FIRST INFORMATION REPORT (FIR)

1. Context

2. First Information Report (FIR)

- The term first information report (FIR) is not defined in the Indian Penal Code (IPC), Code of Criminal Procedure (CrPC), 1973, or in any other law, but in police regulations or rules, information recorded under Section 154 of CrPC is known as First Information Report (FIR).

- Section 154 (“Information in cognizable cases”) says that “every information relating to the commission of a cognizable offence if given orally to an officer in charge of a police station, shall be reduced to writing by him or under his direction, and be read over to the informant; and every such information, whether given in writing or reduced to writing as aforesaid shall be signed by the person giving it, and the substance thereof shall be entered in a book to be kept by such officer in such form as the State Government may prescribe”.

- Also, a copy of the information as recorded shall be given forthwith, free of cost, to the informant.

3. Important elements of an FIR

- the information must relate to the commission of a cognizable offence,

- it should be given in writing or orally to the head of the police station and,

- it must be written down and signed by the informant, and its key points should be recorded in a daily diary.

4. What is a cognizable offence?

- A cognizable offence/case is one in which a police officer may, in accordance with the First Schedule of the CrPC, or under any other law for the time being in force, make an arrest without a warrant.

- In the First Schedule, “the word ‘cognizable’ stands for a police officer may arrest without warrant’; and the word ‘non-cognizable’ stands for a police officer shall not arrest without warrant.”

5. What is the difference between a complaint and an FIR?

- The CrPC defines a “complaint” as “any allegation made orally or in writing to a Magistrate, with a view to his taking action under this Code, that some person, whether known or unknown, has committed an offence, but does not include a police report.”

- However, an FIR is a document that has been prepared by the police after verifying the facts of the complaint. The FIR may contain details of the crime and the alleged criminal.

- If, on the basis of a complaint, it appears that a cognizable offence has been committed, then an FIR under Section 154 CrPC will be registered, and police will open an investigation. If no offence is found, the police will close the inquiry.

- In case of non-cognizable offences, an FIR under Section 155 CrPC, commonly called “NCR”, is registered, and the complainant will be asked to approach a court for an order. The court may then direct the police to conduct an investigation of the complaint.

6. Section 155

7. Zero FIR

- When a police station receives a complaint regarding an alleged offence that has been committed in the jurisdiction of another police station, it registers an FIR and then transfers it to the concerned police station for further investigation. This is called a Zero FIR.

- No regular FIR number is given. After receiving the Zero FIR, the concerned police station registers a fresh FIR and starts the investigation.

8. What if the Police refuse to register an FIR?

- Under Section 154(3) CrPC, if any person is aggrieved by the refusal on the part of the officer in charge of a police station to register an FIR, she can send the complaint to the Superintendent of Police/DCP concerned who, if satisfied that such information discloses the commission of a cognizable offence, will either investigate the case or direct an investigation by a subordinate police officer.

- If no FIR is registered, the aggrieved persons can file a complaint under Section 156(3) CrPC before a concerned court which, if satisfied that a cognizable offence is made out from the complaint, will direct the police to register an FIR and conduct an investigation.

9. What happens after an FIR is filed?

- The police will investigate the case and will collect evidence in the form of statements of witnesses or other scientific materials.

- They can arrest the alleged persons as per law.

If there is sufficient evidence to corroborate the allegations of the complainant, then a chargesheet will be filed. Or else, a Final Report mentioning that no evidence was found will be filed in court. - If it is found that no offence has been committed, a cancellation report will be filed. If no trace of the accused persons is found, an ‘untraced’ report will be filed.

- However, if the court does not agree with the investigation report, it can order further investigation.

| For Prelims: First information report (FIR), Indian Penal Code (IPC), Code of Criminal Procedure (CrPC), Cognizable offence, Non-Cognizable offence, Zero FIR, Section 154 CrPC, and Section 155 of CrPC. |

JALLIANWALA BAGH MASSACRE

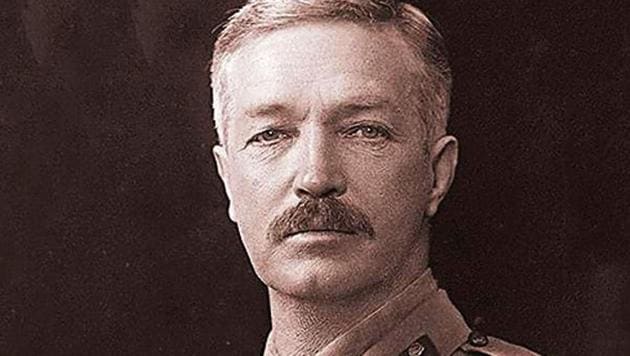

- A British Colonel named Reginald Edward Harry Dyer ordered troops to surround the compound, situated between houses and narrow lanes, and launched indiscriminate firing on the assembled men, women and children who lacked the means to escape. Some of them jumped into a well located within the premises to escape the bullets

- According to the British, around 400 people were killed in the firing, the youngest of whom was nine-years-old and the oldest was 80. Indian historians peg the toll at 1,000

- While British rule in India led to numerous atrocities before and after Jallianwala Bagh, the nature of the violence that unfolded on unarmed civilians led to widespread condemnation later, including from British authorities

- Wartime British Prime Minister Winston Churchill went on to describe the day as “monstrous” and an inquiry was set up to probe Dyer’s orders

- April 13 saw celebrations for the Sikh festival of Baisakhi, which marks the onset of Spring and the harvest of winter crops

- Simultaneously, the movement for independence from British rule had been steadily gaining ground in recent years, and an event was held at Jallianwala Bagh to defy colonial orders and protest against the recently passed Rowlatt Bills

- These Bills curtailed the civil liberties of Indians and let colonial forces arrest people without any warrant or trial

- One of the Acts was pushed through the Legislative Council ignoring objections of elected Indian representatives, leading to resentment among Indians

- Some violent protests had been witnessed in cities of Delhi, Bombay (now Mumbai) and Lahore as well, even as MK Gandhi called for the launch of a non-violent peaceful protest at the time

- Sir Michael O’Dwyer imposed martial rule in Lahore and Amritsar on April 11, but the order reached Amritsar only on April 14

- He also sent Colonel Dyer, who was then holding the temporary rank of Brigadier General, from the Jalandhar cantonment to Amritsar

- On April 13, a Sunday, Col Dyer’s troops marched through the town to warn against the assembly of more than four people

- But the announcement did not reach most people, and devotees headed towards the Golden Temple

- By 4 pm, many gathered for a public meeting against the arrest of Dr Satyapal and Dr Saifuddin Kitchlew for opposing the Rowlatt Act

- Dyer saw the assembly as a violation of government orders. “They had come to fight if they defied me and I was going to give them a lesson……I was going to punish them

- "My idea from the military point of view was to make a wide impression,” Dyer said to the Hunter Committee of 1920

- The 1920 report noted that Dyer entered Jallianwala Bagh with 25 Gorkha soldiers and 25 Baluchis armed with rifles, 40 Gorkhas armed with only Khukris and two armoured cars. A crowd of around 10 to 12,000 was gathered there at the time

- According to the report “Without giving the crowd any warning to disperse, which he considered unnecessary as they were in breach of his proclamation, he ordered his troops to fire and the firing continued for about ten minutes,”

- It noted that no one in the crowd was carrying firearms though some may have been carrying sticks

- In all, the soldiers fired 1,650 rounds. A later investigation brought the number of killed up to 379

- No figure was given for the wounded and it was thought that it may have been three times the dead

- Indian leaders expressed their anger and protested in response to the killings. Notably, Nobel laureate poet Rabindranath Tagore gave up his knighthood

- Dyer was born in Murree in 1854, in present-day Pakistan, and was commissioned in the West Surrey Regiment in 1885 and then transferred to the Indian Army

- The Jallianwala Bagh incident led to focus on his actions in particular

- After the incident too, Dyer was known to engage in barbarity against Indians in at least one other incident

- On April 10, 1919 Marcella Sherwood, a missionary, was cycling down the street in Amritsar when she was allegedly attacked. Some locals intervened and saved her

- Six days after the Jallianwala Bagh massacre, Dyer was informed of how Sherwood was attacked and he issued an order that no one would walk through the street where Sherwood was attacked

- Those who needed to pass through it, were told to crawl. Those disobeying these orders were to be flogged

- As part of the Hunter Committee report, statements from Dyer given to it show that he did not show particular regret for his action on April 13, believing them to be justified to quell the crowd

- He is quoted as saying in the report, “I had made up my mind. I was only wondering whether I should do it or not….The situation was very, very serious. I had made up my mind that I would shoot all men to death if they were going to continue the meeting.”

- The Hunter Committee condemned the incident but did not impose any punishment on Dyer

- Ultimately, the Commander-in-Chief of the Army directed Brig Gen Dyer to resign his appointment as Brigade Commander and informed him that he will receive no further employment in India

- However, Dyer remained a divisive figure at the time. Imperialists at home lauded Dyer for his actions against what they termed as unrest in India

- Conservative newspapers and organisations in the UK later arranged for a fund for Dyer and collected a significant amount

- Dyer would go on to retire and live in Britain. Incidentally, Michael O’Dwyer, the officer to order martial law, was later assassinated in 1940 in his retirement by Sardar Udham Singh, an Indian man who was present at Jallianwala Bagh and escaped the atrocities

|

For Prelims: Rowlatt Act, Hunter Commission, Legislative Council

For Mains: 1.Jallianwala bagh incident has changed the perception about British rule in India. Comment (250 Words)

|

|

Previous Year Questions:

1.Which of the following statement(s) is/are true about the Jallianwala Bagh Massacre? (UPSC CAPF 2019)

1. In Jallianwala Bagh troops opened fire upon an unarmed crowd

2. The troops were under the command of General Dyer

3. The troops did not issue any warning to the people before firing

Select the correct answer using the code below

A. 1 and 2 B. 2 and 3 C. 1 and 3 D. 1, 2, 3

Answer (D)

|

DISCLOSURE OF ASSETS

2. Legal Framework for Candidate Disclosure

- The mandate for candidates to disclose their criminal records, educational qualifications, and financial assets, including those of their spouses and dependents, stems from a pivotal Supreme Court ruling on May 2, 2002. This ruling affirmed that voters' right to information in a democracy is integral to their ability to express their opinions through voting.

- In June 2002, the Election Commission of India (ECI) established rules to implement the court's decision. However, the government at the time sought to limit these disclosures through an ordinance that amended the Representation of the People Act, 1951, in August 2002. This ordinance was later replaced by an Act, which introduced Sections 33A (about the disclosure of pending criminal cases), Section 33B (effectively undermining the ECI's notification by stipulating that only disclosures mandated by the Act were necessary), and Section 125A (penalties for failure to disclose or providing false information).

- The ordinance and subsequent amending Act faced legal challenges. On March 13, 2003, the Supreme Court invalidated Section 33B and reinstated the disclosure requirements for assets, liabilities, and educational qualifications. The ECI then issued revised instructions and disclosure formats by the court's ruling.

3. Consequences of Omission or False Information

According to Section 125A of the Representation of the People Act, 1951, candidates face potential consequences for failing to disclose necessary information, providing false information, or concealing required details. Such actions can result in a six-month prison sentence, a fine, or both.

Beyond criminal prosecution, any omission or provision of false information can serve as grounds to challenge a candidate's election in the High Court. Relevant legal provisions include:

- Under Section 100 of the Act, an election may be declared void due to "improper acceptance of any nomination" or "non-compliance with the provisions of the Constitution or this Act or of any rules or orders made under this Act."

- Unsuccessful candidates have the opportunity to contest the acceptance of the nomination of the eventual winner based on concealment or furnishing of false information. They can also raise concerns regarding potential violations of statutory disclosure requirements.

4. Latest Supreme Court Ruling

- The case revolved around the election of Karikho Kri, an independent candidate who secured a seat in the Arunachal Pradesh Assembly in 2019. His victory was contested by the Congress candidate Nuney Tayang, who alleged that Mr Kri had not disclosed certain movable assets registered under his wife and children's names.

- The Itanagar Bench of the High Court of Assam, Nagaland, Mizoram, and Arunachal Pradesh upheld the allegations and invalidated Mr Kri's election. The court found that his nomination had been improperly accepted due to his failure to disclose three vehicles (which had been sold years prior but not yet registered under the buyers' names) and his omission of a 'No Dues' certificate for government accommodation he had utilised during a previous term as MLA (2009-14).

- However, the Supreme Court overturned the High Court's judgment. The apex court ruled that the non-disclosure did not constitute a substantial enough omission to warrant the rejection of Mr. Kri's nomination. Moreover, it determined that the omission did not amount to non-compliance with the law, as it did not significantly impact the election's outcome.

5. Key Takeaway from the Verdict

- The Supreme Court emphasised that the voter's right to information about candidates is not absolute. It clarified that candidates are not obligated to reveal every detail of their lives to the electorate. There is no requirement to disclose every movable property unless it holds significant value or reflects upon the candidate's lifestyle, thereby being of interest to voters.

- The court cautioned against a rigid standard, stating that there cannot be a one-size-fits-all rule regarding disclosure. The significance of an omission or its potential impact on the election outcome will vary based on the circumstances of each case.

- This ruling underscores the need for a nuanced approach to candidate disclosure, balancing the voters' right to information with candidates' right to privacy. It acknowledges that while transparency is crucial, not every detail of a candidate's life needs to be laid bare unless it is relevant to the election process.

|

For Prelims: Election Commission of India, Supreme Court, Right to Privacy, Representation of the People Act, 1951

For Mains:

1. Evaluate the implications of the Supreme Court's observations regarding the balance between voter's right to information and candidate's right to privacy in the context of asset disclosure. How can electoral authorities ensure transparency while respecting candidates' privacy rights? (250 Words)

|

|

Previous Year Questions

1. According to the Representation of the People Act, 1951, in the event of a person being elected to both houses of Parliament, he has to notify within ______ days in which house he intends to function. (Delhi Police Constable 2020)

A. 22 B. 10 C. 20 D. 15

2. The Protection of Civil Rights Act, 1955 extends to (MPPSC 2018)

A. whole of India

B. whole of India except the State of Jammu and Kashmir

C. Union Territories

D. only the- State of Jammu and Kashmir

3. Under the Protection of Civil Rights Act 1955, all offences are (MPPSC 2013)

A. Cognizable B. Bailable C. Compoundable D.Punishment with imprisonment and fine both

4. The right to vote is in which article of the Indian Constitution? (Bihar Forest Guard 2019)

A. Article 322 B. Article 324 C. Article 326 D. Article 330

5. Right to vote and to be elected in India is a (UPSC 2017)

A. Fundamental Right B. Natural Right C. Constitutional Right D. Legal Right

6. Consider the following statements: (UPSC 2017) 1. The Election Commission of India is a five-member body.

2.The Union Ministry of Home Affairs decides the election schedule for the conduct of both general elections and bye-elections.

3. Election Commission resolves the disputes relating to splits/mergers of recognised political parties.

Which of the statements given above is/are correct? (a) 1 and 2 only (b) 2 only (c) 2 and 3 only (d) 3 only 7. The Voter Verifiable Paper Audit Trail (VVPAT) system was used for the first time by the Election Commission of India in (UPSC CAPF 2019) A. North Paravur Assembly Constituency, Kerala

B. Noksen Assembly Constituency, Nagaland

C. Mapusa Assembly Constituency, Goa

D. Nambol Assembly Constituency, Manipur

8. In which of the following options, Electronic Voting Machines were used for the first time during general elections all over India? (Rajasthan Police Constable 2020) A. 2014 B. 1999 C. 2004 D. 2009 9. Which one of the following statements about 'personal liberty' is not correct? (UPSC CAPF 2021)

A. State does not have the authority to deprive any person within the territory of India of his/her personal liberty without any rational basis.

B. Basis of depriving a person of his/her personal liberty must be in accordance with procedures established by law.

C. Personal liberty can be secured by the judicial writ of Habeas Corpus.

D. The majority view of the Supreme Court in A. K. Gopalan vs. State of Madras case invented 'due process of law'.

10. Consider the following statements about Electoral Bond Scheme 2018: (RPSC RAS 2018) (A) The aim of this scheme is to bring about transparency in the funding process of political parties.

(B) Only the political parties recognized by the Election Commission which secured not less than one per cent of the votes polled in the last general election to the House of People or the Legislative Assembly of the State shall be eligible to receive the Electoral Bonds.

(C) Electoral Bonds shall be valid for fifteen calendar days from the date of issue.

(D) The Electoral Bond deposited by an eligible political party in its account shall be credited on the same day.

Which of the above statements are correct? A. Only (A) and (B) B. (A), (B), (C) and (D) C. Only (B), (C) and (D) D. Only (A), (C) and (D) 11. Consider the following statements : (UPSC CSE 2021)

1. The Montagu-Chelmsford Reforms of 1919 recommended granting voting rights to all women above the age of 21.

2. The Government of India Act of 1935 gave women reserved seats in the legislature.

Which of the statements given above is/are correct?

A. 1 Only B. 2 Only C. Both 1 and 2 D. Neither 1 nor 2

Answer: 1-B, 2-A, 3-A, 4-C, 5-C, 6-D, 7-B, 8-C, 9-D, 10- B, 11-B

Mains

1. Discuss the role of the Election Commission of India in the light of the evolution of the Model Code of Conduct. (UPSC 2022) |

HEPATITIS

2. About Hepatitis

Hepatitis refers to the inflammation of the liver caused by various infectious viruses and non-infectious agents, potentially resulting in a range of health complications, some of which can be life-threatening.

- There are five primary strains of the hepatitis virus, categorized as types A, B, C, D, and E. While all types lead to liver disease, they differ significantly in terms of transmission modes, severity of illness, and geographical distribution.

- Hepatitis B and C are particularly notable as they can progress to chronic disease and are the leading causes of liver cirrhosis, liver cancer, and deaths related to viral hepatitis. An estimated 354 million individuals worldwide are living with hepatitis B or C, with many unable to access adequate treatment, as per the World Health Organization (WHO).

3. Key Findings of the Report

The report underscores the significant impact of viral hepatitis as the second leading infectious cause of death globally, with 1.3 million deaths annually, on par with tuberculosis, another top infectious killer.

- New data from 187 countries indicates a rise in estimated deaths from viral hepatitis from 1.1 million in 2019 to 1.3 million in 2022.

- Of these deaths, 83% were attributed to hepatitis B, while hepatitis C accounted for 17%. This highlights the predominance of hepatitis B as a major contributor to the global burden of viral hepatitis.

- The report reveals that 3,500 individuals succumb to hepatitis B and C infections each day worldwide, underscoring the urgency of addressing this public health challenge.

- Half of the burden of chronic hepatitis B and C infections is borne by individuals aged 30-54 years, with 12% affecting children under 18 years old. Moreover, men constitute 58% of all cases, indicating a gender disparity in hepatitis prevalence.

4. Vulnerability of India to Hepatitis

The report reveals several factors contributing to India's high hepatitis burden.

- India's densely populated environment facilitates the spread of infectious diseases like hepatitis B and C.

- Many people remain unaware of hepatitis symptoms and the importance of testing. This leads to undiagnosed cases that continue to transmit the virus unknowingly.

- Poor hygiene practices, particularly inadequate sanitation, can increase the risk of contracting hepatitis A and E, which spread through contaminated food and water.

- A significant issue is the high prevalence of chronic hepatitis B and C infections. These infections often go undetected for years due to a lack of symptoms, further perpetuating the transmission cycle.

- Lifestyle changes are contributing to an increase in non-viral forms of hepatitis. Increased alcohol consumption, especially in urban areas, is leading to more cases of alcoholic liver disease (ALD). Additionally, the growing prevalence of obesity, metabolic disorders, and sedentary lifestyles is fueling a non-alcoholic fatty liver disease (NAFLD) epidemic, which can progress to severe liver problems.

- Men are disproportionately affected due to higher rates of engaging in high-risk behaviours such as intravenous drug use, sharing needles, and unsafe sexual practices.

5. Prevention of Hepatitis

- Hepatitis B can be effectively prevented through vaccination. It is crucial to ensure widespread coverage of vaccination programs to protect against the transmission of the virus. Additionally, vaccination against hepatitis A and E may also be recommended in certain populations.

- Hepatitis C is curable with medications. In India, the cost of treatment is relatively low as the country produces generic versions of the drugs. Access to affordable treatment options is essential to reduce the burden of hepatitis-related deaths.

- India has implemented the viral hepatitis control program, which offers vaccines to high-risk adults, including healthcare workers. Treatment for both hepatitis B and C is available under this program.

- The Indian Government has integrated the hepatitis B vaccine into the childhood immunization program since 2011-12. This ensures that children are protected against chronic hepatitis B infection from an early age, reducing the risk of transmission in the population.

- Raising awareness about hepatitis prevention, transmission routes, and the importance of vaccination and treatment is crucial. Educational campaigns targeting both the general population and high-risk groups can help reduce the incidence of hepatitis and its associated complications.

6. Significance of the Report

The significance of the report lies in several key aspects

- It marks the first consolidated report by the World Health Organization (WHO) on viral hepatitis epidemiology, service coverage, and product access. The report provides a comprehensive overview of the disease burden and coverage of essential viral hepatitis services across 187 countries.

- The report presents the latest estimates on the disease burden of viral hepatitis, shedding light on the prevalence and impact of the disease worldwide. This information is crucial for policymakers, healthcare professionals, and stakeholders to formulate effective strategies for prevention and control.

- It evaluates the coverage of essential viral hepatitis services, including diagnosis and treatment, highlighting gaps and areas for improvement in healthcare delivery systems globally.

- The report compares the current diagnosis and treatment coverage with global targets set to treat 80% of people living with chronic hepatitis B and hepatitis C by 2030. The findings indicate that current levels of diagnosis and treatment fall well below these targets, emphasizing the need for accelerated efforts to meet these goals.

- While the report shows slight improvements in diagnosis and treatment coverage since 2019, it also highlights persistent challenges and disparities in access to healthcare services for viral hepatitis. This information can guide policymakers and stakeholders in implementing targeted interventions to address these challenges effectively.

7. The Way Forward

- Efforts should focus on eliminating mother-to-child transmission and ensuring extensive treatment coverage, including immunization of every newborn. Discrimination against patients must be eradicated to create a supportive environment for prevention and treatment initiatives.

- Countries must prioritize procurement of affordable generic viral hepatitis medicines to ensure access for all. Pricing disparities need to be addressed, both across and within WHO regions, to ensure equitable access to essential medications.

- Service delivery for viral hepatitis should be decentralized and integrated into primary healthcare systems. This shift from centralized and vertical approaches will reduce out-of-pocket expenses for affected populations and improve access to essential services.

- A public health approach to viral hepatitis should prioritize expanding access to testing and diagnostics, implementing policies for equitable treatment, and strengthening prevention efforts. This approach requires improved funding at both global and national levels, including allocations within countries' health budgets.

- Efforts must be intensified to achieve the global targets for viral hepatitis elimination by 2030. This requires sustained commitment from governments, international organizations, civil society, and other stakeholders to implement evidence-based interventions effectively.

By implementing these actions, countries can accelerate progress towards ending the viral hepatitis epidemic by 2030, improving health outcomes and reducing the burden of this preventable disease worldwide.

|

For Prelims: Hepatitis, World Health Organisation, Global Hepatitis Report

For Mains:

1. Examine the factors contributing to India's vulnerability to hepatitis and propose preventive measures to address the high disease burden. (250 Words)

|

|

Previous Year Questions

1.Which of the following statements is not correct? (UPSC 2019) (a) Hepatitis B virus is transmitted much like HIV.

(b) Hepatitis B, unlike Hepatitis C, does not have a vaccine.

(c) Globally, the number of people infected with Hepatitis B and C viruses are several times more than those infected with HIV.

(d) Some of those infected with Hepatitis B and C viruses do not show the symptoms for many years

2. Which one of the following statements is not correct? (Delhi Police Constable 2017)

A. Hepatitis B virus is transmitted much like HIV.

B. Hepatitis B, unlike Hepatitis C, does not have a vaccine.

C. Globally, the number of people infected with Hepatitis B and C viruses are several times more than those infected with HIV.

D.Some of those infected with Hepatitis B and C viruses do not show the symptoms for many years.

3. Consider the following statements: (UPSC 2010)

1. Hepatitis B is several times more infectious than HIV/AIDS

2. Hepatitis B can cause liver cancer

Which of the statements given above is/are correct?

A. 1 only B. 2 only C. Both 1 and 2 D. Neither 1 nor 2

4. Which of the following diseases can be transmitted from one person to another through tattooing? (2013) 1. Chikungunya

2. Hepatitis B

3. HIV-AIDS

Select the correct answer using the codes given below: (a) 1 only (b) 2 and 3 only (c) 1 and 3 only (d) 1, 2 and 3 Answers: 1-B, 2-C, 3-C, 4-B |

CDP-SURAKSHA

- The CDP-SURAKSHA functions as a digital hub designed to streamline agricultural assistance. SURAKSHA, which stands for “System for Unified Resource Allocation, Knowledge, and Secure Horticulture Assistance,” serves as its backbone. This platform facilitates the prompt distribution of subsidies directly into farmers' bank accounts through the utilization of e-RUPI vouchers provided by the National Payments Corporation of India (NPCI).

- Key components of the CDP-SURAKSHA include database synchronization with PM-KISAN, cloud-based server infrastructure from NIC, validation through UIDAI, integration with eRUPI, access to local government directory (LGD), content management capabilities, geotagging, and geo-fencing functionalities

- The platform provides access to farmers, vendors, implementing agencies (IA), cluster development agencies (CDAs), and officials of the National Horticulture Board (NHB).

- Farmers can log in using their mobile numbers and place orders for planting materials such as seeds, seedlings, and plants according to their needs.

- Once the farmer submits the request, the system prompts them to contribute their portion of the planting material's cost. The government subsidy amount is automatically displayed on the screen.

- Once the farmer makes their contribution, an e-RUPI voucher is generated. This voucher is then received by a vendor who supplies the required planting material to the farmer.

- Upon delivery of the ordered material, the farmer must verify receipt through geo-tagged photos and videos of their field. Only after verification will the IA release funds to the vendor for the e-RUPI voucher. The vendor must upload an invoice of the payment to the portal.

- The IA gathers all necessary documents and forwards them to the CDA for subsidy disbursement, after which the subsidy is released to the IA.

- However, farmers who initiate planting material requests through the platform can only access subsidies at the initial stage

3.What is Horticulture Cluster Development Program (CDP)?

- The Cluster Development Programme (CDP) aims to capitalize on the unique characteristics of horticulture clusters and foster comprehensive and market-driven development across various stages, including preproduction, production, post-harvest management, logistics, branding, and marketing.

- The Ministry of Agriculture and Farmers' Welfare (MoA&FW) has identified 55 horticulture clusters, with 12 chosen initially for the pilot launch.

- Following the insights gained from the pilot phase, the program will expand to cover all 55 clusters.

- The lessons learned from the pilot implementation will inform policy decisions and operational strategies for nationwide implementation across all horticulture clusters in India.

The key objectives of the program are:

a) Addressing the entire horticulture value chain comprehensively, from pre-production to marketing, to enhance competitiveness in domestic and international markets.

b) Minimizing losses during harvesting and post-harvest stages by enhancing infrastructure for post-harvest handling, value addition, and market connections.

c) Introducing innovative technologies and practices to boost the global competitiveness of specific cluster crops.

d) Coordinating resources and aligning government schemes to integrate stakeholders into global value chains.

e) Enhancing stakeholders' capacity and increasing farmers' income through tailored interventions, including brand promotion.

Financial support will be extended by the National Horticulture Board to Implementing Agencies through appointed Cluster Development Agencies (CDAs) for respective clusters. The clusters are categorized into Mega, Midi, and Mini based on their area coverage, with corresponding financial assistance levels provided as follows:

|

Financial Assistance

|

4.What is e-RUPI?

- e-RUPI serves as a digital voucher accessible to beneficiaries via SMS or QR code on their mobile devices. It functions as a prepaid voucher that can be redeemed at any authorized center.

- For instance, if the government aims to cover specific treatment costs for an employee at a designated hospital, it can issue an e-RUPI voucher for the predetermined amount through a partner bank.

- The recipient will then receive the voucher via SMS or QR code on their feature phone or smartphone. They can proceed to the designated hospital, utilize the services, and settle the payment using the e-RUPI voucher received on their phone.

- In essence, e-RUPI represents a single-use, contactless, and cashless payment method that allows users to redeem the voucher without requiring a card, digital payments app, or internet banking access.

- It is distinct from digital currency, which the Reserve Bank of India is exploring, as e-RUPI is specific to individuals and purposes.

- Notably, e-RUPI does not mandate the beneficiary to possess a bank account, setting it apart from other digital payment methods. It facilitates an uncomplicated, contactless redemption process without the need for personal information sharing.

- Moreover, e-RUPI is compatible with basic phones, enabling usage by individuals without smartphones or in areas lacking internet connectivity. The National Payments Corporation of India (NPCI), responsible for overseeing India's digital payments ecosystem, has introduced e-RUPI to promote cashless transactions

DOUBLE TAXATION AVOIDANCE AGREEMENT(DTAA)

A Double Taxation Avoidance Agreement (DTAA) is a treaty between two countries that aims to prevent individuals or companies from being taxed twice on the same income. These agreements are designed to promote economic cooperation and trade between the signatory countries by eliminating or reducing double taxation.

Under a DTAA, the two countries agree on rules to allocate taxing rights over various types of income, such as dividends, interest, royalties, and capital gains. Typically, the agreement includes provisions to determine the residency status of taxpayers, which helps in determining which country has the primary right to tax specific types of income.

DTAAs often involve provisions for the exchange of information between tax authorities to ensure compliance and prevent tax evasion. They also usually include mechanisms for resolving disputes that may arise from differences in interpretation or application of the agreement

3. Benefits of Double Taxation Avoidance Agreements

Double Taxation Avoidance Agreements (DTAAs) offer several benefits to individuals and businesses operating in multiple countries.

Some of the key advantages include:

- One of the primary benefits of DTAAs is the prevention of double taxation on the same income or profits. By allocating taxing rights between countries and providing mechanisms for relief, DTAAs ensure that taxpayers are not subjected to taxation on the same income in both their home country and the country where the income is earned

- DTAAs often include provisions for reduced withholding tax rates on certain types of income, such as dividends, interest, and royalties. This can result in lower tax liabilities for individuals and businesses receiving such income from foreign sources

- By eliminating or reducing tax barriers, DTAAs facilitate cross-border trade and investment by providing certainty and clarity regarding tax obligations. This encourages businesses to expand their operations internationally and promotes economic cooperation between countries

- DTAAs foster economic cooperation between countries by promoting mutual investment and trade. By providing a framework for resolving tax disputes and exchanging information between tax authorities, DTAAs help build trust and confidence among countries, thereby facilitating greater economic collaboration

- DTAAs include provisions for the exchange of information between tax authorities to prevent tax evasion and avoidance. By promoting transparency and cooperation in tax matters, DTAAs help combat tax evasion and ensure compliance with tax laws in both countries

- DTAAs often include provisions regarding the taxation of individuals working abroad. By providing clarity on tax residency rules and the taxation of employment income, DTAAs encourage international mobility and facilitate the movement of workers across borders

- DTAAs provide taxpayers with certainty and predictability regarding their tax obligations in foreign countries. By establishing clear rules for the allocation of taxing rights and the determination of tax liabilities, DTAAs reduce uncertainty and mitigate the risk of double taxation

|

India and DTAA

India has signed Double Taxation Avoidance Agreements (DTAAs) with over 90 countries worldwide. These agreements aim to prevent double taxation of income earned in one country by residents of the other country. The treaties typically outline rules for the allocation of taxing rights over various types of income, such as dividends, interest, royalties, and capital gains, and may include provisions for reduced withholding tax rates

India has an extensive network of Double Taxation Avoidance Agreements (DTAAs) with various countries around the world. These agreements aim to promote cross-border trade and investment by eliminating or reducing double taxation and providing certainty regarding tax obligations for residents of both India and the treaty partner countries

The DTAA was a major reason for a large number of foreign portfolio investors (FPI) and foreign entities to route their investments in India through Mauritius. Mauritius remains India’s fourth largest source of FPI investments, after the US, Singapore, and Luxembourg. FPI investment from Mauritius stood at Rs 4.19 lakh crore at the end of March 2024, which is 6 per cent of the total FPI investment of Rs 69.54 lakh crore in India. FPI investment from Mauritius had stood at Rs 3.25 lakh crore, out of total FPI investment of Rs 48.71 lakh crore at the end of March 2023

|

- India and Mauritius have recently signed a protocol amending their Double Taxation Avoidance Agreement (DTAA) with the aim of curbing treaty abuse for tax evasion or avoidance.

- The updated agreement introduces the Principal Purpose Test (PPT), which stipulates that tax benefits under the treaty will not be applicable if it is found that obtaining those benefits was the primary purpose of any transaction or arrangement.

- Under the amended protocol, a new Article 27B has been added to the treaty, defining the concept of 'entitlement to benefits.'

- The PPT will deny treaty benefits, such as reduced withholding tax on interest, royalties, and dividends, if it is determined that obtaining those treaty benefits was one of the main purposes of the party involved in the transaction.

- The revision of the India-Mauritius treaty, signed on March 7 in Port Louis and made public recently, comes in response to Mauritius being a favored jurisdiction for investments in India, particularly due to the exemption of capital gains from the sale of shares in Indian companies until 2016.

- The treaty was last amended in May 2016, allowing for taxation of capital gains arising from the sale or transfer of shares of an Indian company acquired by a Mauritian tax resident, with investments made until March 31, 2017, being exempt from such taxation.

- Furthermore, the preamble of the treaty has been modified by both nations to emphasize the focus on preventing tax avoidance and evasion.

- The previous objective of 'mutual trade and investment' has been replaced with an intent to "eliminate double taxation" without allowing for opportunities for non-taxation or reduced taxation through tax evasion or avoidance, including through "treaty shopping arrangements" aimed at obtaining benefits provided under this treaty for the indirect benefit of residents of third jurisdictions