PARTICULARLY VULNERABLE GROUPS (PVTG)

- Particularly Vulnerable Tribal Groups (PVTGs) are specific indigenous communities in India that face an exceptionally high risk of vulnerability and marginalization due to various factors like geographic isolation, social and economic deprivation, and historical injustices.

- These groups are identified based on criteria set by the Indian government, considering their unique cultural practices, distinct languages, and social customs that set them apart from the larger population.

- PVTGs receive special attention and support from government agencies and NGOs to protect their distinct identities, preserve their cultural heritage, improve their living conditions, and ensure their socio-economic development. Various welfare schemes and initiatives are directed towards these groups to address their specific needs, including access to healthcare, education, livelihood opportunities, land rights, and basic amenities. The aim is to empower these communities while respecting their traditions and way of life

- The actual number of PVTGs is around 63, accounting for overlaps and repetitions, as per the publication ‘The Particularly Vulnerable Tribal Groups of India — Privileges and Predicaments’ by the Anthropological Survey of India

- Baseline surveys have only been conducted for about 40 PVTG groups, emphasising the need for targeted development planning.

- In India, the identification and declaration of Particularly Vulnerable Tribal Groups (PVTGs) is done by the Ministry of Tribal Affairs at the national level, in collaboration with state governments. The identification process involves specific criteria and guidelines set by the government to assess the vulnerability and distinctiveness of tribal communities

- Odisha (formerly Orissa) in India is known to have the highest number of Primitive Tribal Groups (PTGs). This state is home to a significant population of indigenous or tribal communities, some of which are categorized as Primitive Tribal Groups due to their isolated lifestyle, unique cultural practices, and historical marginalisation.

The development of Particularly Vulnerable Tribal Groups (PVTGs) faces several challenges, primarily due to their unique circumstances, cultural isolation, historical marginalization, and specific vulnerabilities.

Some of the key challenges include:

- Many PVTGs reside in remote and geographically isolated areas, which pose challenges in terms of accessibility for delivering essential services like healthcare, education, and infrastructure development

- PVTGs often face economic deprivation, lack of livelihood opportunities, and limited access to resources. Poverty and inadequate infrastructure exacerbate their challenges

- Balancing the preservation of their distinct cultural identities and traditions with the need for socio-economic development poses a challenge. Development interventions must be culturally sensitive and respect their traditional practices

- PVTGs frequently experience health disparities and inadequate access to healthcare facilities. Malnutrition and lack of awareness about modern healthcare practices are common concerns

- Limited access to quality education due to factors like language barriers, lack of schools in remote areas, and cultural differences hampers educational development among PVTGs

- Disputes over land rights and lack of secure land tenure affect their livelihoods. Encroachment on their traditional lands and displacement due to development projects further exacerbate these challenges

- PVTGs are vulnerable to exploitation due to their marginalized status. They often face social discrimination, human rights violations, and exploitation in labor and other spheres

4.Government's Approach in addressing the Issues

- Participatory approach from the grassroots level: Rather than a standardized approach, the program tailors strategies to suit the unique requirements of PVTGs, actively engaging them in decision-making related to land rights, social integration, and cultural conservation. This method, rooted in community involvement, embraces their customs, beliefs, and traditions, ensuring their active involvement in the planning, execution, and oversight of development endeavors.

- Enhancing livelihoods: Empowering through skill-building programs and providing resources such as land and credit facilitates sustainable livelihoods. Implementation of the Forest Rights Act, specifically Section 3(1)(e) for the rights of primitive tribal groups and pre-agricultural communities, secures their access to forest resources. Encouraging traditional techniques and skill enhancement via partnerships with industries contributes to preserving cultural heritage alongside sustainable progress.

- Health, nutrition, and education focus: Deploying outreach methods like Mobile Medical Health Units becomes imperative in remote regions. Tailoring these strategies to address specific health concerns like teenage pregnancies and dental health, and bridging language and cultural gaps through trained healthcare personnel or recruiting community members is vital. Collaborating with trusted traditional healers can also assist in addressing intricate health challenges.

- Incorporating their language and culture into educational curricula, offering transportation services, and training educators about PVTG cultural contexts enhance educational accessibility. Additionally, incentivizing staff working in PVTG areas and establishing specialized educational institutions catering to PVTG needs can augment opportunities for these communities.

- Infrastructure development challenges: The settlements of PVTGs often fail to meet requirements for schemes like the Pradhan Mantri Grameen Sadak Yojana, Pradhan Mantri Awas Yojana, and Jal Jeevan Mission due to factors like population thresholds or insufficient surveys

Several schemes and initiatives have been introduced by the Indian government to address the needs and uplift the living standards of Particularly Vulnerable Tribal Groups (PVTGs). Some of these schemes include:

-

Vanbandhu Kalyan Yojana: Launched by the Ministry of Tribal Affairs, this scheme aims to improve the socio-economic status of tribal communities, including PVTGs, by focusing on areas like education, healthcare, livelihood, and infrastructure development.

-

Scheduled Tribes Component (STC): Under this scheme, funds are allocated to states to implement various development programs for tribal communities, including PVTGs. These funds support initiatives related to education, health, housing, and skill development.

-

Special Central Assistance to Tribal Sub-Schemes (SCA to TSS): This scheme provides financial assistance to tribal development projects, including those focused on PVTGs, aimed at their socio-economic empowerment.

-

Forest Rights Act (FRA): Implementation of the Forest Rights Act is crucial for securing land and resource rights for tribal communities, including PVTGs, allowing them access to forest resources and improving their livelihoods.

-

Eklavya Model Residential Schools (EMRS): EMRS aims to provide quality education to tribal children, including those from PVTGs, by establishing residential schools with modern facilities and educational resources.

-

Integrated Tribal Development Agencies (ITDAs): These agencies work on comprehensive development plans for tribal areas, including PVTG regions, focusing on education, healthcare, infrastructure, and livelihood promotion.

-

Tribal Sub-Plan (TSP) and Tribal Development Blocks (TDBs): These plans and blocks are dedicated to tribal development, including PVTGs, ensuring targeted allocation of funds for their socio-economic upliftment

|

For Prelims: Indian Polity and Governance-Constitution, Political System, Panchayati Raj, Public Policy, Rights Issues, etc.

For Mains: General Studies II: Government policies and interventions for development in various sectors and issues arising out of their design and implementation

|

|

Previous Year Questions 1. Consider the following statements about Particularly Vulnerable Tribal Groups (PVTGs) in India: (UPSC 2019)

1. PVTGs reside in 18 States and one Union Territory.

2. A stagnant or declining population is one of the criteria for determining PVTG status.

3. There are 95 PVTGs officially notified in the country so far.

4. Irular and Konda Reddi tribes are included in the list of PVTGs.

Which of the statements given above are correct?

A. 1, 2 and 3 B. 2, 3 and 4 C. 1, 2 and 4 D. 1, 3 and 4

Answer: C 2. With reference to the history of India, "Ulgulan" or the Great Tumult is the description of which of the following events? (UPSC 2020) A. The Revolt of 1857

B. The Mappila Rebellion of 1921

C. The Indigo Revolt of 1859 - 60

D. Birsa Munda's Revolt of 1899 - 1900

Answer: D 3. When did the Tana’ Bhagat Movement start? (Jharkhand Civil Service 2015)

A. April 1912 B. April 1913 C. April 1914 D. April 1915

Answer: C

4. Consider the following statements about the Santhal Hool of 1855 - 56: (UPSC CAPF)

1. The Santhals were in a desperate situation as tribal lands were leased out

2. The Santhal rebels were treated very leniently by British officials

3. Santhal inhabited areas were eventually constituted separate administrative units called Santhal parganas

4. The Santhal rebellion was the only major rebellion in mid-19th century India.

Which of the statements given above is/are correct?

A. 1 only B. 2 and 3 C. 1, 3 and 4 D. 1 and 3 only

Answer: D

5. After the Santhal Uprising subsided, what was/were the measure/measures taken by the colonial government? (UPSC 2018)

1. The territories called 'Santhal Paraganas' were created.

2. It became illegal for a Santhal to transfer land to a non-Santhal.

Select the correct answer using the code given below:

A. 1 only B. 2 only C. Both 1 and 2 D. Neither 1 nor 2

Answer: C

6. The National Commission for Backward Classes (NCBC) was formed by insertion of Article ______ in the Constitution of India. (SSC CGL 2020)

A. 328B B. 338A C. 338B D. 328A

Answer: B

7. With reference to the Parliament of India, which of the following Parliamentary Committees scrutinizes and reports to the House whether the powers to make regulations, rules, sub-rules, by-laws, etc. conferred by the Constitution or delegated by the Parliament are being properly exercised by the Executive within the scope of such delegation? (UPSC 2018)

A. Committee on Government Assurances

B. Committee on Subordinate Legislation

C. Rules Committee

D. Business Advisory Committee

Answer: B

8. Justice Madan B Lokur committee was set up to take steps to (Haryana Civil Services 2021)

A. Look into violation of environment rules.

B. Prevent stubble burning

C. Draft new water policy

D. Regulate digital lending

Answer: B

9. Match the pairs - (Committees on Media) (MPSC 2019)

(A) (Name) (B) (Year)

(a) Chanda Committee (i) 1982

(b) Kuldip Nayar Committee (ii) August, 1977

(c) Verghese Committee (iii) March, 1977

(d) P.C. Joshi Committee (iv) 1964

1. (a) – (i), (b) – (ii), (c – (iii), (d) – (iv)

2. (a) – (i), (b) – (iii), (c – (ii), (d) – (iv)

3. (a) – (iv), (b) – (iii), (c – (ii), (d) – (i)

4. (a) – (iv), (b) – (ii), (c – (iii), (d) – (i)

Answer: 3

10. Consider the formation of the following States and arrange these in chronological order : (UPPSC Combined State Exam 2021)

1. Goa

2. Telangana

3. Jharkhand

4. Haryana

Select the correct answer from the codes given below.

A. 1, 2, 3, 4 B. 4, 1, 3, 2 C. 3, 2, 4, 1 D. 4, 3, 1, 2

Answer: 2

|

GOODS AND SERVICE TAX (GST)

- The Goods and Services Tax (GST) is a value-added tax levied on the supply of goods and services at each stage of the production and distribution chain. It is a comprehensive indirect tax that aims to replace multiple indirect taxes imposed by the central and state governments in India.

- GST is designed to simplify the tax structure, eliminate the cascading effect of taxes, and create a unified national market. Under the GST system, both goods and services are taxed at multiple rates based on the nature of the product or service. The tax is collected at each stage of the supply chain, and businesses are allowed to claim a credit for the taxes paid on their inputs.

- The GST system in India came into effect on July 1, 2017, replacing a complex tax structure that included central excise duty, service tax, and state-level taxes like VAT (Value Added Tax), among others. The GST Council, consisting of representatives from the central and state governments, is responsible for making decisions on various aspects of GST, including tax rates and rules.

- GST is intended to create a more transparent and efficient tax system, reduce tax evasion, and promote economic growth by fostering a seamless flow of goods and services across the country. It has a significant impact on businesses, as they need to comply with the new tax regulations and maintain detailed records of their transactions for GST filing

3.Goods and Services Tax (GST) and 101st Amendment Act, 2016

The Goods and Services Tax (GST) in India was introduced through the 101st Amendment Act of 2016. This constitutional amendment was a crucial step in the implementation of GST, which aimed to create a unified and comprehensive indirect tax system across the country.

Here are some key points related to the 101st Amendment Act and GST:

- The 101st Amendment Act was enacted to amend the Constitution of India to pave the way for the introduction of the Goods and Services Tax.

- It added a new article, Article 246A, which confers concurrent powers to both the central and state governments to levy and collect GST

- The amendment led to the creation of the GST Council, a constitutional body consisting of representatives from the central and state governments. The council is responsible for making recommendations on GST rates, exemptions, and other related issues

- The amendment introduced a dual GST structure, where both the central government and the state governments have the power to levy and collect GST on the supply of goods and services

- For inter-state transactions, the 101st Amendment Act provides that the central government would levy and collect the Integrated Goods and Services Tax (IGST), which would be a sum total of the central and state GST

- The amendment also included a provision for compensating states for any revenue loss they might incur due to the implementation of GST for a period of five years

In India, the Goods and Services Tax (GST) is structured into different tax rates based on the nature of the goods and services. As of my last knowledge update in January 2022, the GST rates are divided into multiple slabs. It's important to note that tax rates may be subject to changes, and new amendments could have been introduced since then. As of my last update, the GST rates are as follows:

-

Nil Rate:

- Some goods and services are categorized under the nil rate, meaning they attract a 0% GST. This implies that no tax is levied on the supply of these goods or services.

-

5% Rate:

- This is a lower rate, applicable to essential goods such as certain food items, medical supplies, and other basic necessities.

-

12% Rate:

- Goods and services falling in this category attract a 12% GST rate. Items such as mobile phones, processed foods, and certain services fall under this slab.

-

18% Rate:

- A higher rate of 18% is applicable to goods and services such as electronic items, capital goods, and various services.

-

28% Rate:

- The highest GST rate of 28% is applied to luxury items, automobiles, and certain goods and services that are considered non-essential or fall into the luxury category.

-

Compensation Cess:

- In addition to the above rates, some specific goods attract a compensation cess, which is levied to compensate the states for any revenue loss during the transition to GST. This is often applied to items like tobacco and luxury cars.

-

Zero Rate:

- Certain categories of goods and services may be specified as "zero-rated," which means they are effectively taxed at 0%. This is different from the nil rate, as it allows businesses to claim input tax credit on inputs, capital goods, and input services.

-

Exempt Supplies:

- Some goods and services may be exempt from GST altogether. This means that they are not subject to any GST, and businesses cannot claim input tax credit on related inputs

| Subject | Central GST (CGST) | State GST (SGST) | Union Territory GST (UTGST) | Integrated GST (IGST) |

|---|---|---|---|---|

| Levied by | Central Government | Respective State Governments | Union Territory Administrations | Central Government (on inter-state transactions) |

| Applicability | On intra-state supplies (within the same state) | On intra-state supplies (within the same state) | On intra-union territory supplies (within the same union territory) | On inter-state supplies (across states or union territories) |

| Rate Determination | Determined by the Central Government | Determined by the Respective State Government | Determined by the Union Territory Administration | IGST rate is a sum of CGST and SGST rates |

| Revenue Collection | Collected by the Central Government | Collected by the Respective State Government | Collected by the Union Territory Administration | Collected by the Central Government (on inter-state transactions) |

| Utilization of Revenue | Shared between Central and State Governments | Retained by the Respective State Government | Retained by the Union Territory Administration | Shared between Central and State Governments |

| Purpose | Part of the dual GST structure, meant to cover central taxes | Part of the dual GST structure, meant to cover state taxes | Applicable in union territories for intra-territory supplies | Applied to regulate and tax inter-state supplies |

| Input Tax Credit (ITC) | ITC available for CGST paid on inputs and services | ITC available for SGST paid on inputs and services | ITC available for UTGST paid on inputs and services | ITC available for both CGST and SGST paid on inputs |

| Tax Jurisdiction | Applies within a particular state | Applies within a particular state | Applies within a particular union territory | Applies to transactions across states and union territories |

| GSTN Portal for Filing Returns | Central GSTN portal | State-specific GSTN portals | UTGSTN portal | Integrated GSTN portal |

- GST replaced multiple indirect taxes levied by the central and state governments, simplifying the tax structure. This streamlined system reduces the complexity of compliance for businesses

- GST eliminates the cascading effect of taxes, where taxes are levied on top of other taxes. With a seamless credit mechanism, businesses can claim input tax credit on the taxes paid on their purchases, leading to a more transparent and efficient system

- GST has facilitated the creation of a common national market by harmonizing tax rates and regulations across states. This has reduced trade barriers and promoted the free flow of goods and services throughout the country

- The GST system has incorporated technology-driven processes, including electronic filing and real-time reporting, making it harder for businesses to evade taxes. This has contributed to increased tax compliance

- The input tax credit mechanism under GST benefits manufacturers, as they can claim credits for taxes paid on raw materials and input services. This has a positive impact on the cost of production and enhances the competitiveness of Indian goods in the international market

- GST brings transparency to the taxation system. The online filing of returns and the availability of transaction-level data make it easier for tax authorities to monitor and track transactions, reducing the scope for corruption

- GST has replaced a complex system of filing multiple tax returns with a more straightforward mechanism. Businesses now need to file fewer returns, reducing the compliance burden

- The implementation of GST has contributed to an improvement in the ease of doing business in India. The unified tax system has made it simpler for businesses to operate across states and has reduced the paperwork and bureaucratic hurdles associated with tax compliance

- GST has led to the harmonization of tax rates across states and union territories, minimizing the tax rate disparities that existed earlier. This creates a more predictable tax environment for businesses

- Despite the intention to simplify the tax structure, the multi-tiered rate system (0%, 5%, 12%, 18%, and 28%) and the inclusion of cess on certain goods have introduced complexity. The classification of goods and services under different tax slabs can be challenging, leading to disputes and confusion

- The successful implementation of GST relies heavily on technology. Issues such as technical glitches on the GSTN (Goods and Services Tax Network) portal, especially during the initial phases, have caused difficulties for businesses in filing returns and complying with regulations

- The compliance requirements for businesses under GST, including multiple returns filing, have been perceived as burdensome. Smaller businesses, in particular, may find it challenging to adapt to the new system and comply with the various provisions

- The transition from the previous tax regime to GST posed challenges, especially for businesses in terms of understanding the new tax structure, reconfiguring accounting systems, and ensuring a smooth transition of credits from the old tax system to the GST system

- The classification of certain goods and services into specific tax slabs has been a source of contention. Ambiguities in classification have led to disputes and litigations, with businesses seeking clarity on the applicable tax rates

- The implementation of GST has increased compliance costs for businesses due to the need for sophisticated IT infrastructure, the hiring of tax professionals, and efforts to ensure accurate reporting and filing

- Challenges related to availing and matching input tax credits have been reported. Timely matching of credits and resolving discrepancies can be cumbersome, leading to concerns about the seamless flow of credit across the supply chain

- The anti-profiteering provisions were introduced to ensure that businesses pass on the benefits of reduced tax rates to consumers. However, the implementation of anti-profiteering measures has been criticized for its complexity and potential for disputes

- The periodic changes in the GST return filing system have created challenges for businesses in adapting their processes. Delays and complexities in return filing can affect working capital management

The GST Council consists of the following members:

- The Union Finance Minister, who is the Chairperson of the Council.

- The Union Minister of State in charge of revenue or any other Minister of State nominated by the Union Government.

- One Minister from each state, nominated by the Governor of that state.

- The Chief Secretary of each state, ex-officio.

- If the President, on the recommendation of the Council, so directs, one representative of each Union territory which has a legislature, to be nominated by the Lieutenant Governor of that Union territory.

- Three to seven members (other than Ministers) to be nominated by the Union Government, of whom at least one member shall be from the field of economics and another from the field of chartered accountancy, legal affairs or public finance

|

For Prelims: Economic and Social Development and Indian Polity and Governance

For Mains: General Studies II: Functions and responsibilities of the Union and the States, issues and challenges pertaining to the federal structure, devolution of powers and finances up to local levels and challenges therein

General Studies III: Inclusive growth and issues arising from it |

|

Previous Year Questions

1.Which of the following are true of the Goods and Services Tax (GST) introduced in India in recent times? (UGC Paper II 2020)

A. It is a destination tax

B. It benefits producing states more

C. It benefits consuming states more

D. It is a progressive taxation

E. It is an umbrella tax to improve ease of doing business

Choose the most appropriate answer from the options given below:

A.B, D and E only

B.A, C and D only

C.A, D and E only

D.A, C and E only

Answer (D)

2.What is/are the most likely advantages of implementing ‘Goods and Services Tax (GST)’? (UPSC CSE 2017)

1. It will replace multiple taxes collected by multiple authorities and will thus create a single market in India. 2. It will drastically reduce the ‘Current Account Deficit’ of India and will enable it to increase its foreign exchange reserves. 3. It will enormously increase the growth and size of the economy of India and will enable it to overtake China in the near future. Select the correct answer using the code given below: (a) 1 only (b) 2 and 3 only (c) 1 and 3 only (d) 1, 2 and 3 Answer (a)

|

INTERNATIONAL SOLAR ALLIANCE (ISA)

- The International Solar Alliance (ISA) is an initiative led by India and France, launched during the United Nations Climate Change Conference (COP21) in Paris in 2015.

- It aims to promote the use of solar energy globally, especially in solar-rich countries lying fully or partially between the Tropic of Cancer and the Tropic of Capricorn. However, membership is now open to all UN member countries

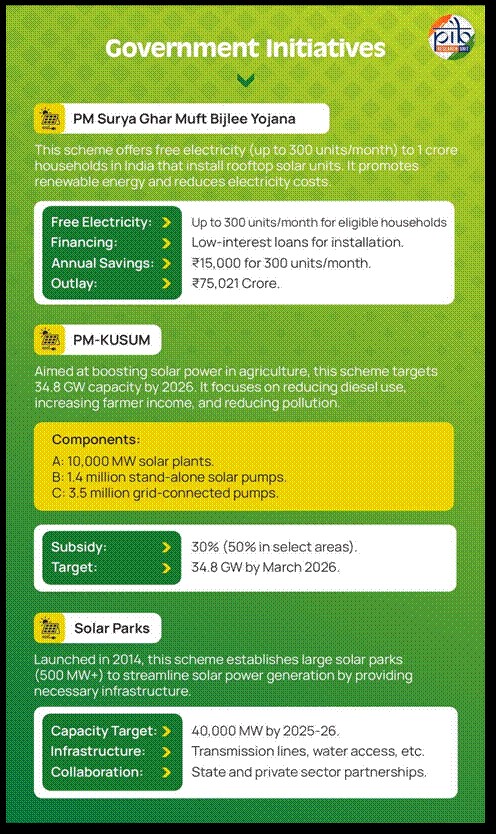

- India, as a founding member, uses ISA as a platform to advance its renewable energy targets, including the ambitious goal of achieving 500 GW of renewable capacity by 2030.

- The ISA complements India's domestic initiatives, like the National Solar Mission

- In 2021, the United States joined the ISA, signaling global support for solar energy adoption.

- The One Sun, One World, One Grid (OSOWOG) initiative, also led by India, aligns with ISA’s objectives by advocating for a transnational solar grid that connects renewable energy sources globally.

-

The ISA was intended to act as a catalyst, helping countries tackle challenges like financial, technological, and regulatory barriers to adopt solar energy effectively.

-

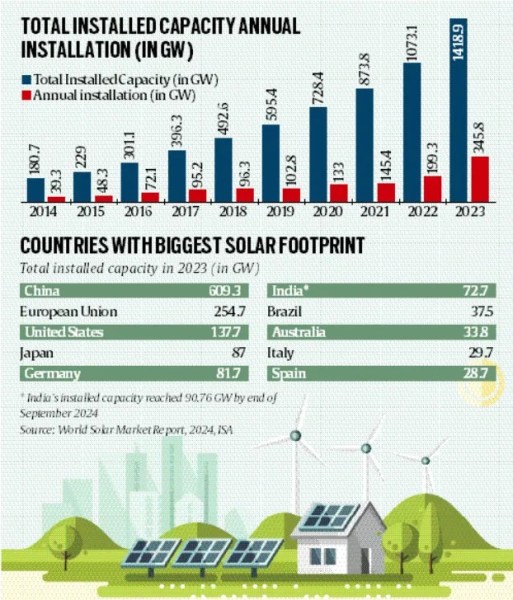

Despite significant advancements in solar energy deployment, ISA has had limited success in facilitating a large number of projects. Over the past five years, global solar power capacity has grown by over 20% annually, with a more than 30% increase reported last year, as indicated by ISA’s World Solar Market Report 2024.

-

Ajay Mathur, director general of ISA, noted that most of these new installations are concentrated in a few countries, with China leading the way. Of the 345 GW of solar capacity added in 2023, China alone contributed over 216 GW, representing more than 62% of the total.

-

More than 80% of global solar energy investments go to developed countries, China, and major emerging markets like India.

-

Many countries lack experience with large-scale energy projects, especially in solar, which is a relatively new technology. Local developers are often absent, meaning international companies are needed for investment. However, these investors typically look for policy stability and well-defined regulatory frameworks.

-

ISA has partnered with governments and local organizations to help establish regulatory frameworks, prepare power purchase agreements, and train local professionals

| India’s dedication to renewable energy and climate action was fundamental to the establishment of the ISA. With a goal of reaching 500 GW of non-fossil fuel energy by 2030, India’s renewable energy targets align with the ISA’s mission to promote solar energy worldwide. This target is part of India’s broader Panchamrit Initiative, which focuses on reducing carbon emissions and advancing sustainable development. Additionally, India is instrumental in shaping ISA’s programs and promoting global cooperation. Its extensive experience in scaling solar energy projects and developing supportive policies serves as a model for other member nations, particularly those aiming to expand energy access. By sharing best practices and technical knowledge, India seeks to support other countries in advancing their solar energy initiatives. |

- Solar energy plays a pivotal role in the global shift to renewable energy, which is essential for addressing climate change. It is the fastest-growing renewable source, though it does face the challenge of intermittency.

-

In many parts of the world, solar is now the most cost-effective energy source when sunlight is available. Projections for solar energy capacity show it could expand by 3 to 15 times by 2050, depending on the pathway chosen to reach global net-zero emissions.

-

China leads in solar PV installations, accounting for about 43% of the world's total. The top ten markets together hold over 95% of installed capacity, while less than 2% of new solar installations are in Africa—a region where nearly 80% of the 745 million people without electricity reside.

-

The ISA was founded with a broader strategic vision for India, aiming to enhance its influence, especially among the Global South, with a particular focus on African nations

- The International Solar Alliance (ISA) seeks to mobilize $1 trillion in solar investments by 2030 through its 'Towards 1000' strategy, which aims to lower both technology and financing costs.

- This ambitious plan targets energy access for 1 billion people and the installation of 1,000 GW of solar capacity. Achieving these objectives would reduce global carbon emissions by approximately 1,000 million tonnes of CO₂ per year.

- ISA’s programs focus on three core areas—Analytics & Advocacy, Capacity Building, and Programmatic Support—to establish a supportive environment for solar investments and share best practices among member nations.

- ISA also drives solar adoption across sectors such as agriculture, healthcare, transportation, and power generation. By promoting policies and facilitating the exchange of successful strategies, ISA enables member countries to encourage solar energy deployment.

- The alliance has introduced innovative business models, supported governments in developing solar-friendly policies via its Ease of Doing Solar analytics, and pooled demand to reduce costs of solar technologies.

- Additionally, ISA enhances financing access by lowering investment risks, making the solar sector more attractive to private investors and paving the way toward a sustainable energy future.

- India's solar sector is growing rapidly, placing the country fifth globally in terms of solar power capacity. As of September 2024, India’s installed solar capacity has reached around 90.76 GW, a 30-fold increase over the last nine years. According to the National Institute of Solar Energy, the country’s solar potential is estimated at 748 GW.

- India’s Panchamrit targets include: (i) achieving 500 GW of non-fossil fuel energy capacity by 2030, (ii) sourcing 50% of its energy from renewables by 2030, (iii) reducing projected carbon emissions by one billion tonnes by 2030, (iv) cutting carbon intensity by 45% by 2030, and (v) reaching Net Zero by 2070.

- India has made significant progress, with its non-fossil fuel capacity increasing by 396% over the past 8.5 years, and 46.3% of its total energy capacity now comes from non-fossil sources, underscoring its dedication to sustainable energy as highlighted in international climate forums.

- Government policies, including the 100% FDI allowance in renewable energy projects, have enhanced the sector's appeal to investors. Additionally, technological advancements and a strong regulatory framework are creating an enabling environment for the continued expansion of solar energy projects

The International Solar Alliance (ISA) represents a pivotal shift towards a sustainable energy future, with India at the forefront of this initiative. The ISA’s mission extends beyond improving energy access and security to making substantial global carbon emissions reductions. The upcoming assembly offers an essential platform for nations to collaborate and emphasize the urgent need to accelerate solar energy adoption.

As more countries align with ISA’s mission, solar energy is positioned to play a central role in the global energy landscape. The ISA’s efforts, coupled with India’s strong commitment to solar advancement, pave the way for a cleaner, more sustainable world for future generations. Through international cooperation and innovative approaches, the ISA is well-positioned to contribute meaningfully to global climate objectives and universal energy access

|

For Prelims: General issues on Environmental ecology, Bio-diversity & climate change For Mains: GS-III: Conservation, environmental pollution and degradation, environmental impact assessment. |

|

Previous Year Questions

1.Consider the following statements: (2016)

Which of the statements given above is/are correct? (a) 1 only Answer (a)

|

RUPEE EXCHANGE RATE

Exchange rate for 1 Indian Rupee (INR) is as follows:

- United States Dollar (USD): 0.012011 INR

- Euro (EUR): 0.011223 INR

- British Pound (GBP): 0.009784 INR

- Australian Dollar (AUD): 0.018827 INR

- Singapore Dollar (SGD): 0.016343 INR

- Swiss Franc (CHF): 0.010845 INR

- Malaysian Ringgit (MYR): 0.056619 INR

- Japanese Yen (JPY): 1.824210 INR

- If the rupee experiences a faster depreciation rate than its long-term average, it surpasses the dotted line, and vice versa.

- Over the past couple of years, the rupee has demonstrated greater resilience than the long-term trend, but the current decline indicates a correction.

- When considering a diverse range of currencies, data indicates that the rupee has strengthened or appreciated against this basket.

- To clarify, while the US dollar has strengthened against various major currencies, including the rupee, the rupee, in contrast, has strengthened compared to many other currencies like the euro. For example, forex reserves have decreased by over $50 billion between September 2021 and now. Over these 10 months, the rupee's exchange rate with the dollar has declined by 8.7%, from 73.6 to 80.

- To provide context, historically, the rupee typically depreciates by around 3% to 3.5% in a year. Moreover, many experts anticipate further weakening of the rupee in the next 3-4 months, potentially falling to as low as 82 to a dollar.

When the rupee depreciates, it has several implications:

Import Costs: Imported goods and services become more expensive, as it takes more rupees to buy the same amount of foreign currency needed for these transactions. This can contribute to inflationary pressures in the economy.

Export Competitiveness: On the positive side, a depreciated rupee can make the country's exports more competitive in the global market. Foreign buyers find the country's products and services relatively cheaper, potentially boosting export volumes.

External Debt: Countries with significant external debt denominated in foreign currencies may face increased repayment burdens when their domestic currency depreciates. Servicing debt in stronger foreign currencies becomes more expensive.

Inflation: Depreciation can contribute to inflationary pressures by increasing the cost of imported goods and raw materials.

5. Effects on the Indian economy

- Due to a substantial portion of India's imports being priced in dollars, these imports will become more expensive.

- An illustrative example is the higher cost associated with the crude oil import bill. The increased expense of imports, in turn, will contribute to the expansion of the trade deficit and the current account deficit.

- This, in consequence, will exert pressure on the exchange rate. On the export side, the situation is more complex, as noted by Sen.

- In bilateral trade, the rupee has strengthened against many currencies. In exports conducted in dollars, the impact is contingent on factors such as how much other currencies have depreciated against the dollar.

- If the depreciation of other currencies against the dollar is greater than that of the rupee, the overall effect could be negative.

|

For Prelims: Inflation, Deflation, Depreciation, Appreciation

For Mains: General Studies III: How does Depreciation of rupee affect Indian economy

|

|

Previous Year Questions

1. Which one of the following groups of items is included in India's foreign exchange reserves? (UPSC CSE 2013)

A.Foreign-currency assets, Special Drawing Rights (SDRs) and loans from foreign countries B.Foreign-currency assets, gold holdings of the RBI and SDRs

C.Foreign-currency assets, loans from the World Bank and SDRs

D.Foreign-currency assets, gold holdings of the RBI and loans from the World Bank

Answer (B)

2.Which one of the following is not the most likely measure the Government/RBI takes to stop the slide of Indian rupee? (UPSC CSE 2019)

A.Curbing imports of non-essential goods and promoting exports

B.Encouraging Indian borrowers to issue rupee-denominated Masala Bonds

C.Easing conditions relating to external commercial borrowing

D.Following an expansionary monetary policy

Answer (D)

|

INDIAN JUDICIARY

- On January 28, 1950, two days after India became a sovereign democratic republic, the Supreme Court of India came into being.

- The inauguration took place in the Chamber of Princes in the Parliament building which was the home to the Federal Court of India for 12 years preceding the Supreme Court's establishment.

- The Parliament House was to be the home of the Supreme Court for years that were to follow until the court acquired its present building with lofty domes and its signature spacious collonaded verandas in 1958.

- The inaugural proceedings on the 28th began at 9.45 a.m. when the Judges of the Federal Court Chief Justice Harilal J.Kania and Justices Saiyid Fazl Ali, M. Patanjali Sastri, Mehr Chand Mahajan, Bijan Kumar Mukherjea and S.R. Das took their seats.

- The inaugural proceedings ensured that the rules of the court were published and the names of all the advocates and agents of the Federal Court were brought on the rolls of the Supreme Court.

Evolution of the Supreme Court

- In 1958, when the court shifted its premises, the building was shaped to project the image of scales of justice, in the central wing.

- In 1979, two new wings the East wing and the West wing were added to the complex.

- In all, there are 19 Courtrooms in the various wings of the building.

- The Chief Justice's Court is the largest of the Courts at the Central Wing's Centre.

- The original Constitution of 1950 envisaged a Supreme Court with a Chief Justice and 7 puisne judges leaving it to Parliament to increase this number.

- In the early years, all the judges of the Supreme Court sat together to hear the cases presented before them.

- As the work of the Court increased and arrears of cases began to accumulate, Parliament increased the number of Judges from 8 in 1950 to 11 in 1956, 14 in 1960, 18 in 1978, 26 in 1986, 31 in 2009 and 34 in 2019 (Current Strength).

- As the number of Judges has increased, they sit in smaller benches of two and three coming together in larger benches of 5 and more only when required to do so or to settle a difference of opinion or controversy.

- Article 124 establishes the Supreme Court of India, consisting of a Chief Justice and other judges. It outlines the composition and jurisdiction of the Supreme Court.

- Article 125 empowers Parliament to determine the salaries, allowances, and other conditions of service for the judges of the Supreme Court.

- Article 126 allows the President to appoint an acting Chief Justice when the office of the Chief Justice is vacant or when the Chief Justice is unable to perform duties.

- Article 127 The President has the authority to appoint a person who has been a judge of the Supreme Court or High Court as an ad hoc judge for a temporary period.

- Article 128 Retired judges may be requested by the Chief Justice of India to sit and act as judges of the Supreme Court, emphasizing the importance of their experience.

- Article 129 Declares the Supreme Court as a court of record with the power to punish for contempt of itself, highlighting its authority.

- Article 130 The Supreme Court shall sit in Delhi, or in such other place or places as the Chief Justice of India may, with the approval of the President, appoint.

- Article 131 Grants the Supreme Court original jurisdiction in disputes between the Government of India and States or between different States.

- Article 131A Originally provided exclusive jurisdiction to the Supreme Court in constitutional matters related to Central laws; however, it has been repealed.

- Article 132 Details the appellate jurisdiction of the Supreme Court in certain cases coming from High Courts.

- Article 133 Specifies the appellate jurisdiction of the Supreme Court in civil matters.

- Article 134 Outlines the Supreme Court's appellate jurisdiction in criminal matters.

- Article 134A Deals with the certification required for an appeal to the Supreme Court in certain cases.

- Article 135 Confers the jurisdiction and powers of the former Federal Court on the Supreme Court.

- Article 136 Grants the Supreme Court the discretionary power to grant special leave to appeal from any judgment or order.

- Article 137 Empowers the Supreme Court to review its own judgments or orders.

- Article 138 Allows Parliament to extend the jurisdiction of the Supreme Court.

- Article 139 Grants the Supreme Court the power to issue writs for the enforcement of fundamental rights.

- Article 139A Provides for the transfer of certain cases from one High Court to another or from a High Court to the Supreme Court.

- Article 140 Empowers the Supreme Court to exercise ancillary powers necessary for the effective discharge of its jurisdiction.

- Article 141 Declares that the law declared by the Supreme Court is binding on all courts within the territory of India.

- Article 142 Grants the Supreme Court the power to pass decrees and orders necessary for doing complete justice in any cause or matter.

- Article 143 Allows the President to refer questions of law or fact to the Supreme Court for its opinion.

- Article 144 Requires all authorities to act in aid of the Supreme Court.

- Article 144A Originally provided special provisions for the disposal of questions regarding the constitutional validity of laws but has been repealed.

- Article 145 Grants the Supreme Court the authority to make rules regulating the practice and procedure of the court.

- Article 146 Deals with the appointment of officers and servants of the Supreme Court and the expenses associated with it.

- Article 147 Provides for the interpretation of the expression "existing law" about the jurisdiction, powers, and authority of the Supreme Court under this chapter.

The Supreme Court of India has a well-defined organizational structure, which includes the Chief Justice of India, other judges, and various administrative and supporting staff.

Chief Justice of India (CJI)

- The Chief Justice of India is the head of the Supreme Court.

- The CJI is appointed by the President of India and is responsible for the overall functioning of the court.

- The CJI presides over important matters, assigns cases to other judges, and represents the judiciary in various capacities.

Judges

- The Supreme Court can have a maximum strength of 34 judges, including the Chief Justice.

- Judges are appointed by the President of India based on recommendations from the collegium (a group of top judges).

- Judges of the Supreme Court hear and decide cases, contribute to the formulation of legal principles, and may also be involved in administrative responsibilities.

- Registry: The Registry is the administrative wing of the Supreme Court responsible for handling administrative and procedural aspects. It is headed by the Secretary-General, who is an officer appointed by the Chief Justice of India.

- Court Officers and Staff: Various court officers and staff assist in the day-to-day functioning of the Supreme Court. This includes Registrars, Deputy Registrars, Assistant Registrars, and other administrative staff who manage the filing of cases, scheduling, and other administrative tasks.

- Advocates and Legal Professionals: Advocates and legal professionals, including Senior Advocates and Advocates-on-Record, play a crucial role in presenting cases before the Supreme Court. Advocates-on-Record are registered practitioners who are eligible to file cases and plead on behalf of litigants.

- Library and Research Staff: The Supreme Court library is an integral part of the institution, providing extensive legal resources to judges and legal professionals. Research staff may assist judges in legal research and analysis.

- Security and Support Staff: The Supreme Court has security personnel to ensure the safety of the premises and those present. Support staff includes personnel responsible for maintenance, cleaning, and other logistical aspects.

- Committees and Commissions: Various committees and commissions may be constituted by the Chief Justice or the Supreme Court for specific purposes, such as judicial reforms, ethics, or other administrative matters.

- Supreme Court Bar Association (SCBA) is an association of lawyers who are authorized to practice in the Supreme Court. It plays a role in addressing the concerns of lawyers practising in the Supreme Court.

- Legal Aid and Pro Bono Services: The Supreme Court may have mechanisms in place to provide legal aid to those who cannot afford legal representation.

- Judicial Committees and Panels: Special committees or panels may be formed for specific tasks, inquiries, or recommendations related to the functioning of the judiciary.

.png)

Collegium System

- The Collegium system is not rooted in the Constitution. Instead, it has evolved through judgments of the Supreme Court.

- Under the system, the Chief Justice of India along with four senior-most Supreme Court judges recommend appointments and transfers of judges.

- A High Court Collegium, meanwhile, is led by the incumbent Chief Justice and the two senior-most judges of that court.

- In this system, the government’s role is limited to getting an inquiry conducted by the Intelligence Bureau (IB) if a lawyer is to be elevated as a judge in a High Court or the Supreme Court.

- The government can also raise objections and seek clarifications regarding the Collegium’s choices, but, if the Collegium reiterates the same names, the government is bound, under Constitution Bench judgments, to appoint them to the post.

Evolution of Collegium System

- In the First Judges case, the court held that the consultation with the CJI should be "full and effective".

- The Second Judges Case introduced the collegium system in 1993, as they ordered the CJI to consult a collegium of his two senior judges in the apex court on judicial appointments, such a "collective opinion" of the collegium would have primacy over the government.

- The Third Judges case in 1998, expanded the judicial collegium to its present composition of the CJI and four of its senior-most judges.

Procedure for replacement of Collegium System

- Replacing the Collegium system calls for a Constitutional Amendment Bill.

- It requires a majority of not less than two-thirds of MPs (Members of Parliament) present and voting in Lok Sabha as well as Rajya Sabha.

- It also needs the ratification of legislatures of not less than one-half of the states.

The concerns associated with the Collegium system

- Constitutional Status: The Collegium is not prescribed in the Constitution. Article 124 mentions consultation, which the SC interpreted as ‘concurrence’ in the Second Judges Case (1993). During the hearing against the NJAC, the then SC Bar President had argued that the Constituent Assembly had considered a proposal for making Judges’ appointment ‘in concurrence’ with the CJI but had eventually rejected it.

- Transparency: There is no official procedure for selection or any written manual for the functioning of the Collegium. The parameters considered for selection (or rejection) are not available in the public domain.

- Accountability: The selection of Judges by the Judges is considered undemocratic. Judges are not accountable to the people or any other organ of the State (Legislature or Executive). It can add an element of arbitrariness in functioning.

- Criticism by Judges: Many retired Judges have criticized the working of the Collegium, especially the lack of transparency. Several controversial appointments have been made despite objections by the members of the Collegium.

- No Checks: There are no checks on the process. Nor has there been any review regarding the effectiveness of the process. Critics of the system argue the phenomena of ‘Uncle Judges’ wherein near relatives, kith, and kin of sitting Judges are appointed to the higher judiciary leading to nepotism. Law Commission in its 230th Report (2012) recommended that the Judges, whose kith and kin are practising in a High Court, should not be appointed in the same High Court. The absence of transparency, accountability, and external checks creates space for subjectivity and individual bias in appointments. In some cases, the principle of seniority has been ignored.

- No Reforms: The Supreme Court did not amend the contentious provisions of the NJAC Act or add safeguards to the Act. Instead, it struck down the whole Act. The Supreme Court reverted to the old Collegium System. However, the Court did not take any steps to address the concerns associated with the Collegium System.

6. About the National Judicial Appointments Commission (NJAC)

- The Constitution (99th Amendment) Act, which established the NJAC and the NJAC Act, was passed by Parliament in 2014 to set up a commission for appointing judges,

replacing the Collegium system. - This would essentially increase the government’s role in the appointment of judges.

- The laws were repealed in October 2015 after the Supreme Court struck them down.

Composition of NJAC

- The Chief Justice of India as the ex officio Chairperson.

- Two senior-most Supreme Court Judges as ex officio members.

- The Union Minister of Law and Justice as ex officio members.

- Two eminent persons from civil society (one of whom would be nominated by a committee consisting of the CJI, Prime Minster, and the Leader of Opposition in the Lok Sabha, and the other would be nominated from the SC/ST/OBC/minority communities or women.

| Article 124A created the NJAC, a constitutional body to replace the collegium system, Article 124B conferred the NJAC with the power to make appointments to Courts and Article 124C accorded express authority to Parliament to make laws regulating the manner of the NJAC's functioning. |

Recommendations

- Under the NJAC Act, the Chief Justice of India and Chief Justices of the HCs were recommended by the NJAC on seniority while SC and HC judges were recommended based on ability, merit and "other criteria specified in the regulations".

- Notably, the Act empowered any two members of the NJAC to veto a recommendation if they did not agree with it.

- In the collegium system, senior judges make appointments to the higher judiciary.

NJAC challenged

- In early 2015, the Supreme Court Advocates-on-Record Association (SCAORA) fled a plea challenging the provisions which had by then become laws.

- The SCAORA Contended in its petition that both the Acts were "Unconstitutional" and "invalid".

| It argued that the 99th Amendment which provided for the creation of the NJAC took away the "Primacy of the collective opinion of the Chief Justice of India and the two Senior-most Judges of the Supreme Court of India" as their collective recommendation could be vetoed or "suspended by a majority of three non-Judge members". |

- It invoked the Second Judge Case to say that CJI primacy had to be protected.

- It also stated that the amendment "severely" damaged the basic structure of the Constitution, of which the independence of the judiciary in appointing judges was an integral part.

|

For Prelims: Collegium system, National Judicial Appointments Commission (NJAC), Supreme court, Article 124, 99th Constitutional Amendment Act

For Mains:

1. Discuss the evolution of the Supreme Court of India from its inauguration in 1950 to the present day. How has its structure and capacity evolved to meet the changing demands of the legal landscape? (250 Words)

2. Examine the constitutional provisions that govern the Supreme Court of India. How do these provisions delineate the powers, jurisdiction, and composition of the Supreme Court? (250 Words)

3. What are the key features of the National Judicial Appointments Commission (NJAC) Act, and how did it differ from the Collegium system? (250 Words)

4. How does the appointment process of judges in the Supreme Court of India, emphasise the role of the Collegium system? What are the concerns associated with this system, and do you believe reforms are necessary? (250 Words)

|

|

Previous Year Questions

1. With reference to the Indian judiciary, consider the following statements: (UPSC 2021)

1. Any retired judge of the Supreme Court of India can be called back to sit and act as a Supreme Court judge by the Chief Justice of India with the prior permission of the President of India.

2. A High Court in India has the power to review its own judgment as the Supreme Court does.

Which of the statements given above is/are correct?

A. 1 only B. 2 only C. Both 1 and 2 D. Neither 1 nor 2

2. In India, Judicial Review implies (UPSC 2017)

A. the power of the Judiciary to pronounce upon the constitutionality of laws and executive orders

B. the power of the Judiciary to question the wisdom of the laws enacted by the Legislatures

C. the power of the Judiciary to review all the legislative enactments before they are assented to by the President

D. the power of the Judiciary to review its own judgments given earlier in similar or different cases

3. Consider the following statements:

1. The motion to impeach a Judge of the Supreme Court of India cannot be rejected by the Speaker of the Lok Sabha as per the Judges (Inquiry) Act, 1968.

2. The Constitution of India defines and gives details of what constitutes 'incapacity and proved misbehaviour' of the Judges of the Supreme Court of India

3. The details of the process of impeachment of the Judges of the Supreme Court of India are given in the Judges (Inquiry) Act, of 1968.

4. If the motion for the impeachment of a Judge is taken up for voting, the law requires the motion to be backed by each House of the Parliament and supported by a majority of the total membership of that House and by not less than two-thirds of total members of that House present and voting.

Which of the statements given above is/are correct?

A. 1 and 2 B. 3 only C. 3 and 4 only D. 1, 3 and 4

4.The power to increase the number of judges in the Supreme Court of India is vested in (UPSC 2014)

A. the President of India B. the Parliament C. the Chief Justice of India D. the Law Commission 5.The power of the Supreme Court of India to decide disputes between the Centre and the States falls under its (UPSC P 2014)

A. advisory jurisdiction B. appellate jurisdiction. C. original jurisdiction D. writ jurisdiction Answers: 1-A, 2-A, 3-C, 4-B, 5-C

|