estimated average Monthly Per Capita Consumption Expenditure (MPCE) for 2023-24 in rural and urban India is Rs. 4,122 and Rs. 6,996, respectively, excluding the value of items received for free through social welfare programs. When the imputed value of these free items is considered, the estimates rise to Rs. 4,247 for rural areas and Rs. 7,078 for urban areas.

- In nominal terms, the average MPCE (without imputation) grew by approximately 9% in rural areas and 8% in urban areas compared to 2022-23 levels. The urban-rural MPCE gap has also narrowed, decreasing to 70% in 2023-24 from 71% in 2022-23 and 84% in 2011-12, reflecting consistent consumption growth in rural areas.

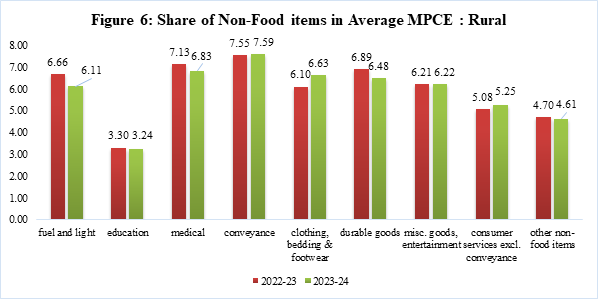

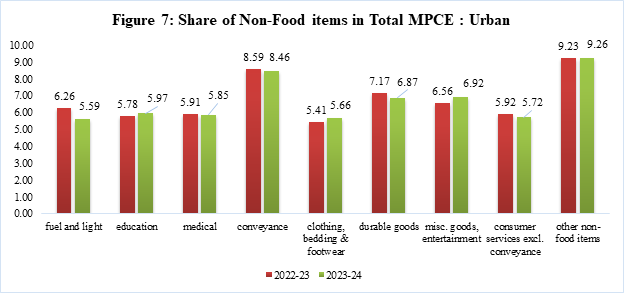

- The largest increase in average MPCE from 2022-23 to 2023-24 occurred among the bottom 5-10% of the population in both rural and urban areas. Following the trend from the 2022-23 HCES, non-food items accounted for the majority of household expenditure in 2023-24, comprising about 53% of MPCE in rural areas and 60% in urban areas.

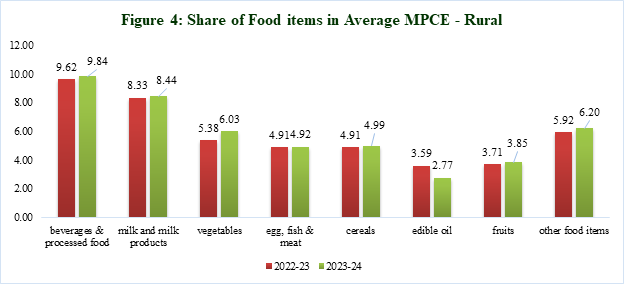

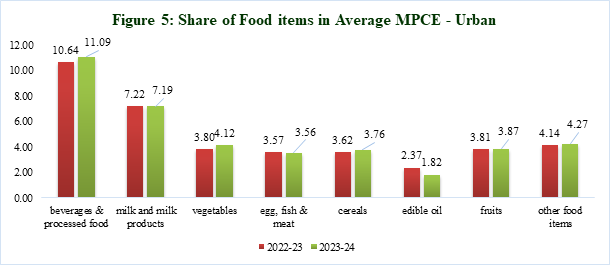

- Within the food category, beverages, refreshments, and processed foods continued to dominate household spending in 2023-24. Non-food expenditure remained concentrated in categories such as conveyance, clothing, bedding, footwear, miscellaneous goods, entertainment, and durable goods. For urban households, rent—including house rent, garage rent, and accommodation charges—accounted for around 7% of non-food expenditure.

- Consumption inequality has decreased in both rural and urban areas. The Gini coefficient for rural areas declined from 0.266 in 2022-23 to 0.237 in 2023-24, while in urban areas, it fell from 0.314 to 0.284 during the same period

- Households across all States and Union Territories spend a larger portion of their budget on non-food items, with non-food expenditure accounting for 53% of the average MPCE in rural areas and 60% in urban areas.

- The key areas of non-food spending in 2023-24 include: (i) Conveyance, (ii) clothing, bedding & footwear, (iii) miscellaneous goods & entertainment, and (iv) durable goods. In urban areas, rent makes up around 7% of non-food expenditure.

- As in 2022-23, beverages and processed foods remain the largest contributors to food expenditure in 2023-24, followed by milk and milk products, and vegetables.

- A comparison of the contribution of various item categories to household consumption expenditure in both rural and urban areas for 2022-23 and 2023-24 is provided in Figures 4, 5, 6, and 7

|

For Prelims: Current events of national and international importance For Mains: General Studies III: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment |