MINIMUM SUPPORT PRICE

1. Context

2. What is Minimum Support Price (MSP)?

- MSP is the minimum price a farmer must be paid for their food grains as guaranteed by the government. They are recommended by the Commission for Agricultural Costs and Prices (CACP) and approved by the Cabinet Committee on Economic Affairs.

- The CACP submits its recommendations to the government in the form of Price Policy Reports every year.

- After considering the report and views of the state governments and also keeping in view the overall demand and supply situation in the country, the central government takes the final decision.

- Food Corporation of India (FCI) is the nodal agency for procurement along with State agencies, at the beginning of the sowing season.

- 7 cereals (paddy, wheat, maize, bajra, jowar, ragi, and barley)

- 5 pulses (chana, tur/arhar, moong, urad, and Masur)

- 7 oilseeds (rapeseed-mustard, groundnut, soya bean, sunflower, sesamum, safflower, and nigerseed) and

- 4 commercial crops (sugarcane, cotton, copra, and raw jute).

3. How MSP is Cauclated?

- MSP, presently, is based on a formula of 1.5 times the production costs.

- The CACP projects three kinds of production costs for every crop, both at state and all-India average levels.

- A2 covers all paid-out costs directly incurred by the farmer — in cash and kind — on seeds, fertilizers, pesticides, hired labor, leased-in land, fuel, irrigation, etc.

- A2+FL includes A2 plus an imputed value of unpaid family labor.

- C2: Estimated land rent and the cost of interest on the money taken for farming are added to A2 and FL.

- Farm unions are demanding that a comprehensive cost calculation (C2) must also include capital assets and the rentals and interest forgone on owned land, as recommended by the National Commission for Farmers.

4. The issue with the calculation of MSP

- To calculate MSP, the government uses A2+FL cost. The criticism of A2+FL is that it doesn’t cover all costs and that a more representative measure, C2, needs to be used.

- For example, in the 2017-18 rabi season, CACP data shows that C2 for wheat was 54% higher than A2+FL.

- The Swaminathan Commission also stated that the MSP should be based on the comprehensive cost of production, which is the C2 method.

5. Key Points about the Farmer's Demand

- After the recent decision to repeal three contentious farm laws, protesting farmer unions are now pressing for their demand of the legalization of the Minimum Support Price (MSP).

- They want a legal guarantee for the MSP, which at present is just an indicative or a desired price.

- Legalising MSP would put the government under a legal obligation to buy every grain of the crops for which MSPs have been announced.

- At present, the PM has announced the formation of a committee to make MSP more transparent, as well as to change crop patterns and to promote zero-budget agriculture which would reduce the cost of production.

- The entire issue of enforcing MSP legally is a tricky, complicated, and multidimensional one, involving lots of factors.

- Core demand: MSP based on a C2+50% formula should be made a legal entitlement for all agricultural produce. This would mean a 34% increase in the latest MSP for paddy and a 13% increase for wheat. MSP should also be extended to fruit and vegetable farmers who have been excluded from benefits so far.

6. The rationale behind the demand for legislation of MSP

- Farmers receive less than MSP: In most crops grown across much of India, the prices received by farmers, especially during harvest time, are well below the officially-declared MSPs. And since MSPs have no statutory backing, they cannot demand these as a matter of right.

- Limited procurement by the Govt: Also, the actual procurement at MSP by the Govt. is confined to only about a third of wheat and rice crops (of which half is bought in Punjab and Haryana alone), and 10%-20% of select pulses and oilseeds. According to the Shanta Kumar Committee’s 2015 report, only 6% of the farm households sell wheat and rice to the government at the MSP rates.

7. Why has the committee been set up?

- It has been constituted by the Ministry of Agriculture and Farmers Welfare as a follow-up to an announcement by the Prime Minister when he declared the government’s intention to withdraw the three farm laws.

- The protesting farm unions had demanded a legal guarantee on MSP based on the Swaminathan Commission’s ‘C2+50% formula’ (C2 is a type of cost incurred by farmers;). This was in addition to their demand for repeal of the three farm laws.

8. Committee on MSP, Natural Farming and Crop Diversification

- To suggest measures to make MSP available to farmers by making the systems more effective and transparent,

- Give more autonomy to Commission for Agricultural Costs and Prices (CACP).

On Natural Farming: To make suggestions for programs and schemes for value chain development, protocol validation, and research for future needs and support for area expansion under the Indian Natural Farming System.

On Crop diversification:

To provide suggestions related to crop diversification including

- Mapping of existing cropping patterns of agro-ecological zones of producer and consumer states,

- Strategy for diversification policy to change the cropping pattern according to the changing needs of the country and

- A system to ensure remunerative prices for the sale of new crops.

9. Why have the protesting farm unions opposed this committee?

- Firstly, this committee includes members who supported the now-repeated farm laws.

- Secondly, the terms and references of the committee do not mention the legal guarantee to MSP. Instead, it mentions making MSP more effective and transparent.

10. Challenges associated with MSP

- Protest by Farmers: Farm unions have been protesting for more than six months on Delhi's outskirts, demanding legislation to guarantee MSP for all farmers for all crops and a repeal of three contentious farm reforms laws.

- MSP and Inflation: When announcing the MSP, inflation should be taken into account. But often the price is not increased up to the mark. For example, this time MSP for Maize has not even considered inflation then how it will benefit farmers! Also, frequent increases in the MSPs can lead to inflation too.

- High Input Costs: The input costs have been rising faster than sale prices, squeezing the meager income of the small farmers and driving them into debt.

- Lack of Mechanism: There is no mechanism that guarantees that every farmer can get at least the MSP as the floor price in the market. So proper mechanisms need to be fixed for all times to come.

- Restriction in Europe: Even after producing surplus grains, every year a huge portion of these grains gets rotten. This is due to the restrictions under WTO norms, that grain stocks with the FCI (being heavily subsidized due to MSP) cannot be exported.

|

For Prelims: Minimum Support Price (MSP), World Trade Organisation (WTO), Commission for Agricultural Costs and Prices (CACP), Cabinet Committee on Economic Affairs, Food Corporation of India (FCI).

For Mains: 1. The Minimum Support Price (MSP) scheme protects farmers from price fluctuations and market imperfections. In light of the given statement, critically analyze the efficacy of the MSP. (250 Words)

|

| Previous year Question

1. Consider the following statements: (UPSC CSE 2020)

1. In the case of all cereals, pulses, and oil seeds, the procurement at Minimum Support Price (MSP) is unlimited in any State/UT of India.

2. In the case of cereals and pulses, the MSP is fixed in any State/UT at a level to which the market price will never rise.

Which of the statements given above is/are correct?

A. 1 only

B. 2 only

C. Both 1 and 2

D. Neither 1 nor 2

Answer: D

2.Which of the following factors/policies were affecting the price of rice in India in the recent past? (UPSC CSE, 2020)

(1) Minimum Support Price (2) Government’s trading (3) Government’s stockpiling (4) Consumer subsidies Select the correct answer using the code given below: (a) 1, 2 and 4 only (b) 1, 3 and 4 only (c) 2 and 3 only (d) 1, 2, 3 and 4 Answer (d)

3.In India, which of the following can be considered as public investment in agriculture? (UPSC GS1, 2020)

(1) Fixing Minimum Support Price for agricultural produce of all crops (2) Computerization of Primary Agricultural Credit Societies (3) Social Capital development (4) Free electricity supply to farmers (5) Waiver of agricultural loans by the banking system (6) Setting up of cold storage facilities by the governments. In India, which of the following can be considered as public investment in agriculture? Select the correct answer using the code given below: (a) 1, 2 and 5 only (b) 1, 3, 4 and 5 only (c) 2, 3 and 6 only (d) 1, 2, 3, 4, 5 and 6 Answer (c)

4.The Fair and Remunerative Price (FRP) of sugarcane is approved by the (UPSC CSE, 2015)

(a) Cabinet Committee on Economic Affairs (b) Commission for Agricultural Costs and Prices (c) Directorate of Marketing and Inspection, Ministry of Agriculture (d) Agricultural Produce Market Committee Answer (a)

|

COLLEGIUM VS NJAC

1. Context

2. Collegium System

- The Collegium system is not rooted in the Constitution. Instead, it has evolved through judgments of the Supreme Court.

- Under the system, the Chief Justice of India along with four senior-most Supreme Court judges recommend appointments and transfers of judges.

- A High Court Collegium, meanwhile, is led by the incumbent Chief Justice and the two senior-most judges of that court.

- In this system, the government’s role is limited to getting an inquiry conducted by the Intelligence Bureau (IB) if a lawyer is to be elevated as a judge in a High Court or the Supreme Court.

- The government can also raise objections and seek clarifications regarding the Collegium’s choices, but, if the Collegium reiterates the same names, the government is bound, under Constitution Bench judgments, to appoint them to the post.

3. Evolution of Collegium System

- In the First Judges case, the court held that the consultation with the CJI should be "full and effective".

- The Second Judges Case introduced the collegium system in 1993, as they ordered the CJI to consult a collegium of his two senior judges in the apex court on judicial appointments, such a "collective opinion" of the collegium would have primacy over the government.

- The Third Judges case in 1998, expanded the judicial collegium to its present composition of the CJI and four of its senior-most judges.

4. Constitutional Provisions for Appointment of Judges

5. Procedure for replacement of Collegium System

- Replacing the Collegium system calls for a Constitutional Amendment Bill.

- It requires a majority of not less than two-thirds of MPs (Members of Parliament) present and voting in Lok Sabha as well as Rajya Sabha.

- It also needs the ratification of legislatures of not less than one-half of the states.

6. What are the concerns associated with the Collegium system?

- Constitutional Status: The Collegium is not prescribed in the Constitution. Article 124 mentions consultation, which the SC interpreted as ‘concurrence’ in Second Judges Case (1993). During the hearing against the NJAC, the then SC Bar President had argued that the Constituent Assembly had considered a proposal for making Judges’ appointment ‘in concurrence’ with the CJI but had eventually rejected it.

- Transparency: There is no official procedure for selection or any written manual for the functioning of the Collegium. The parameters considered for selection (or rejection) are not available in the public domain.

- Accountability: The selection of Judges by the Judges is considered undemocratic. Judges are not accountable to the people or any other organ of the State (Legislature or Executive). It can add an element of arbitrariness in functioning.

- Criticism by Judges: Many retired Judges have criticized the working of the Collegium, especially the lack of transparency. Several controversial appointments have been made despite objections by the member-Judges of the Collegium.

- No Checks: There are no checks on the process. Nor has there been any review regarding the effectiveness of the process. Critics of the system argue the phenomena of ‘Uncle Judges’ wherein near relatives, kith, and kin of sitting Judges are appointed to the higher judiciary leading to nepotism. Law Commission in its 230th Report (2012) recommended that that the Judges, whose kith and kin are practicing in a High Court, should not be appointed in the same High Court. The absence of transparency, accountability, and external checks creates space for subjectivity and individual bias in appointments. In some cases, the principle of seniority has been ignored.

- No Reforms: The Supreme Court did not amend the contentious provisions of the NJAC Act or added safeguards to the Act. Instead, it struck down the whole Act. The Supreme Court reverted to the old Collegium System. However, the Court did not take any steps to address the concerns associated with the Collegium System.

7. What is National Judicial Appointments Commission (NJAC)

- The Constitution (99th Amendment) Act, which established the NJAC and the NJAC Act, was passed by Parliament in 2014 to set up a commission for appointing judges,

replacing the Collegium system. - This would essentially increase the government’s role in the appointment of judges.

- The laws were repealed in October 2015 after the Supreme Court struck them down.

7.1 Composition of NJAC

- The Chief Justice of India as the ex officio Chairperson.

- Two senior-most Supreme Court Judges as ex officio members.

- The Union Minister of Law and Justice as ex officio members.

- Two eminent persons from civil society (one of whom would be nominated by a committee consisting of the CJI, Prime Minster, and the Leader of Opposition in the Lok Sabha, and the other would be nominated from the SC/ST/OBC/minority communities or women.

|

For Prelims: Collegium system, National Judicial Appointments Commission (NJAC), Supreme court, High court, Intelligence Bureau (IB), First Judges case, Second Judges Case, Third Judges Case, Article 124(2), Article 217, Law Commission, and 99th Constitutional Amendment Act.

For Mains: 1. What are the two systems of the appointment of Judges that has triggered the fresh debate on the Judicial system in India? (250 Words).

|

|

Previous year Question

1. With reference to the Indian judiciary, consider the following statements: (UPSC 2021)

1. Any retired judge of the Supreme Court of India can be called back to sit and act as a Supreme Court judge by the Chief Justice of India with the prior permission of the President of India.

2. A High Court in India has the power to review its own judgment as the Supreme Court does.

Which of the statements given above is/are correct?

A. 1 only

B. 2 only

C. Both 1 and 2

D. Neither 1 nor 2

Answer: A

2. In India, Judicial Review implies (UPSC 2017)

A. the power of the Judiciary to pronounce upon the constitutionality of laws and executive orders

B. the power of the Judiciary to question the wisdom of the laws enacted by the Legislatures

C. the power of the Judiciary to review all the legislative enactments before they are assented to by the President

D. the power of the Judiciary to review its own judgments given earlier in similar or different cases

Answer: A

3. Consider the following statements:

1. The motion to impeach a Judge of the Supreme Court of India cannot be rejected by the Speaker of the Lok Sabha as per the Judges (Inquiry) Act, 1968.

2. The Constitution of India defines and gives details of what constitutes 'incapacity and proved misbehavior' of the Judges of the Supreme Court of India

3. The details of the process of impeachment of the Judges of the Supreme Court of India are given in the Judges (Inquiry) Act, of 1968.

4. If the motion for the impeachment of a Judge is taken up for voting, the law requires the motion to be backed by each House of the Parliament and supported by a majority of the total membership of that House and by not less than two-thirds of total members of that House present and voting.

Which of the statements given above is/are correct?

A. 1 and 2

B. 3 only

C. 3 and 4 only

D. 1, 3 and 4

Answer: C

|

GOODS AND SERVICE TAX (GST)

- The Goods and Services Tax (GST) is a value-added tax levied on the supply of goods and services at each stage of the production and distribution chain. It is a comprehensive indirect tax that aims to replace multiple indirect taxes imposed by the central and state governments in India.

- GST is designed to simplify the tax structure, eliminate the cascading effect of taxes, and create a unified national market. Under the GST system, both goods and services are taxed at multiple rates based on the nature of the product or service. The tax is collected at each stage of the supply chain, and businesses are allowed to claim a credit for the taxes paid on their inputs.

- The GST system in India came into effect on July 1, 2017, replacing a complex tax structure that included central excise duty, service tax, and state-level taxes like VAT (Value Added Tax), among others. The GST Council, consisting of representatives from the central and state governments, is responsible for making decisions on various aspects of GST, including tax rates and rules.

- GST is intended to create a more transparent and efficient tax system, reduce tax evasion, and promote economic growth by fostering a seamless flow of goods and services across the country. It has a significant impact on businesses, as they need to comply with the new tax regulations and maintain detailed records of their transactions for GST filing

3.Goods and Services Tax (GST) and 101st Amendment Act, 2016

The Goods and Services Tax (GST) in India was introduced through the 101st Amendment Act of 2016. This constitutional amendment was a crucial step in the implementation of GST, which aimed to create a unified and comprehensive indirect tax system across the country.

Here are some key points related to the 101st Amendment Act and GST:

- The 101st Amendment Act was enacted to amend the Constitution of India to pave the way for the introduction of the Goods and Services Tax.

- It added a new article, Article 246A, which confers concurrent powers to both the central and state governments to levy and collect GST

- The amendment led to the creation of the GST Council, a constitutional body consisting of representatives from the central and state governments. The council is responsible for making recommendations on GST rates, exemptions, and other related issues

- The amendment introduced a dual GST structure, where both the central government and the state governments have the power to levy and collect GST on the supply of goods and services

- For inter-state transactions, the 101st Amendment Act provides that the central government would levy and collect the Integrated Goods and Services Tax (IGST), which would be a sum total of the central and state GST

- The amendment also included a provision for compensating states for any revenue loss they might incur due to the implementation of GST for a period of five years

In India, the Goods and Services Tax (GST) is structured into different tax rates based on the nature of the goods and services. As of my last knowledge update in January 2022, the GST rates are divided into multiple slabs. It's important to note that tax rates may be subject to changes, and new amendments could have been introduced since then. As of my last update, the GST rates are as follows:

-

Nil Rate:

- Some goods and services are categorized under the nil rate, meaning they attract a 0% GST. This implies that no tax is levied on the supply of these goods or services.

-

5% Rate:

- This is a lower rate, applicable to essential goods such as certain food items, medical supplies, and other basic necessities.

-

12% Rate:

- Goods and services falling in this category attract a 12% GST rate. Items such as mobile phones, processed foods, and certain services fall under this slab.

-

18% Rate:

- A higher rate of 18% is applicable to goods and services such as electronic items, capital goods, and various services.

-

28% Rate:

- The highest GST rate of 28% is applied to luxury items, automobiles, and certain goods and services that are considered non-essential or fall into the luxury category.

-

Compensation Cess:

- In addition to the above rates, some specific goods attract a compensation cess, which is levied to compensate the states for any revenue loss during the transition to GST. This is often applied to items like tobacco and luxury cars.

-

Zero Rate:

- Certain categories of goods and services may be specified as "zero-rated," which means they are effectively taxed at 0%. This is different from the nil rate, as it allows businesses to claim input tax credit on inputs, capital goods, and input services.

-

Exempt Supplies:

- Some goods and services may be exempt from GST altogether. This means that they are not subject to any GST, and businesses cannot claim input tax credit on related inputs

| Subject | Central GST (CGST) | State GST (SGST) | Union Territory GST (UTGST) | Integrated GST (IGST) |

|---|---|---|---|---|

| Levied by | Central Government | Respective State Governments | Union Territory Administrations | Central Government (on inter-state transactions) |

| Applicability | On intra-state supplies (within the same state) | On intra-state supplies (within the same state) | On intra-union territory supplies (within the same union territory) | On inter-state supplies (across states or union territories) |

| Rate Determination | Determined by the Central Government | Determined by the Respective State Government | Determined by the Union Territory Administration | IGST rate is a sum of CGST and SGST rates |

| Revenue Collection | Collected by the Central Government | Collected by the Respective State Government | Collected by the Union Territory Administration | Collected by the Central Government (on inter-state transactions) |

| Utilization of Revenue | Shared between Central and State Governments | Retained by the Respective State Government | Retained by the Union Territory Administration | Shared between Central and State Governments |

| Purpose | Part of the dual GST structure, meant to cover central taxes | Part of the dual GST structure, meant to cover state taxes | Applicable in union territories for intra-territory supplies | Applied to regulate and tax inter-state supplies |

| Input Tax Credit (ITC) | ITC available for CGST paid on inputs and services | ITC available for SGST paid on inputs and services | ITC available for UTGST paid on inputs and services | ITC available for both CGST and SGST paid on inputs |

| Tax Jurisdiction | Applies within a particular state | Applies within a particular state | Applies within a particular union territory | Applies to transactions across states and union territories |

| GSTN Portal for Filing Returns | Central GSTN portal | State-specific GSTN portals | UTGSTN portal | Integrated GSTN portal |

- GST replaced multiple indirect taxes levied by the central and state governments, simplifying the tax structure. This streamlined system reduces the complexity of compliance for businesses

- GST eliminates the cascading effect of taxes, where taxes are levied on top of other taxes. With a seamless credit mechanism, businesses can claim input tax credit on the taxes paid on their purchases, leading to a more transparent and efficient system

- GST has facilitated the creation of a common national market by harmonizing tax rates and regulations across states. This has reduced trade barriers and promoted the free flow of goods and services throughout the country

- The GST system has incorporated technology-driven processes, including electronic filing and real-time reporting, making it harder for businesses to evade taxes. This has contributed to increased tax compliance

- The input tax credit mechanism under GST benefits manufacturers, as they can claim credits for taxes paid on raw materials and input services. This has a positive impact on the cost of production and enhances the competitiveness of Indian goods in the international market

- GST brings transparency to the taxation system. The online filing of returns and the availability of transaction-level data make it easier for tax authorities to monitor and track transactions, reducing the scope for corruption

- GST has replaced a complex system of filing multiple tax returns with a more straightforward mechanism. Businesses now need to file fewer returns, reducing the compliance burden

- The implementation of GST has contributed to an improvement in the ease of doing business in India. The unified tax system has made it simpler for businesses to operate across states and has reduced the paperwork and bureaucratic hurdles associated with tax compliance

- GST has led to the harmonization of tax rates across states and union territories, minimizing the tax rate disparities that existed earlier. This creates a more predictable tax environment for businesses

- Despite the intention to simplify the tax structure, the multi-tiered rate system (0%, 5%, 12%, 18%, and 28%) and the inclusion of cess on certain goods have introduced complexity. The classification of goods and services under different tax slabs can be challenging, leading to disputes and confusion

- The successful implementation of GST relies heavily on technology. Issues such as technical glitches on the GSTN (Goods and Services Tax Network) portal, especially during the initial phases, have caused difficulties for businesses in filing returns and complying with regulations

- The compliance requirements for businesses under GST, including multiple returns filing, have been perceived as burdensome. Smaller businesses, in particular, may find it challenging to adapt to the new system and comply with the various provisions

- The transition from the previous tax regime to GST posed challenges, especially for businesses in terms of understanding the new tax structure, reconfiguring accounting systems, and ensuring a smooth transition of credits from the old tax system to the GST system

- The classification of certain goods and services into specific tax slabs has been a source of contention. Ambiguities in classification have led to disputes and litigations, with businesses seeking clarity on the applicable tax rates

- The implementation of GST has increased compliance costs for businesses due to the need for sophisticated IT infrastructure, the hiring of tax professionals, and efforts to ensure accurate reporting and filing

- Challenges related to availing and matching input tax credits have been reported. Timely matching of credits and resolving discrepancies can be cumbersome, leading to concerns about the seamless flow of credit across the supply chain

- The anti-profiteering provisions were introduced to ensure that businesses pass on the benefits of reduced tax rates to consumers. However, the implementation of anti-profiteering measures has been criticized for its complexity and potential for disputes

- The periodic changes in the GST return filing system have created challenges for businesses in adapting their processes. Delays and complexities in return filing can affect working capital management

The GST Council consists of the following members:

- The Union Finance Minister, who is the Chairperson of the Council.

- The Union Minister of State in charge of revenue or any other Minister of State nominated by the Union Government.

- One Minister from each state, nominated by the Governor of that state.

- The Chief Secretary of each state, ex-officio.

- If the President, on the recommendation of the Council, so directs, one representative of each Union territory which has a legislature, to be nominated by the Lieutenant Governor of that Union territory.

- Three to seven members (other than Ministers) to be nominated by the Union Government, of whom at least one member shall be from the field of economics and another from the field of chartered accountancy, legal affairs or public finance

|

For Prelims: Economic and Social Development and Indian Polity and Governance

For Mains: General Studies II: Functions and responsibilities of the Union and the States, issues and challenges pertaining to the federal structure, devolution of powers and finances up to local levels and challenges therein

General Studies III: Inclusive growth and issues arising from it |

|

Previous Year Questions

1.Which of the following are true of the Goods and Services Tax (GST) introduced in India in recent times? (UGC Paper II 2020)

A. It is a destination tax

B. It benefits producing states more

C. It benefits consuming states more

D. It is a progressive taxation

E. It is an umbrella tax to improve ease of doing business

Choose the most appropriate answer from the options given below:

A.B, D and E only

B.A, C and D only

C.A, D and E only

D.A, C and E only

Answer (D)

|

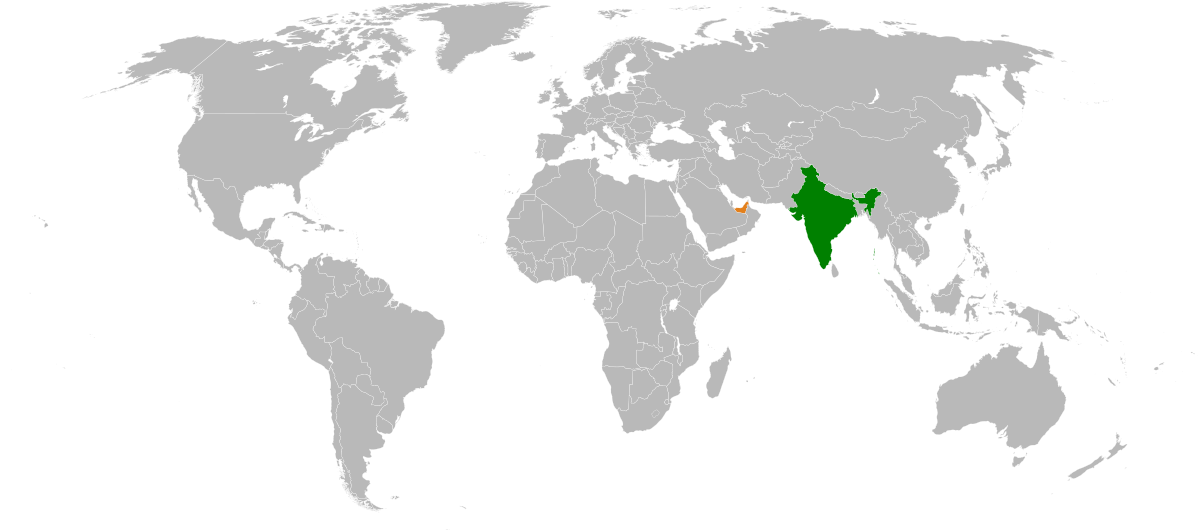

INDIA-UAE

-

Economic Relations: The UAE is India's third-largest trading partner and one of the major investors in India. Bilateral trade between the two countries has been growing steadily, with a focus on sectors like energy, information technology, pharmaceuticals, textiles, and agriculture. The UAE is also a significant source of remittances for India due to the large Indian diaspora residing in the UAE.

-

Investment: The UAE has made substantial investments in India across sectors such as infrastructure, real estate, hospitality, logistics, and renewable energy. The Abu Dhabi Investment Authority (ADIA) and the Dubai-based DP World are prominent examples of UAE investments in India.

-

Energy Cooperation: The UAE is a crucial source of energy for India. The Abu Dhabi National Oil Company (ADNOC) supplies crude oil to Indian refineries, and both countries have explored opportunities for collaboration in the energy sector, including renewable energy projects.

-

Defense and Security: India and the UAE have enhanced cooperation in defense and security matters. They conduct joint military exercises, exchange intelligence, and cooperate in countering terrorism and maritime security. The UAE has also supported India's efforts to combat terrorism and extradite wanted individuals.

-

Strategic Partnership: In 2015, India and the UAE elevated their bilateral relationship to a "Comprehensive Strategic Partnership." This designation reflects the deepening ties and shared interests between the two countries.

-

Cultural Exchanges and People-to-People Contacts: There is a significant Indian community in the UAE, comprising professionals, skilled workers, and businesspeople. Both countries have encouraged cultural exchanges, tourism, and educational cooperation to strengthen people-to-people contacts and promote mutual understanding.

-

Diplomatic Engagements: High-level visits between India and the UAE have been frequent, reflecting the importance both countries attach to the relationship. The leaders of both countries have engaged in regular dialogues to enhance bilateral cooperation and address common challenges.

The United Arab Emirates (UAE) holds significant importance to India for several reasons:

-

Economic Relations: The UAE is one of India's major trading partners and a significant source of investment. Bilateral trade between the two countries has been growing steadily, with the UAE being India's third-largest trading partner. The UAE's investments in India span various sectors, including infrastructure, real estate, hospitality, logistics, and renewable energy. This economic partnership contributes to India's economic growth and development.

-

Energy Security: The UAE is an important source of energy for India. It supplies crude oil to Indian refineries, helping to meet India's energy needs. Ensuring a stable and reliable energy supply is crucial for India's growing economy, and the UAE plays a significant role in fulfilling India's energy requirements.

-

Indian Diaspora: The UAE is home to a large Indian diaspora, comprising professionals, skilled workers, and businesspeople. The Indian community in the UAE plays a vital role in strengthening people-to-people ties and contributing to the UAE's economy through their work and remittances. The UAE's favorable policies towards the Indian community and its contributions have fostered a sense of goodwill and mutual understanding between the two countries.

-

Defense and Security Cooperation: India and the UAE have been strengthening their defense and security cooperation in recent years. They conduct joint military exercises, share intelligence, and collaborate in countering terrorism and ensuring maritime security. The UAE's support to India's counter-terrorism efforts and extradition of wanted individuals have been crucial in addressing shared security concerns.

-

Strategic Location: The UAE's geographic location at the crossroads of Asia, Europe, and Africa makes it an important hub for trade, connectivity, and investment. Its modern infrastructure, world-class ports, and air connectivity make it an attractive destination for Indian businesses looking to expand their reach globally. The UAE's strategic location serves as a gateway for India's trade with the Middle East, North Africa, and beyond.

-

Cultural Exchanges and Tourism: The UAE and India have fostered cultural exchanges and tourism, facilitating people-to-people contacts and enhancing mutual understanding. Millions of Indians visit the UAE for business, tourism, and religious purposes, strengthening the cultural and social ties between the two countries.

-

Diplomatic Engagements: India and the UAE maintain regular high-level engagements, with frequent visits by leaders and officials from both sides. These interactions help in deepening bilateral relations, addressing common challenges, and exploring new avenues of cooperation..

|

For Prelims: India-UAE, Global food security, G20, I2U2, Public Distribution System, POSHAN Abhiyaan, Covid, Conflict and Climate, Comprehensive Economic Partnership Agreement,

For Mains:

1. Discuss India's role in ensuring global food security during the pandemic and post-pandemic times. (250 Words)

|

|

Previous Year Questions

1. With reference to the international trade of India at present, which of the following statements is/are correct? (UPSC 2020)

1. India's merchandise exports are less than its merchandise imports.

2. India's imports of iron and steel, chemicals, fertilizers, and machinery have decreased in recent years.

3. India's exports of services are more than its imports of services.

4. India suffers from an overall trade/current deficit.

Select the correct answer using the code given below:

A. 1 and 2 only B. 2 and 4 only C. 3 only D. 1, 3 and 4 only

Answer: D

2. Consider the following countries: (UPSC 2018)

Which of the above are among the ‘free-trade partners’ of ASEAN? (a) 1, 2, 4 and 5 (b) 3, 4, 5 and 6 (c) 1, 3, 4 and 5 (d) 2, 3, 4 and 6 Answer: C 3. The term ‘Regional Comprehensive Economic Partnership’ often appears in the news in the context of the affairs of a group of countries known as (UPSC 2016) (a) G20 (b) ASEAN (c) SCO (d) SAARC Answer: B 4. The area known as ‘Golan Heights’ sometimes appears in the news in the context of the events related to ( UPSC 2015) (a) Central Asia (b) Middle East (c) South-East Asia (d) Central Africa Answer: B 5. Which of the following are the objectives of ‘National Nutrition Mission’? (UPSC 2017)

Select the correct answer using the code given below: (a) 1 and 2 only (b) 1, 2 and 3 only (c) 1, 2 and 4 only (d) 3 and 4 only Answer: A |

SWACHH BHARAT

1. Context

2. Impacts of Poor Sanitation

- Exposure to contaminated drinking water and food with pathogen-laden human waste is a major cause of diarrhea and can cause cholera, trachoma, intestinal worms, etc, leading to the “stunting” of huge swathes of our children.

- Poor hygiene and waste management practices also impact the environment with untreated sewage flowing directly into water bodies and affecting coastal and marine ecosystems, contaminating soil and air, and exposing millions to disease.

- A study by the World Bank states that the absence of toilets and conventional sanitation costs India 6.4 percent of its GDP in 2006.

- The economic impact of poor sanitation for India is at least $38.5 billion every year under health, education, access time, and tourism.

3. Swachh Bharat Mission (SBM)

- The launch of the Swachh Bharat Mission (SBM) had a unique goal — to achieve universal sanitation coverage and to make the country Open Defecation Free (ODF).

- By offering financial incentives for building household toilets, as well as community toilets for slums and migrant populations, the government gave a huge fillip to the toilet infrastructure.

- To bring changes to the age-old idea that toilets in the home were unclean, the government ran several programs with the participation of the private sector and NGOs to educate the population on the benefits of ODF in what is acclaimed as one of the largest behavior change programs in the world. From 2014 to 2020, more than 10 crore toilets were constructed. The country declared itself ODF on October 2, 2019.

4. Swachh Bharat Mission 2.0 (SBM 2.0)

5. Light House Initiative (LHI)

5.2 Significance of Light House Initiative (LHI)

- Joint ownership and accountability between local governments, communities, and corporates will ensure the success of the initiative.

- Managing household and plastic waste as well as wastewater at a village level, defining and implementing solutions to convert waste to achieve a remunerative return not only creates hygienic surroundings for the communities but allows them to become economically self-sufficient in the medium to long term.

- Recovery of precious grey water through minimal treatment and treatment of sewage helps tackle scarce water resources, encouraging reuse and conserving water bodies.

6. India Sanitation Coalition (ISC)

- The India Sanitation Coalition (ISC) is a multi-stakeholder platform that creates meaningful collaborations.

- These stakeholders include the private sector, government, financial institutions, civil society groups, media, donors, etc.

- ISC is recognized as the official intersection between the government and the private sector for engagement in helping build solid and liquid waste management infrastructure sustainably.

- In choosing to partner with ISC on the LHI initiative and the early batch of corporates that have come forward such as ITC, Jindal Steel and Power, JSW, Nayara, HCL, and foundations such as Ambuja Cement, Tata Trusts and Aga Khan Trust, the Department of Drinking Water and Sanitation has recognized the benefits of working with the private sector.

- Understanding the on-ground need for solid and liquid waste management infrastructure has included activities such as the construction of soak pits, waste stabilization ponds, drainage channels, compost pits, collection and segregations sheds, and biogas plants as part of the Rs1,40,881 crore that will be provided over the next five years. The private sector will supplement this through CSR funding.

6.1 Management and Technology Expertise

- The ISC will continue to focus on the government’s position on the thematic interlinkages between WASH and sectors such as health, education, gender, nutrition, and livelihoods.

- This will include urban and rural challenges and create viable programs where government funding will be used primarily for infrastructure building and the private sector comes in as a strategic partner providing expertise in management and technology.

For Prelims & Mains

|

For Prelims: Swachh Bharat Mission 2.0, Light House Initiative (LHI), India Sanitation Coalition (ISC), Sustainable Development Goals (SDG).

For Mains:1. What is Swachh Bharat Mission and explain the impact and achievements of the Swachh Bharat Mission-U and AMRUT?

|