GROSS DOMESTIC PRODUCT (GDP)

There are three primary ways to calculate GDP:

-

Production Approach (GDP by Production): This approach calculates GDP by adding up the value-added at each stage of production. It involves summing up the value of all final goods and services produced in an economy.

-

Income Approach (GDP by Income): This approach calculates GDP by summing up all the incomes earned in an economy, including wages, rents, interests, and profits. The idea is that all the income generated in an economy must ultimately be spent on purchasing goods and services.

-

Expenditure Approach (GDP by Expenditure): This approach calculates GDP by summing up all the expenditures made on final goods and services. It includes consumption by households, investments by businesses, government spending, and net exports (exports minus imports).

3. Measuring GDP

GDP can be measured in three different ways:

-

Nominal GDP: This is the raw GDP figure without adjusting for inflation. It reflects the total value of goods and services produced at current prices.

-

Real GDP: Real GDP adjusts the nominal GDP for inflation, allowing for a more accurate comparison of economic performance over time. It represents the value of goods and services produced using constant prices from a specific base year.

-

GDP per capita: This is the GDP divided by the population of a country. It provides a per-person measure of economic output and can be useful for comparing the relative economic well-being of different countries.

The GDP is a useful measure of economic health, but it has some limitations. For example, it does not take into account the distribution of income in an economy. It also does not take into account the quality of goods and services produced.

Despite its limitations, the GDP is a widely used measure of economic health. It is used by economists, policymakers, and businesses to track the performance of an economy and to make decisions about economic policy

4. Gross Value Added (GVA)

Gross Value Added (GVA) is a closely related concept to Gross Domestic Product (GDP) and is used to measure the economic value generated by various economic activities within a country. GVA represents the value of goods and services produced in an economy minus the value of inputs (such as raw materials and intermediate goods) used in production. It's a way to measure the contribution of each individual sector or industry to the overall economy.

GVA can be calculated using the production approach, similar to one of the methods used to calculate GDP. The formula for calculating GVA is as follows:

GVA = Output Value - Intermediate Consumption

Where:

- Output Value: The total value of goods and services produced by an industry or sector.

- Intermediate Consumption: The value of inputs used in the production process, including raw materials, energy, and other intermediate goods.

Gross Domestic Product (GDP) and Gross National Product (GNP) are both important economic indicators used to measure the size and health of an economy, but they focus on slightly different aspects of economic activity and include different factors. Here are the key differences between GDP and GNP:

-

Definition and Scope:

- GDP: GDP measures the total value of all goods and services produced within a country's borders, regardless of whether the production is done by domestic or foreign entities. It only considers economic activities that take place within the country.

- GNP: GNP measures the total value of all goods and services produced by a country's residents, whether they are located within the country's borders or abroad. It takes into account the production of residents, both domestically and internationally.

-

Foreign Income and Payments:

- GDP: GDP does not consider the income earned by residents of a country from their economic activities abroad, nor does it account for payments made to foreigners working within the country.

- GNP: GNP includes the income earned by a country's residents from their investments and activities abroad, minus the income earned by foreign residents from their investments within the country.

-

Net Factor Income from Abroad:

- GDP: GDP does not account for net factor income from abroad, which is the difference between income earned by domestic residents abroad and income earned by foreign residents domestically.

- GNP: GNP includes net factor income from abroad as part of its calculation.

-

Foreign Direct Investment:

- GDP: GDP does not directly consider foreign direct investment (FDI) flowing into or out of a country.

- GNP: GNP considers the impact of FDI on the income of a country's residents, both from investments made within the country and from investments made by residents abroad.

-

Measurement Approach:

- GDP: GDP can be calculated using three different approaches: production, income, and expenditure approaches.

- GNP: GNP is primarily calculated using the income approach, as it focuses on the income earned by residents from their economic activities.

|

For Prelims: GDP, GVA, FDI, GNP

For Mains: 1.Discuss the recent trends and challenges in India's GDP growth

2.Examine the role of the service sector in India's GDP growth

3.Compare and contrast the growth trajectories of India's GDP and GNP

|

|

Previous Year Questions

1.With reference to Indian economy, consider the following statements: (UPSC CSE, 2015)

1. The rate of growth of Real Gross Domestic Product has steadily increased in the last decade. 2. The Gross Domestic Product at market prices (in rupees) has steadily increased in the last decade. Which of the statements given above is/are correct? (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 Answer (b)

2.A decrease in tax to GDP ratio of a country indicates which of the following? (UPSC CSE, 2015) 1. Slowing economic growth rate 2. Less equitable distribution of national income Select the correct answer using the code given below: (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 Answer (a)

Previous year UPSC Mains Question Covering similar theme: Define potential GDP and explain its determinants. What are the factors that have been inhibiting India from realizing its potential GDP? (UPSC CSE GS3, 2020) Explain the difference between computing methodology of India’s Gross Domestic Product (GDP) before the year 2015 and after the year 2015. (UPSC CSE GS3, 2021) |

RUPEE EXCHANGE RATE

Exchange rate for 1 Indian Rupee (INR) is as follows:

- United States Dollar (USD): 0.012011 INR

- Euro (EUR): 0.011223 INR

- British Pound (GBP): 0.009784 INR

- Australian Dollar (AUD): 0.018827 INR

- Singapore Dollar (SGD): 0.016343 INR

- Swiss Franc (CHF): 0.010845 INR

- Malaysian Ringgit (MYR): 0.056619 INR

- Japanese Yen (JPY): 1.824210 INR

- If the rupee experiences a faster depreciation rate than its long-term average, it surpasses the dotted line, and vice versa.

- Over the past couple of years, the rupee has demonstrated greater resilience than the long-term trend, but the current decline indicates a correction.

- When considering a diverse range of currencies, data indicates that the rupee has strengthened or appreciated against this basket.

- To clarify, while the US dollar has strengthened against various major currencies, including the rupee, the rupee, in contrast, has strengthened compared to many other currencies like the euro. For example, forex reserves have decreased by over $50 billion between September 2021 and now. Over these 10 months, the rupee's exchange rate with the dollar has declined by 8.7%, from 73.6 to 80.

- To provide context, historically, the rupee typically depreciates by around 3% to 3.5% in a year. Moreover, many experts anticipate further weakening of the rupee in the next 3-4 months, potentially falling to as low as 82 to a dollar.

When the rupee depreciates, it has several implications:

Import Costs: Imported goods and services become more expensive, as it takes more rupees to buy the same amount of foreign currency needed for these transactions. This can contribute to inflationary pressures in the economy.

Export Competitiveness: On the positive side, a depreciated rupee can make the country's exports more competitive in the global market. Foreign buyers find the country's products and services relatively cheaper, potentially boosting export volumes.

External Debt: Countries with significant external debt denominated in foreign currencies may face increased repayment burdens when their domestic currency depreciates. Servicing debt in stronger foreign currencies becomes more expensive.

Inflation: Depreciation can contribute to inflationary pressures by increasing the cost of imported goods and raw materials.

5. Effects on the Indian economy

- Due to a substantial portion of India's imports being priced in dollars, these imports will become more expensive.

- An illustrative example is the higher cost associated with the crude oil import bill. The increased expense of imports, in turn, will contribute to the expansion of the trade deficit and the current account deficit.

- This, in consequence, will exert pressure on the exchange rate. On the export side, the situation is more complex, as noted by Sen.

- In bilateral trade, the rupee has strengthened against many currencies. In exports conducted in dollars, the impact is contingent on factors such as how much other currencies have depreciated against the dollar.

- If the depreciation of other currencies against the dollar is greater than that of the rupee, the overall effect could be negative.

|

For Prelims: Inflation, Deflation, Depreciation, Appreciation

For Mains: General Studies III: How does Depreciation of rupee affect Indian economy

|

|

Previous Year Questions

1. Which one of the following groups of items is included in India's foreign exchange reserves? (UPSC CSE 2013)

A.Foreign-currency assets, Special Drawing Rights (SDRs) and loans from foreign countries B.Foreign-currency assets, gold holdings of the RBI and SDRs

C.Foreign-currency assets, loans from the World Bank and SDRs

D.Foreign-currency assets, gold holdings of the RBI and loans from the World Bank

Answer (B)

2.Which one of the following is not the most likely measure the Government/RBI takes to stop the slide of Indian rupee? (UPSC CSE 2019)

A.Curbing imports of non-essential goods and promoting exports

B.Encouraging Indian borrowers to issue rupee-denominated Masala Bonds

C.Easing conditions relating to external commercial borrowing

D.Following an expansionary monetary policy

Answer (D)

|

CYBERSECURITY

Cybercrimes are illegal activities that are carried out using computers, computer networks, and the internet. These crimes often target individuals, organizations, or governments and can have serious consequences. Here are some common cybercrimes:

-

Phishing: Phishing involves sending deceptive emails or messages that appear to be from a legitimate source but are designed to trick recipients into revealing sensitive information, such as passwords, credit card numbers, or personal identification.

-

Identity Theft: Identity theft occurs when someone steals another person's personal information, such as Social Security numbers or bank account details, with the intent to commit fraud, financial theft, or other criminal activities.

-

Malware: Malicious software, or malware, includes viruses, worms, Trojans, ransomware, and spyware. These programs are designed to damage, disrupt, or gain unauthorized access to computer systems and data.

-

Cyberbullying: Cyberbullying involves using digital communication tools like social media, email, or text messages to harass, threaten, or humiliate individuals. It can have serious psychological and emotional effects on victims.

-

Online Scams: Various online scams exist, including advance-fee fraud, lottery scams, and romance scams. These scams aim to deceive individuals into providing money or personal information to fraudsters.

-

Hacking: Hacking involves unauthorized access to computer systems or networks. Hackers may steal data, disrupt services, or gain control of systems for various purposes, including financial gain, activism, or espionage.

- Cyberstalking: Cyberstalking is a pattern of online harassment or persistent unwanted attention directed at an individual. It can involve threats, monitoring, or intimidation and may escalate to physical harm

-

Data Breaches: Data breaches involve the unauthorized access, acquisition, or release of sensitive data, such as personal information or financial records. These breaches can have severe consequences for individuals and organizations.

-

Online Piracy: Online piracy involves the unauthorized distribution or downloading of copyrighted materials, such as movies, music, software, or books, without permission from the copyright holders.

- Distributed Denial of Service (DDoS) Attacks: In a DDoS attack, multiple compromised computers are used to flood a target system with excessive traffic, rendering it inaccessible to legitimate users. These attacks can disrupt online services and websites

- Cybersecurity refers to the practice of protecting computer systems, networks, software, and data from various forms of digital threats, attacks, and unauthorized access. In an increasingly interconnected and digital world, cybersecurity is of paramount importance to individuals, organizations, and governments to safeguard sensitive information, maintain privacy, and ensure the integrity and availability of digital resources

- Confidentiality in cybersecurity ensures that sensitive data remains private and accessible only to authorized individuals or systems. Measures to achieve confidentiality include encryption, access controls, and user authentication.

- Integrity ensures that data remains accurate and unaltered during storage, transmission, and processing. Data integrity is maintained through mechanisms like checksums and digital signatures

- Authentication verifies the identity of users and systems trying to access a network or data. Common authentication methods include passwords, biometrics, and multi-factor authentication (MFA).

- The National Cybercrime Reporting Portal (NCRP) is a centralized online portal for reporting cybercrime in India. It was launched in 2019 by the Ministry of Home Affairs (MHA) to provide a single platform for citizens to report cybercrime incidents. The NCRP is accessible to all citizens of India, regardless of their location or the type of cybercrime they have experienced.

- To report a cybercrime incident on the NCRP, citizens need to create an account and fill out a complaint form. The form requires basic information about the victim, the accused, and the nature of the cybercrime incident. Citizens can also attach relevant evidence, such as screenshots, emails, or chat logs, to their complaint.

- Once a complaint is submitted, it is assigned to a law enforcement agency for investigation. The NCRP also provides a tracking system so that citizens can check the status of their complaint at any time.

- The NCRP is a valuable resource for citizens who have been victims of cybercrime. It provides a convenient and user-friendly platform for reporting cybercrime incidents. The NCRP also helps law enforcement agencies to track and investigate cybercrime more effectively.

|

Previous Year Questions

1.In India, under cyber insurance for individuals, which of the following benefits are generally covered, in addition to payment for the loss of funds and other benefits? (UPSC CSE 2020)

1. Cost of restoration of the computer system in case of malware disrupting access to one's computer

2. Cost of a new computer if some miscreant wilfully damages it, if proved so

3. Cost of hiring a specialized consultant to minimize the loss in case of cyber extortion

4. Cost of defence in the Court of Law if any third party files a suit

Select the correct answer using the code given below:

A.1, 2 and 4 only

B.1, 3 and 4 only

C.2 and 3 only

D.1, 2, 3 and 4

Answer (D)

|

GLOBAL POSITIONING SYSTEM (GPS)

- The Global Positioning System (GPS) is a network of satellites that orbit the Earth and provide precise location and time information to GPS receivers anywhere on or near the Earth. Originally developed by the United States Department of Defense for military applications, GPS has become widely used in various civilian applications like navigation, mapping, surveying, and outdoor activities.

- GPS works by triangulating signals from multiple satellites to determine the receiver's exact location, typically using signals from at least four satellites to pinpoint a specific position. Each satellite broadcasts signals containing its own location and the precise time the signal was transmitted.

- By measuring the time it takes for the signals to reach the receiver, the GPS device can calculate how far away each satellite is and use this information to determine its own location through a process called trilateration.

- Apart from navigation in vehicles and smartphones, GPS technology has found applications in agriculture, aviation, disaster management, tracking systems, and more due to its accuracy and reliability in determining precise geographic coordinates

3. History of GPS

The history of GPS dates back to the 1960s when the United States began developing the technology for military purposes. Here's a brief timeline of the significant milestones in GPS development:

1960s: The U.S. Department of Defense starts experimenting with satellite-based navigation systems. The system was initially called NAVSTAR (Navigation System with Timing and Ranging).

1973: Physicist and engineer Ivan Getting proposed the concept of a global positioning system using satellites in geostationary orbits. This idea later evolved into the GPS we know today.

1978: The first experimental Block-I GPS satellite was launched, initiating the development of the operational system.

1983: Korean Air Lines Flight 007, a passenger jet, was shot down after straying into Soviet airspace due to navigational errors. This incident accelerated the development and deployment of GPS for civilian use to prevent similar tragedies.

1993: GPS achieved full operational capability with a complete constellation of 24 satellites in orbit.

Late 1990s: Selective Availability (SA), intentional degradation of GPS signals for civilian users, was turned off, significantly improving the accuracy of civilian GPS receivers.

2000s: With advancements in technology, the use of GPS became widespread in various civilian applications, including navigation devices, smartphones, agriculture, surveying, and more.

Modern Developments: Over time, the system has seen upgrades, including the launch of new satellites (modernized Block IIR, IIR-M, IIF, and GPS III satellites), improved accuracy, and the integration of other satellite systems like GLONASS (Russia), Galileo (Europe), and BeiDou (China) for enhanced global coverage and accuracy.

GPS has evolved from a purely military technology into an integral part of everyday life, powering various industries and navigation systems worldwide. Its accuracy and reliability continue to improve with ongoing technological advancements

4. How does the Global Positioning System Work?

The Global Positioning System (GPS) works through a network of satellites orbiting the Earth. Here's a simplified breakdown of how GPS functions:

Satellite Constellation: The GPS system consists of at least 24 satellites orbiting the Earth. These satellites are placed in such a way that at any given time and place on Earth, there are usually multiple satellites visible in the sky.

Triangulation: A GPS receiver on the ground or in a device, such as a smartphone or a GPS unit, communicates with these satellites by receiving signals from them. To determine its location, the receiver needs signals from at least four satellites. This is because each satellite sends out signals containing information about its location and the exact time the signal was transmitted.

Calculating Distance: The GPS receiver calculates its distance from each satellite by measuring the time it takes for the signals to travel from the satellites to the receiver. Since the speed of the signal is known (the speed of light), the receiver can calculate how far away each satellite is based on the time it took for the signal to arrive.

Trilateration: Once the receiver has gathered distance measurements from at least four satellites, it uses a process called trilateration. Trilateration involves intersecting spheres (or in this case, spheres in three dimensions) to determine the precise location where the spheres intersect. In GPS, these spheres are representations of the distances from each satellite. By finding the intersection point of these spheres, the receiver can calculate its exact position on Earth in terms of latitude, longitude, and altitude.

Data Processing: Once the receiver has calculated its position based on signals from multiple satellites, it uses this information along with maps or other geographical data to display the location or provide navigational instructions to the user.

The accuracy of GPS depends on various factors like the number of satellites visible, the quality of the receiver, atmospheric conditions, and any obstructions (such as tall buildings or mountains) that might interfere with signal reception. However, modern GPS receivers can typically provide very accurate location information, often within a few meters

Satellites, especially those involved in navigation systems like GPS, rely on incredibly precise timekeeping. They achieve this accuracy through a combination of factors:

Atomic clocks: Each satellite carries multiple atomic clocks, considered the most accurate timekeeping devices ever created. These clocks tick based on the natural vibrations of atoms, resulting in minimal drift over time. Compared to regular quartz clocks, atomic clocks are millions of times more precise, losing only a few nanoseconds per day.

Ground control and synchronization: Despite their exceptional accuracy, even atomic clocks experience slight variations. Ground stations continuously monitor the satellite clocks, detecting any deviations from International Atomic Time (TAI), the global standard. Based on these measurements, the ground stations send correction signals to the satellites, keeping their clocks precisely aligned.

Relativity factor: Time itself runs slightly differently depending on factors like gravity and velocity. Satellites orbiting Earth experience weaker gravity and travel faster than stationary objects on the ground. This tiny difference, though minuscule, is accounted for in calculations to ensure accurate timekeeping. Regular adjustments are made to compensate for this relativistic effect.

Redundancy and backup systems: To ensure uninterrupted timekeeping, satellites have multiple atomic clocks. If one clock malfunctions, the others take over, minimizing disruptions. Additionally, regular maintenance and updates are performed on both ground stations and satellites to maintain optimal performance.

Through this intricate interplay of cutting-edge technology, meticulous monitoring, and clever calculations, satellites hold onto time with mind-boggling precision. This unwavering accuracy is vital not only for GPS navigation but also for scientific research, telecommunications, and financial transactions that rely on split-second timing

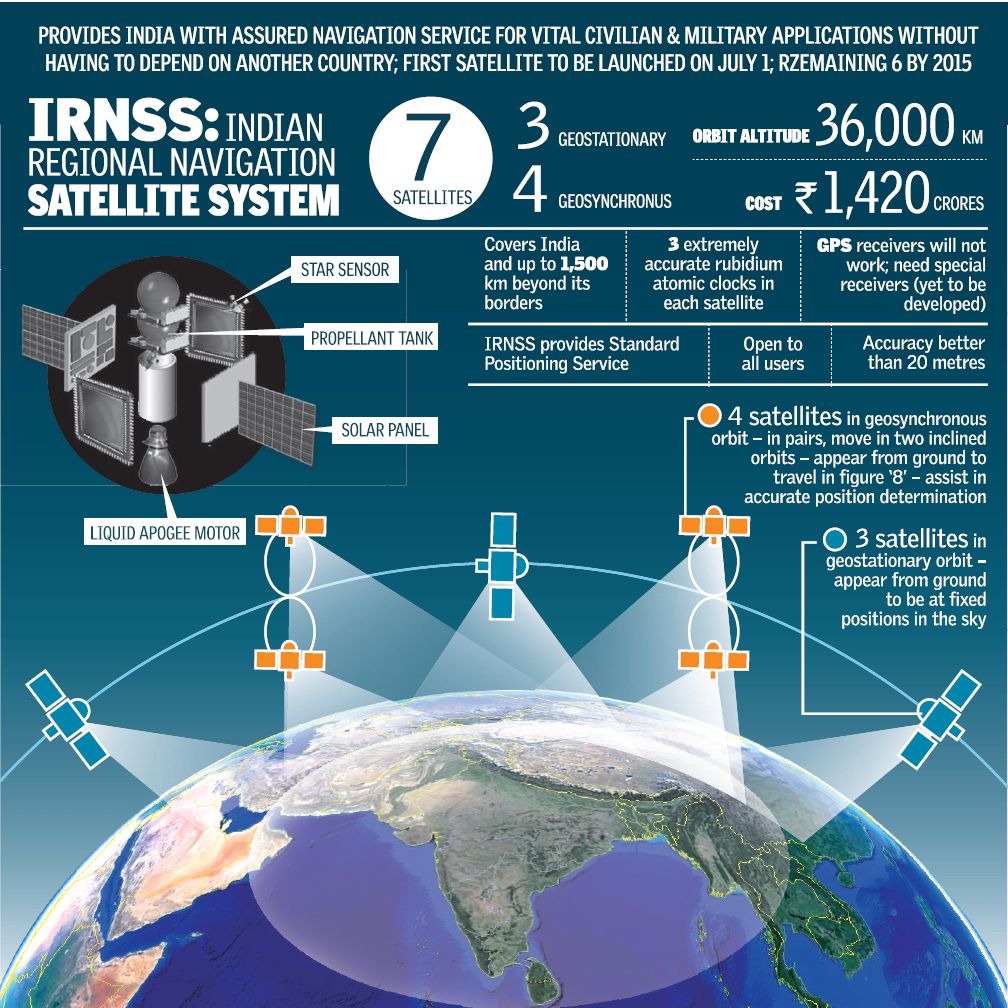

6. India's NaVIC?

- NavIC, or Navigation with Indian Constellation, is an independent stand-alone navigation satellite system developed by the Indian Space Research Organisation (ISRO).

- NavIC was originally approved in 2006 at a cost of $174 million. It was expected to be completed by late 2011 but only became operational in 2018.

- NavIC consists of eight satellites and covers the whole of India’s landmass and up to 1,500 km (930 miles) from its boundaries.

- Currently, NavIC’s use is limited. It is being used in public vehicle tracking in India, for providing emergency warning alerts to fishermen venturing into the deep sea where there is no terrestrial network connectivity, and for tracking and providing information related to natural disasters.

- Enabling it in smartphones is the next step India is pushing for

7. Others Countries Satellites

Several countries operate or have operated satellite navigation systems similar to GPS. Some of these systems include:

-

GLONASS (Global Navigation Satellite System): Developed by Russia, GLONASS is a satellite navigation system that provides global coverage. It's similar to GPS and operates with a constellation of satellites. GLONASS is widely used in Russia and by other countries for various applications.

-

Galileo: Developed by the European Union and the European Space Agency, Galileo is another global satellite navigation system. It aims to provide highly accurate positioning and timing information. Galileo is intended to be interoperable with GPS and other systems to enhance overall navigation capabilities.

-

BeiDou Navigation Satellite System (BDS): Developed by China, BeiDou is another satellite navigation system that aims to provide global coverage. It has been operational in China and surrounding regions and has expanded its coverage to become a global system.

-

NavIC (Navigation with Indian Constellation): Developed by India, NavIC is a regional satellite navigation system designed to provide accurate positioning in India and surrounding regions.

These satellite navigation systems function similarly to GPS, employing constellations of satellites and ground control stations to provide precise positioning, navigation, and timing information to users on Earth. Many modern receivers can utilize signals from multiple satellite systems simultaneously, improving accuracy, availability, and reliability for navigation purposes

7. Way forward

GPS has evolved from a purely military technology into an integral part of everyday life, powering various industries and navigation systems worldwide. Its accuracy and reliability continue to improve with ongoing technological advancements

|

Previous Year Questions 1.In which of the following areas can GPS technology be used? (UPSC CSE 2018) 1. Mobile phone operations 2. Banking operations 3. Controlling the power grids Select the correct answer using the code given below: A.1 only B.2 and 3 only C.1 and 3 only D.1, 2 and 3 Answer (D) 2.With reference to the Indian Regional Navigation Satellite System (IRNSS), consider the following statements: (UPSC CSE 2018) 1. IRNSS has three satellites in geostationary and four satellites in geosynchronous orbits. 2. IRNSS covers entire India and about 5500 sq. km beyond its borders. 3. India will have its own satellite navigation system with full global coverage by the middle of 2019. Which of the statements given above is/are correct? A. 1 Only B.1 and 2 only C.2 and 3 only D. None Answer (A)

1.Why is Indian Regional Navigational Satellite System (IRNSS) needed? How does it help in navigation? (2018) |

Source: The Hindu

FINANCE COMMISSION OF INDIA

The Finance Commission is a constitutional body in India, established under Article 280 of the Indian Constitution. Its primary purpose is to define the financial relations between the central government and the individual state governments.

Here are some key functions and roles of the Finance Commission:

-

Distribution of Taxes: It recommends how the net proceeds of taxes should be divided between the Centre and the States, and among the States themselves.

-

Grants-in-Aid: It determines the principles governing Grants-in-Aid to the States from the Consolidated Fund of India.

-

Augmenting State Finances: It suggests measures needed to augment the Consolidated Fund of a State to supplement the resources of the Panchayats and Municipalities in the State, based on the recommendations made by the State Finance Commissions.

-

Financial Performance Review: It evaluates the financial performance of both the central and state governments and suggests corrective measures for better fiscal management.

-

Any Other Matter: The Commission may also address any other matter referred to it by the President of India in the interest of sound finance.

The Finance Commission is reconstituted every five years and comprises a chairman and four other members, who are appointed by the President of India. The recommendations of the Finance Commission are advisory in nature, meaning they are not binding but are generally followed by the government

- The Finance Commission determines the percentage of the central government's net tax revenue allocated to the States overall (vertical devolution) and how this share is distributed among the individual States (horizontal devolution).

- The horizontal distribution is typically based on a formula devised by the Commission, which considers factors such as a State's population, fertility rate, income level, and geography.

- In contrast, vertical devolution does not follow a specific objective formula. Recent Finance Commissions have recommended increasing the share of tax revenues allocated to States. For instance, the 13th, 14th, and 15th Finance Commissions proposed that the Centre share 32%, 42%, and 41% of the divisible pool of funds, respectively, with the States. Additionally, the Centre may provide extra grants to States for certain jointly funded schemes.

- The 16th Finance Commission is anticipated to suggest ways to boost the revenues of local bodies, such as panchayats and municipalities. It is worth noting that, as of 2015, only about 3% of public spending in India occurred at the local body level, in contrast to countries like China, where over half of public spending happened at the local level

- Disagreements over the allocation of financial resources and the share of tax revenue. States often feel that they do not receive an adequate share of central taxes and grants, impacting their ability to fund local projects and services

- The central government sometimes makes decisions unilaterally, leading to perceptions of overreach and undermining the autonomy of state governments. This centralization can be seen in policy decisions, imposition of centrally sponsored schemes, and emergency provisions

- Conflicts often arise when different political parties govern the Centre and the States. Political rivalries can lead to tensions and lack of cooperation, impacting the implementation of policies and schemes

- The Constitution divides subjects into Union, State, and Concurrent Lists. Disputes can arise over subjects in the Concurrent List, where both the Centre and States have legislative powers. The Centre’s laws can sometimes override state laws, causing friction

- States may resist the implementation of central policies and reforms that they believe do not align with local needs and priorities. This resistance can lead to conflicts over policy implementation

- Disputes over the control and distribution of natural resources like water, minerals, and forests can create tensions. States often demand a greater say in the management and revenue from these resources

- Conditional grants and loans from the Centre can be a point of contention. States may feel that conditions imposed are restrictive and interfere with their autonomy

- Issues related to the appointment and control of key administrative positions, such as governors, can lead to conflicts. Governors are appointed by the Centre but play a crucial role in state administration

- The States and Centre often clash over the percentage of total tax proceeds that should be allocated to the States and the actual disbursement of these funds.

- States contend that they deserve a larger share than what the Finance Commission recommends, arguing that their responsibilities are greater than those of the Centre.

- They also criticize the Centre for not even allocating the recommended amounts, which they believe are already insufficient.

- For instance, analysts note that the Centre has transferred an average of only 38% of funds from the divisible pool to the States under the current Fifteenth Finance Commission, compared to the Commission’s recommendation of 41%.

- Additionally, States dispute what portion of the Centre’s total tax revenues should be included in the divisible pool from which they are funded. It is believed that cesses and surcharges, which are not included in the divisible pool and thus not shared with the States, can account for as much as 28% of the Centre’s total tax revenues in some years, significantly reducing States' revenues.

- Consequently, the increased devolution of funds from the divisible pool recommended by successive Finance Commissions may be offset by rising cess and surcharge collections. In fact, estimates suggest that if these cesses and surcharges are considered, the States' share of the Centre’s overall tax revenues could drop to as low as 32% under the 15th Finance Commission.

- More developed States like Karnataka and Tamil Nadu have also complained that they receive less money from the Centre than they contribute in taxes. For example, Tamil Nadu received only 29 paise for each rupee it contributed to the Centre’s exchequer, while Bihar gets more than ₹7 for each rupee it contributes.

- Critics argue that more developed States with better governance are being penalized by the Centre to support States with poorer governance. Some also believe that the Finance Commission, whose members are appointed by the Centre, may not be entirely independent and free from political influence

|

For Prelims: Finance Commission, Article 280, Fiscal Consolidation, Fiscal Federalism, and Alternative Dispute Resolution (ADR) mechanism.

For Mains: 1. Discuss the Role and Challenges of the Finance Commission in Promoting Fiscal Federalism and Ensuring Equitable Resource Distribution in India. (250 words).

|

Previous year Question1. With reference to the Finance Commission of India, which of the following statements is correct? (UPSC 2011)

A. It encourages the inflow of foreign capital for infrastructure development.

B. It facilitates the proper distribution of finances among the Public Sector Undertaking.

C. It ensures transparency in financial administration.

D. None of the statements (a), (b), and (c) given above is correct in this context.

Answer: D

2. With reference to the Fourteenth Finance Commission, which of the following statements is/are correct? (UPSC 2015)

1. It has increased the share of States in the central divisible pool from 32 percent to 42 percent.

2. It has made recommendations concerning sector-specific grants.

Select the correct answer using the code given below.

A. 1 only

B. 2 only

C. Both 1 and 2

D. Neither 1 nor 2

Answer: A

3. Which of the following is/are among the noticeable features of the recommendations of the Thirteenth Finance Commission? (UPSC 2012)

1. A design for the Goods and Services Tax, and a compensation package linked to adherence to the proposed design.

2. A design for the creation of lakhs of jobs in the next ten years in consonance with India's demographic dividend.

3. Devolution of a specified share of central taxes to local bodies as grants

Select the correct answer using the codes given below:

A. 1 only

B. 2 and 3 only

C. 1 and 3 only

D. 1, 2 and 3

Answer: C

|

RARE EARTH ELEMENTS

| The 17 rare earths are cerium (Ce), dysprosium (Dy), erbium (Er), europium (Eu), gadolinium (Gd), holmium (Ho), lanthanum (La), lutetium (Lu), neodymium (Nd), praseodymium (Pr), promethium (Pm), samarium (Sm), scandium (Sc), terbium (Tb), thulium (Tm), ytterbium (Yb), and yttrium (Y) |

- These elements are important in technologies of consumer electronics, computers and networks, communications, clean energy, advanced transportation, healthcare, environmental mitigation, and national defence, among others

- Scandium is used in televisions and fluorescent lamps, and yttrium is used in drugs to treat rheumatoid arthritis and cancer

- Rare earth elements are used in space shuttle components, jet engine turbines, and drones

- Cerium, the most abundant rare earth element, is essential to NASA’s Space Shuttle Programme

- In recent years, rare earths have become even more important because there has been an increase in demand for green energy

- Elements like neodymium and dysprosium, which are used in wind turbine motors, are sought-after more than ever as wind mills across the world continue to grow

- Moreover, the push for switching from internal combustion cars to electric vehicles has also led to a rise in demand for rare earth magnets made from neodymium, boron, and iron and batteries

- China has imposed restrictions on the export of seven rare earth elements (REEs) — dysprosium, gadolinium, lutetium, samarium, scandium, terbium, and yttrium — which are part of the 17 REEs.

- The country dominates the global refining of heavy REEs, giving it substantial control over critical supply chains, ranging from consumer electronics to defense. Although these measures do not constitute a complete export ban, they may cause temporary supply disruptions, as exporters navigate the permit process.

- India may not face an immediate disruption due to these restrictions. Despite government efforts to enhance domestic manufacturing of semiconductors and defense systems, the more sophisticated phases of production largely take place abroad, particularly in China and Japan. Japan, in anticipation of such issues, has already built stockpiles to buffer against REE-related supply shocks.

- Recognizing the strategic importance of REEs, India is aware that it holds around 6% of global deposits. However, the country’s capacity for mining and refining is minimal, largely due to the environmental challenges associated with such operations.

- India does extract some light REEs through its state-run firm, Indian Rare Earths Ltd, including monazite from coastal sands in Kerala. Nonetheless, imports still play a role.

- According to a recent statement by the Ministry of Mines in the Lok Sabha, India imported approximately 2,270 tonnes of REEs in 2023–24. Consequently, the national approach involves a mix of increasing domestic output and maintaining import channels

To support the strategic use of essential resources such as rare earth elements, India has launched the National Critical Mineral Mission (NCMM). This initiative aims to strengthen the country’s supply chain for critical minerals by boosting domestic production and establishing alternative international supply partnerships. According to a presentation by the Ministry of Mines in January, global events like China’s export restrictions, the Russia–Ukraine conflict, and other geopolitical factors have exposed vulnerabilities in the global critical mineral supply, underscoring the urgency of diversifying sources.

As part of the NCMM, the Indian government plans to oversee or support around 1,200 mineral exploration projects. It also intends to offer exploration licenses to encourage private sector participation and conduct auctions for additional critical mineral blocks

|

For Prelims: Applications of rare earths, rare earth elements

For Mains:

1.Europe’s largest known deposit of rare earth elements found in Sweden: Could the discovery change geopolitics?

|

|

Previous Year Questions

1.Recently, there has been a concern over the short supply of a group of elements called ‘rare earth metals’. Why? (2012)

Which of the statements given above is/are correct? (a) 1 only Answer (c)

|

BIOREMEDIATION

- Bioremediation, in simple terms, refers to using biological agents to revive or clean polluted environments.

- It relies on microorganisms — including bacteria, fungi, algae, and even certain plants — to capture, break down, or neutralise hazardous substances like petroleum spills, pesticides, plastics, and heavy metals. These organisms treat the contaminants as nutrients, decomposing them into safer end-products such as carbon dioxide, water, and organic acids.

- In some situations, they can also alter toxic metals into more stable, less harmful forms that do not seep into soil or groundwater.

- Bioremediation is generally classified into two categories. In situ bioremediation involves treating pollutants at the site itself, for instance by introducing oil-degrading bacteria directly onto an ocean spill.

- Ex situ bioremediation, on the other hand, requires excavating the contaminated soil or water, processing it at a specialised facility, and then returning it once it is detoxified.

- Contemporary bioremediation blends conventional microbiology with advanced biotechnology.

- Emerging tools allow scientists to study biological systems more precisely, identify molecules with beneficial traits, and reproduce them under controlled conditions — such as in wastewater treatment systems or on farmlands.

- For instance, genetically engineered microbes are being developed to break down stubborn pollutants like plastics and persistent oil residues that natural organisms cannot efficiently degrade

- India’s fast-paced industrial growth has taken a significant toll on the environment. Even though pollution levels are showing gradual improvement, major rivers like the Ganga and Yamuna continue to be burdened with untreated household waste and industrial discharge.

- Additional threats — including oil spills, pesticide accumulation, and heavy metals — continue to endanger natural ecosystems as well as human health.

- Conventional methods of environmental clean-up are costly, require high energy inputs, and sometimes generate new forms of pollution.

- In contrast, bioremediation provides a more affordable, scalable, and eco-friendly solution — particularly valuable in a country where large areas of soil and water are contaminated but financial and technological resources remain limited.

- India’s rich biological diversity further strengthens this approach. Native microbial species, already adapted to local climate and conditions such as extreme heat or salinity, often perform better than foreign microbial strains

- Bioremediation is slowly becoming more prominent in India, although much of the work is still at the trial or experimental stage. The Department of Biotechnology (DBT), through its Clean Technology Programme, has been funding various initiatives and promoting collaboration between academic institutions, government research bodies, and industry players.

- The CSIR–National Environmental Engineering Research Institute (NEERI) is actively involved in developing and implementing bioremediation-related projects.

- At the Indian Institutes of Technology, scientists have tested innovations such as a cotton-based nanocomposite that can absorb oil spills, and others have discovered microbial strains capable of breaking down hazardous contaminants in soil.

- The private sector is also beginning to participate. Startups like Biotech Consortium India Limited (BCIL) and Econirmal Biotech are providing microbial products aimed at treating polluted soil and wastewater.

- Despite this growth, large-scale deployment still encounters obstacles. Key issues include inadequate understanding of local contamination conditions, the diverse and complex nature of pollutants, and the absence of uniform national standards for bioremediation practices

- Countries around the world are already incorporating bioremediation into their environmental management systems. Japan uses combinations of microbes and plants as part of its urban waste treatment approach.

- In the European Union, multinational projects are funded to deploy microorganisms for cleaning oil spills and rehabilitating former mining regions. China, under its national soil pollution control programme, has prioritised bioremediation and is using genetically enhanced microbial strains to revive degraded industrial zones.

- For India, the potential is significant. Bioremediation can rejuvenate polluted rivers, recover degraded land, and decontaminate industrial areas, while simultaneously generating employment in fields such as biotechnology, environmental services, and waste-treatment industries.

- It can also complement existing government initiatives like Swachh Bharat Mission, Namami Gange, and various clean-technology programmes

- Releasing genetically modified organisms into natural ecosystems requires strict oversight to avoid unforeseen ecological consequences.

- If testing is insufficient or containment measures fail, such interventions may create new challenges even as they attempt to address existing ones.

- Meaningful public participation will also be essential to ensure wider acceptance of emerging biotechnologies.

- To expand bioremediation safely, India will need updated biosafety regulations, proper certification mechanisms, and a skilled workforce.

Environmentally Friendly

-

Uses natural organisms such as bacteria, fungi, and plants.

-

Breaks down pollutants into harmless by-products like water, CO₂, or organic acids.

-

Minimises secondary pollution compared to chemical or mechanical treatments.

Cost-Effective

-

Generally cheaper than traditional remediation methods that require heavy machinery, chemicals, or high energy consumption.

-

Suitable for developing countries with limited cleanup budgets.

Sustainable and Self-Propagating

-

Microorganisms can multiply and continue degradation without continuous human intervention.

-

Supports long-term ecological restoration.

Versatile

-

Effective against a wide range of contaminants: petroleum oils, pesticides, plastics, sewage sludge, heavy metals (in altered forms), and industrial effluents.

-

Can be applied to soil, groundwater, wastewater, marine environments, and sediments.

In Situ Application Reduces Disturbance

-

Many bioremediation processes can occur directly at the contaminated site.

-

Eliminates the need to transport hazardous material, reducing risk and cost.

Enhances Soil and Water Quality

-

Restores soil fertility by promoting microbial diversity and organic content.

-

Improves water quality in rivers, lakes, wetlands, and groundwater systems.

Scalable and Adaptable

-

Can be applied on small patches of polluted land as well as large, industrially degraded regions.

-

Indigenous microbial strains adapt well to local environmental conditions.

Supports Circular Economy & Green Jobs

-

Creates employment opportunities in biotechnology, environmental consulting, waste management, and research.

-

Integrates with green technology initiatives like Swachh Bharat Mission, Namami Gange, and waste-to-wealth programmes.

|

For Prelims: bioremediation, microorganisms , In situ bioremediation

For Mains: GS III - Environment and ecology

|

|

Previous Year Questions

1. Bioremediation is most effective in which of the following? (UPSC CSE 2020)

A) Solid waste management Answer (C) Mains 1.Examine the role of bioremediation in environmental sustainability (UPSC CSE GS III 2019) |

BOOTH LEVEL OFFICERS (BLO)

- A Booth Level Officer (BLO) is typically a government or semi-government employee who is familiar with the voters in a particular area and generally resides or casts their vote in the same locality.

- Their primary responsibility is to assist in updating the electoral roll by using their on-ground knowledge.

- As per Section 13B(2) of the Representation of the People Act, 1950, BLOs are selected from staff working in government schools, government offices, and various local bodies.

A BLO acts as the grassroots representative of the Election Commission of India (ECI). Their key duties include:

-

Ensuring the electoral roll is accurate and free of errors

-

Collecting, verifying, and revising voter information

-

Supplying necessary forms for inclusion, deletion, or correction of voter details

-

Assisting eligible residents in registering as voters and obtaining voter ID cards

-

Conducting field verification and sending reports to the Electoral Registration Officer (ERO)

They also coordinate with residents and political party representatives to identify voters who have died, relocated, or have duplicate entries so that they can be removed. This makes their work demanding and labor-intensive.

4. Why are BLOs under stress?

- A Special Intensive Revision (SIR) of electoral rolls is currently being conducted in nine states and three Union Territories.

- During this process, several deaths of BLOs have been reported in the regions undergoing SIR, raising concerns about heavy workload and pressure.

- As per the Election Commission’s announcement on October 27, the SIR commenced on November 4.

- Citizens in these 12 states/UTs were required to submit their enumeration forms by December 4, ahead of the publication of draft rolls on December 9.

- According to Section 21(3) of the Representation of the People Act, 1950, the Election Commission of India (ECI) has the authority to order a special revision of the electoral roll for any constituency or a part of it, whenever it considers necessary and in a manner it deems appropriate.

- The Registration of Electors’ Rules, 1960 further provide that electoral roll revisions may be conducted in three ways — intensive, summary, or a mix of both — depending on the ECI’s directions.

- An intensive revision involves preparing the electoral roll anew, whereas a summary revision focuses on updating or modifying the existing roll

-

Once a person casts their vote, an indelible ink mark is applied to their finger to ensure they cannot vote again. This practice is provided for under the Representation of the People Act (RoPA), 1951. The ink used contains silver nitrate, a colourless chemical that turns visible when exposed to ultraviolet rays, including sunlight.

-

The formulation for this indelible ink was created in 1961 by the National Physical Laboratory (NPL), New Delhi, which is part of the CSIR network. In 1962, the technology was licensed to Mysore Paints and Varnish Limited (MPVL), a Karnataka government enterprise.

-

From 1962 onwards, Mysore Paints & Varnish Ltd. has been the sole producer of this ink. Formerly known as Mysore Lac & Paint Works Ltd, the company was founded in 1937 by Nalwadi Krishnaraja Wodeyar, the then Maharaja of Mysore

|

For Prelims: Representation of People Act 1951, Special Intensive Revision (SIR), Election Commission of India (ECI)

For Mains: GS II - Indian Polity

|

|

Previous Year Questions

1. Consider the following statements: (UPSC 2017)

1. The Election Commission of India is a five-member body.

2. Union Ministry of Home Affairs decides the election schedule for the conduct of both general elections and bye-elections.

3. Election Commission resolves the disputes relating to splits/mergers of recognized political parties.

Which of the statements given above is/are correct?

A. 1 and 2 only

B. 2 only

C. 2 and 3 only

D. 3 only

Answer: D

2. Consider the following statements : (UPSC 2021)

1. In India, there is no law restricting the candidates from contesting in one Lok Sabha election from three constituencies.

2. In the 1991 Lok Sabha Election, Shri Devi Lal contested from three Lok Sabha constituencies.

3. As per the- existing rules, if a candidate contests in one Lok Sabha election from many constituencies, his/her party should bear the cost of bye-elections to the constituencies vacated by him/her in the event of him/her winning in all the constituencies.

Which of the statements given above is/are correct?

A. 1 only

B. 2 only

C. 1 and 3

D. 2 and 3

Answer: B

|