UNLAWFUL ACTIVITIES (PREVENTION) ACT (UAPA)

The Unlawful Activities (Prevention) Act (UAPA) is an Indian law that was enacted in 1967 to effectively prevent unlawful activities that pose a threat to the sovereignty and integrity of India.

Key highlights of the UAPA

- Objective: The primary objective of the UAPA is to provide law enforcement agencies with effective tools to combat terrorism and other activities that threaten the security of the nation.

- Definition of Unlawful Activities: The act defines unlawful activities to include actions that intend to or support the cession of a part of the territory of India or disrupt the sovereignty and integrity of the country.

- Powers of Designation: The government has the authority to designate an organization as a terrorist organization if it believes that such an organization is involved in terrorism. This designation has significant legal consequences, including the freezing of assets.

- Powers of Arrest and Detention: The UAPA provides law enforcement agencies with powers of arrest and detention to prevent individuals from engaging in unlawful activities. The act allows for preventive detention to curb potential threats before they materialise.

- Banning of Terrorist Organizations: The government can proscribe organizations as terrorist organizations, making their activities illegal. This includes banning these organisations, freezing their assets, and taking other measures to curb their operations.

- Admissibility of Confessions: The UAPA allows for confessions made to police officers to be admissible in court, subject to certain safeguards. This provision has been a point of contention, with concerns about potential misuse and coercion.

- Designation of Individuals as Terrorists: In addition to organizations, the UAPA allows the government to designate individuals as terrorists. This designation carries legal consequences, including restrictions on travel and freezing of assets.

- Amendments and Stringency: Over the years, the UAPA has undergone several amendments to strengthen its provisions and make it more effective in dealing with emerging threats. However, these amendments have also been criticized for potential violations of civil liberties.

- International Cooperation: The UAPA allows for cooperation with foreign countries in matters related to the prevention of unlawful activities. This includes extradition of individuals involved in such activities.

3. Unlawful Activities (Prevention) Act (UAPA) and Human Rights

The Unlawful Activities (Prevention) Act (UAPA) and human rights lie in the impact the act can have on various fundamental rights guaranteed by the Constitution of India and international human rights standards.

The key points connecting the UAPA and human rights:

- The UAPA allows for preventive detention, which means individuals can be detained without formal charges based on suspicions of involvement in unlawful activities. This raises concerns about the right to liberty, as individuals may be deprived of their freedom without the presumption of innocence until proven guilty.

- The admissibility of confessions made to police officers under the UAPA raises issues related to the right against self-incrimination. There is a risk that such confessions might be obtained under duress or coercion, compromising the fairness of legal proceedings.

- Designating individuals as terrorists and proscribing organizations without due process may impinge on the right to a fair trial. This includes the right to be informed of charges, the right to legal representation, and the right to present a defense.

- The UAPA provides authorities with the power to proscribe organizations as terrorist organizations, limiting their activities. Critics argue that this may infringe upon the right to freedom of association, particularly when such designations are made without sufficient evidence or proper legal procedures.

- The potential for misuse of the UAPA to target individuals or organizations critical of the government raises concerns about freedom of expression. If the act is used to suppress dissent or stifle legitimate political or social activities, it can undermine this fundamental right.

- The UAPA grants authorities the power to intercept communications and conduct surveillance on individuals suspected of engaging in unlawful activities. This raises concerns about the right to privacy, as individuals may be subjected to intrusive surveillance without adequate safeguards.

- Human rights standards require that any restrictions on rights, such as those imposed by the UAPA, must be proportionate and necessary for achieving a legitimate aim. Critics argue that the broad scope of the UAPA may lead to disproportionate measures that unduly restrict individual rights.

- The UAPA's compatibility with international human rights standards, including the International Covenant on Civil and Political Rights (ICCPR), is a critical point of consideration. Ensuring that the act aligns with these standards is essential to upholding human rights principles.

4. Unlawful Activities (Prevention) Act (UAPA) and Article 22 of the Constitution

The Unlawful Activities (Prevention) Act (UAPA) and Article 22 of the Indian Constitution lie in how the UAPA's provisions for arrest and detention intersect with the constitutional safeguards provided under Article 22.

- Article 22 provides certain protections to individuals who are arrested or detained. It outlines the rights of arrested individuals, emphasizing safeguards to prevent arbitrary or unlawful detention.

- Article 22(1) states that every person who is arrested and detained shall be informed, as soon as may be, of the grounds for such arrest. This provision ensures that individuals are aware of the reasons behind their arrest, preventing arbitrary or secret detentions.

- Article 22(1) also guarantees the right of an arrested person to consult and be defended by a legal practitioner of their choice. This ensures that individuals have access to legal assistance during the legal process, contributing to a fair and just legal system.

- The UAPA includes provisions for preventive detention, allowing authorities to detain individuals to prevent them from committing certain offences. However, Article 22(4) allows preventive detention only under specific circumstances, and certain safeguards must be followed, such as providing the detenu with the grounds for detention and an opportunity to make a representation against the detention.

- Article 22(4) further mandates that a person detained under a law providing for preventive detention must be afforded the earliest opportunity to make a representation against the detention. Additionally, the case of every person detained is required to be placed before an advisory board within three months.

- The UAPA allows for confessions made to police officers to be admissible in court, subject to certain safeguards. However, this provision has been a point of concern concerning Article 22, as confessions obtained under duress or coercion may violate the right against self-incrimination.

- Article 22(2) ensures the right to be brought before the nearest magistrate within 24 hours of arrest, excluding the time necessary for the journey. This provision aims to prevent prolonged detention without judicial oversight and contributes to the right to a speedy trial.

|

For Prelims: Unlawful Activities (Prevention) Act, Article 22, Terrorism

For Mains:

1. Discuss the key provisions of the Unlawful Activities (Prevention) Act (UAPA) and analyze how they may impact fundamental human rights. Elaborate on the balance between national security concerns and the protection of individual rights. (250 Words)

|

|

Previous Year Questions 1. Under Article 22 of the Constitution of India, with the exception of certain provisions stated there in, what is the maximum period for detention of a person under preventive detention? (MPSC 2014) A. 2 months B. 3 months C. 4 months D. 6 months

2. Article 22 of the Constitution ensures (CTET 2016) A. Right not to be ill-treated during arrest or while in custody B. Right to Constitutional Remedies C. Right against Exploitation D. Right to Education Answers: 1-B, 2-A Mains 1. Indian government has recently strengthed the anti-terrorism laws by amending the Unlawful Activities(Prevention) Act, (UAPA), 1967 and the NIA Act. Analyze the changes in the context of prevailing security environment while discussing scope and reasons for opposing the UAPA by human rights organizations. (UPSC 2019) |

Source: The Indian Express

ARTICLE 371A

1. Context

Article 371A of the Constitution of India has been the major hurdle in the Nagaland government’s efforts to regulate small-scale illegal coal mining activities in the State.

Specific to Nagaland, Article 371A has special provisions guaranteeing the protection of land and its resources apart from the Naga customary law and procedure.

2.Article 371A and Nagaland

Article 371A is a special provision in the Constitution of India that grants certain special powers and autonomy to the state of Nagaland. It is part of the broader provisions under Article 371, which includes special provisions for various states to address their unique historical and cultural contexts.

Key features of Article 371A include:

-

Special Status for Nagaland: Article 371A provides special provisions for Nagaland, recognizing its unique history, culture, and customs.

-

Legislative Powers: The state of Nagaland has special legislative powers, allowing it to enact laws on certain specified subjects. The Parliament of India does not have exclusive powers to legislate on all matters for Nagaland.

-

Formation of Regional Council: The Article allows for the establishment of a regional council for Nagaland with members elected by the Hill Areas and other specified areas in the state.

-

Governor's Special Responsibility: The Governor of Nagaland has a special responsibility to ensure the proper functioning of the constitutional provisions for the state.

-

Safeguards for Naga customary laws and practices: The Article provides safeguards for the Naga customary laws and practices, protecting the traditional social and customary practices of the Naga people.

Article 371A was included in the Constitution of India to address the concerns and aspirations of the Naga people and to provide a framework that respects the unique identity and history of Nagaland. It is a part of the broader constitutional philosophy that recognizes and accommodates the diversity of India's states and regions

3. What is Special Category Status?

Special Category Status (SCS) is a classification given by the Central government to assist the development of states that face geographical and socio-economic disadvantages. SCS was introduced in 1969 on the recommendations of the Fifth Finance Commission. The states with SCS receive several benefits, including:

- The Central government bears 90% of the cost of centrally sponsored schemes in SCS states, while the remaining 10% is borne by the state government.

- In the SCS States, the Centre-State funding of centrally sponsored schemes is divided in the ratio of 90:10, far more favourable than the 60:40 or 80:20 splits for the general category States.

- SCS States receive several incentives to attract investments, such as concession in customs and excise duties, income tax rates and corporate tax rates.

3.1. The parameters for granting SCS are as follows:

- SCS is granted to states with hilly terrain, making it difficult to develop infrastructure.

- SCS is granted to states with low population density or a sizeable share of tribal population, indicating socio-economic backwardness.

- SCS is granted to states with strategic locations along borders, requiring additional security measures.

- CS is granted to states with economic and infrastructure backwardness, indicating the need for special assistance.

- SCS is granted to states with nonviable state finances, indicating the need for special financial assistance.

3.2. Benefits of Special Category Status

States with SCS receive several benefits, including:

- SCS states used to receive grants based on the Gadgil-Mukherjee formula, which earmarked nearly 30% of the total central assistance for states to the SCS states. However, this assistance has been subsumed in an increased devolution of the divisible pool funds for all states.

- In the SCS states, the Centre-State funding of centrally sponsored schemes is divided in the ratio of 90:10, far more favourable than the 60:40 or 80:20 splits for the general category states.

- SCS states receive several incentives to attract investments, such as concession in customs and excise duties, income tax rates and corporate tax rates.

4. Reasons for Bihar Demanding Special Category Status

Bihar has been demanding SCS for several reasons, including:

- The state has consistently been one of the poorest states in terms of per capita GDP.

- Bihar faces a lack of natural resources, a continuous supply of water for irrigation, regular floods, and severe droughts.

- The bifurcation of the state led to the shifting of industries to Jharkhand and created a dearth of employment and investment opportunities.

- While Bihar meets several criteria for the grant of Special Category Status, it falls short in fulfilling the requirement of hilly terrain and geographically challenging areas.

- This limitation is identified as a primary hurdle in the state's infrastructural development. In 2013, the Raghuram Rajan Committee, constituted by the Centre, categorized Bihar as the "least developed category."

- The committee proposed a new methodology based on a 'multi-dimensional index' for devolving funds, presenting an alternative approach to address the state's backwardness.

5. Other States Demanding Special Category Status

- Andhra Pradesh: After the bifurcation of Andhra Pradesh in 2014, the new state of Telangana was formed, which took away the capital city of Hyderabad. Andhra Pradesh has been demanding SCS to compensate for the loss of revenue and infrastructure due to the bifurcation.

- Odisha: Odisha is prone to natural disasters such as cyclones and floods, and it also has a large tribal population. The state has been demanding SCS to address these challenges and promote its development.

- Tamil Nadu: Tamil Nadu has been demanding SCS for a long time, citing its economic backwardness and its contribution to the national economy.

- Karnataka: Karnataka has also been demanding SCS, highlighting its challenges in terms of infrastructure development and its contribution to the IT industry.

- West Bengal: West Bengal has been demanding SCS citing its economic backwardness and significant Muslim population.

6. Central Government's Stance on SCS

- The Central Government has been hesitant to grant SCS to additional states, citing the recommendations of the 14th Finance Commission.

- The 14th Finance Commission recommended that SCS be discontinued for all states except the Northeastern states and the three hill states of Jammu and Kashmir, Himachal Pradesh, and Uttarakhand.

- The commission argued that SCS should be provided only to states facing exceptionally challenging circumstances.

|

For Prelims: Special Category Status, 14th Finance Commission, Bihar Castebased Survey, Raghuram Rajan Committee,

For Mains:

1. Examine the reasons behind the Central Government's reluctance to grant SCS to additional states. Discuss the implications of the 14th Finance Commission's recommendations in this regard. (250 Words)

|

|

Previous Year Questions

1. The status of "Special Category States" is given to certain states to target the fund flow for better-balanced growth. Which of the following states fall under this category? (UPSSSC Lower PCS Prelims 2016)

1. Rajasthan

2. Uttarakhand

3. Bihar

4. Jammu & Kashmir

5. Himachal Pradesh

6. Jharkhand

Select the correct answer using the codes given below:

A. 1, 5 and 6 B. 2, 4 and 5 C. 3, 5 and 6 D. 1, 3 and 6

2. With reference to the Fourteenth Finance Commission, which of the following statements is/are correct? (UPSC 2015)

1. It has increased the share of States in the central divisible pool from 32 percent to 42 percent.

2. It has made recommendations concerning sector-specific grants.

Select the correct answer using the code given below.

A. 1 only B. 2 only C. Both 1 and 2 D. Neither 1 nor 2

3. Based on the Sixth Schedule of Indian Constitution, with respect to the tribal areas of Assam, Meghalaya, Tripura and Mizoram Which of the following can the Governor of a State do? (DSSSB PRT General Section Officer 2019)

1. Can create a new autonomous district

2. The area of atonomous district can be increased

A. 1 Only B. 2 Only C. Both 1 and 2 D. Neither 1 nor 2

4. If a particular area is brought under the Fifth Schedule of the Constitution of India, which one of the following statements best reflects the consequence of it? (UPSC 2022)

A. This would prevent the transfer of land of tribal people to non-tribal people.

B. This would create a local self-governing body in that area.

C. This would convert that area into a Union Territory.

D. The State having such areas would be declared a Special Category State.

5. Article _____ of the Constitution of India deals with provisions related to the administration and control of Scheduled Areas and Scheduled Tribes. (SSC CGL 2020)

A. 222(1) B. 244(1) C. 244(2) D. 222(2)

6. The National Commission for Backward Classes (NCBC) was formed by insertion of Article ______ in the Constitution of India. (SSC CGL 2020)

A. 328B B. 338A C. 338B D. 328A

Answers: 1-A, 2-A, 3-C, 4-A, 5-B, 6-B

|

RARE DISEASES

1. Context

2. What are Rare Diseases?

- Rare diseases as the name suggests are conditions that affect very few people.

- The World Health Organisation defines it as any debilitating lifelong disease or disorder with a prevalence of ten or fewer per 10,000 population.

- other countries follow standards ranging between 1 and 10 cases per 10,000 to define a condition as a rare disease.

- There are about 7,000 to 8,000 conditions globally that have been defined as rare diseases.

- The landscape of rare diseases keeps changing, with newer conditions being identified and reported constantly.

- With limited experience with these diseases, they are extremely difficult to diagnose and more difficult to test for.

- A report quoted by the country’s National Rare Disease Policy 2021 says that in the United States, a person with rare disease gets diagnosed on average after 7.6 years and in the United Kingdom after 5.6 years.

- The patients have to visit as many as eight physicians, including four specialists, to get a diagnosis.

- Two to three misdiagnoses are also typical before getting the final diagnosis, as per the study.

- Even after one gets a diagnosis, most rare diseases do not have a specific treatment and, the ones that do can be prohibitively expensive.

3. What are the drugs that have been exempted from customs duty?

The specified conditions include

- Lysosomal storage disorder (a group of metabolic disorders that lead to a buildup of toxic materials in the cells).

- Maple syrup urine disease (a hereditary condition where the body cannot process the building blocks of proteins resulting in the buildup of harmful substances in blood and urine).

- Severe food protein allergy, Wilson’s disease (a disorder that results in the body accumulating copper) among others.

- These medicines usually attract a basic customs duty of 10 percent, with some vaccines or medicines attracting a lower 5 percent or nil as previously notified.

- Medicines for the treatment of spinal muscular athrophy and duchenne muscular dystrophy were already exempt from customs.

- This will be a huge relief for people living with rare diseases because many of the medicines and food products are not available in India and have to be imported.

- The cost of medicines is also usually very high, going up with the increasing age and weight of the person. And, the medicines for many of the conditions have to be taken for life.

4. How can one avail of the exemption?

- To avail of the benefits, people importing it have to get a certificate from the central director general, deputy director general, or assistant director general of health services, director general of state health services, or district medical officer or civil surgeon.

- The certificate has to be provided to the deputy commissioner of customs or assistant commissioner of customs at the time of clearance. (or)

- The person will have to give the undertaking to furnish the certificate in a specified period, failing which the customs duty will have to be paid.

5. Why are drugs for rare diseases so expensive?

- Even though there have been developments in the treatment of rare diseases in recent years, almost 95 percent of the conditions do not have specific treatment.

- With a very small number of people suffering from each of the 7,000- 8,000 rare conditions, they do not make a good market for drugs.

- This is the reason most pharmaceutical companies are reluctant to spend on research for treatments of the disease.

- This is the reason the medicine for rare conditions that do exist are known as “orphan drugs” and are prohibitively priced to recoup the cost of research and development.

- As per the National Rare Disease Policy, treatment for some rare diseases can vary from Rs 10 lakh to 1 crore per year for a child weighing 10 kg.

- The treatment has to be continued lifelong, with the costs going up along with the age and weight of the person.

- At present, very few pharmaceutical companies are manufacturing drugs for rare diseases globally and there are no domestic manufacturers in India.

6. Situation in India

- Data on how many people suffer from conditions that are considered to be rare diseases globally is not available in India.

- There is no epidemiological data on the incidence, but cases reported from tertiary care hospitals do get recorded in the national portal that was set up by the Indian Council of Medical Research after the rare disease policy came out.

- As per data submitted to the parliament in December 2021, at least 4,001 rare disease cases were recorded on the portal.

- Primary immunodeficiency disorder (a genetic condition that impairs the immune system)

- Lysosomal storage disorders (a group of metabolic disorders that lead to a buildup of toxic materials in the cells)

- Small molecule inborn errors of metabolism (a large group of genetic conditions, where the genetic code for metabolic enzymes are defective)

- Cystic fibrosis (a condition that severely damages the lung leading to the need for a transplant)

- Osteogenesis imperfect (a condition where bones fracture easily) and

- Certain forms of muscular dystrophies and spinal muscular atrophy.

7. Government Provision for financial support

- Other than relief from customs duty, the government also has provision for providing financial support up to R50 lakh for the treatment of any kind of rare disease at the Centres of Excellence.

- Earlier, financial aid of up to R20 lakh was provided to those with Group 1 rare diseases where one-time curative treatments exist.

For Prelims & Mains

|

For Prelims: Rare Diseases, National Rare Disease Policy 2021, Customs Duty, Indian Council of Medical Research (ICMR).

For Mains: 1. What are Rare Diseases? Discuss the India scenario of Rare Diseases as per the National Disease policy 2021.

|

Previous Year Question

| 1. With reference to Ayushman Bharat Digital Mission, consider the following statements: (UPSC 2022)

1. Private and public hospitals must adopt it.

2. As it aims to achieve universal, health coverage, every citizen of India should be part of it ultimately.

3. It has seamless portability across the country.

Which of the statements given above is/are correct?

A. 1 and 2 only

B. 3 only C. 1 and 3 only D. 1, 2 and 3 Answer: D

|

GENOME INDIA PROJECT

1. Context

2. About Genome Sequencing

- The human genome is the entire set of deoxyribonucleic acid (DNA) residing in the nucleus of every cell of the human body.

- It carries the complete genetic information responsible for the development and functioning of an organism.

- The DNA consists of a double-stranded molecule built up by four bases.

- While the sequence of base pairs is identical in all humans, there are differences in the genome of every human being that make them unique.

- The process of deciphering the order of base pairs, to decode the genetic fingerprint of a human is called genome sequencing.

- In 1990, a group of scientists began to work on determining the whole sequence of the human genome under the Human Genome Project.

- The Project released its latest version of the complete human genome in 2023, with a 0.3 per cent error margin.

- This shows that genomic sequencing has now evolved to a stage where large sequencers can process thousands of samples simultaneously.

- There are several approaches to genome sequencing, including whole genome sequencing.

- The process of whole genome sequencing, made possible by the Human Genome Project, now facilitates the reading of a person's genome to identify differences from the average human genome.

3. Applications of sequencing

- Genome sequencing has been used to evaluate rare disorders, preconditions for disorders and even cancer from the viewpoint of genetics, rather than as diseases of certain organs.

- Nearly 10, 000 diseases including cystic fibrosis and thalassemia are known to be the result of a single gene malfunctioning.

- In public health, however, sequencing has been used to read the codes of viruses.

- One of its first practical usages was in 2014 when a group of scientists from M.I.T and Harvard sequenced samples of Ebola from infected African patients to show how genomic data of viruses could reveal hidden pathways of transmission.

4. Effective response against COVID-19

- In January 2020, at the start of the pandemic, Chinese scientist YongZhen Zhang sequenced the genome of a novel pathogen causing infections in the city of Wuhan.

- Mr Zhang then shared it with his virologist friend Edward Holmes in Australia, who published the genomic code online.

- It was after this that virologists began evaluating the sequence to try and understand how to combat the virus, track the mutating variants and their intensity and spread and come up with a vaccine.

- To enable an effective response against COVID-19, researchers kept track of emerging variants, conducting further studies about their transmissibility, immune escape and potential to cause severe disease.

- Genomic sequencing became one of the first steps in this important process.

- Here, the purpose of genome sequencing was to understand the role of certain mutations in increasing the virus's infectivity.

- India also put in place a sequencing framework the Indian SARSCOV2 Genomics Consortia (INSACOG).

- This consortium of labs across the country was tasked with scanning coronavirus samples from patents and flagging the presence of variants known to have spiked transmission internationally.

- As of early December 2021, INSACOG had sequenced about 1, 00, 000 samples.

5. About Genome India Project

- India's 1.3 billion strong population consists of over 4, 600 population groups, many of which are endogamous.

- Thus, the Indian population harbours distinct variations, with disease-causing mutations often amplified within some of these groups.

- But despite being a large population with diverse ethnic groups, India lacks a comprehensive catalogue of genetic variations.

- Creating a database of Indian genomes allows researchers to learn about genetic variants unique to India's population groups and use that to customise drugs.

- About 20 institutions across India are involved in the Project.

|

For Prelims: Genome India Project, Covid-19, DNA,

For Mains:

1. What is the significance of genome sequencing? Discuss the reasons for the importance of the Genome India Project. (250 Words)

|

|

Previous Year Questions

1. With reference to agriculture in India, how can the technique of 'genome sequencing', often seen in the news, be used in the immediate future? (UPSC 2017)

1. Genome sequencing can be used to identify genetic markers for disease resistance and drought tolerance in various crop plants.

2. This technique helps in reducing the time required to develop new varieties of crop plants.

3. It can be used to decipher the host-pathogen relationships in crops.

Select the correct answer using the code given below:

A. 1 only B. 2 and 3 only C. 1 and 3 only D. 1, 2 and 3

Answer: D

2. Consider the following statements: (UPSC 2020)

1. Genetic changes can be introduced in the cells that produce eggs or sperms of a prospective parent.

2. A person’s genome can be edited before birth at the early embryonic stage.

3. Human-induced pluripotent stem cells can be injected into the embryo of a pig.

Which of the statements given above is/are correct?

A. 1 only B. 2 and 3 only C. 2 only D. 1, 2 and 3

Answer: D

|

- The net divisible pool, encompassing the net proceeds, constitutes a significant portion of gross tax revenue slated for vertical devolution from the Union to the States. Over time, changes in tax structures, including a constitutional amendment in 2000, expanded the scope of taxes included in the net proceeds, although certain cesses and surcharges remained excluded.

- Despite expectations that the introduction of the Goods and Services Tax (GST) in 2017 would streamline tax structures and absorb many cesses and surcharges, new ones continued to emerge, further exacerbating the issue. For instance, the recent introduction of the Agriculture Infrastructure and Development Cess in 2021-22 exemplifies this trend.

- Conflicting government data regarding the proportion of cesses and surcharges in gross tax revenue underscores the need for accurate estimation. Disaggregated data analysis reveals a significant increase in collections from ₹70,559 crore in 2009-10 to ₹6.6 lakh crore in 2023-24 (RE) and ₹7 lakh crore in 2024-25 (BE). Excluding the GST compensation cess, collections rose from ₹70,559 crore in 2009-10 to ₹5.1 lakh crore in 2023-24 (RE) and ₹5.5 lakh crore in 2024-25 (BE).

- Although cesses and surcharges as a share of gross tax revenue dipped initially from 11.3% in 2009-10 to 9.5% in 2014-15, they surged to 20.2% in 2020-21 before settling at 16.3% in 2022-23. Tentative figures for 2023-24 suggest a share of 14.8%, still higher than earlier years.

- Between 2009-10 and 2023-24, the Union government collected a cumulative total of ₹36.6 lakh crore from cesses and surcharges, with an additional ₹5.5 lakh crore projected for 2024-25. Notably, these funds were retained solely by the Union government, bypassing sharing with States, thus impacting fiscal federalism.

.png)

- The Union government may argue that a portion of the cesses and surcharges collected is used to fund centrally sponsored schemes and central sector schemes, as well as provide non-plan grants or capital transfers to States. However, these transfers are not untied, unlike the devolution of the State's share in central taxes. In centrally sponsored schemes, States are required to bear about 40% of the cost, and even in central sector schemes, the Union government's contribution is often minimal, leaving States to shoulder a significant financial burden.

- Moreover, when States contribute substantially to implementing a central project, the Union government often seeks to claim the credit by insisting on displaying the Prime Minister's photograph or other forms of labelling. Recent disputes over labelling in the Ayushman Bharat wellness centres exemplify this issue. Additionally, many grants given to States are contingent on fulfilling conditionalities, some of which include the requirement for labelling. Furthermore, most capital transfers provided to States are in the form of loans, which must be repaid to the Union government.

- None of the transfers to States outside the recommendations of the Finance Commission are either unconditional or suited to meet their specific needs. Instead, they reinforce a centralizing tendency in the fiscal realm, effectively pushing the Union-State relationship toward a patron-client dynamic. Any deviation from the guidelines or failure to meet imposed conditionalities can result in the denial of such resources.

- The share of States in central taxes is considered a benchmark in assessing fiscal federalism. It is concerning, then, that the Union government is increasingly providing fewer untied transfers to States while retaining more gross tax revenue as cesses and surcharges. Substituting untied transfers with central schemes does not mitigate the loss; rather, it introduces inflexibilities in Union-State relations and undermines the spirit of cooperative fiscal federalism.

4. CAG's Critical Scrutiny of Cesses and Surcharges

- The Comptroller and Auditor General (CAG) has subjected cesses and surcharges to critical examination. According to the established protocol, all cesses must be transferred to a reserve fund in the Public Account of India upon collection. However, CAG reports have revealed numerous instances of either non-transfer or short transfer of the collected amounts to the respective funds.

- For instance, a CAG report in 2023 highlighted that out of the ₹52,732 crore collected towards the Health and Education Cess in 2021-22, only ₹31,788 crore (or 60%) was transferred to the reserve fund of Prarambhik Shikha Kosh. Similarly, the Research and Development Cess, intended for the Fund for Technology Development and Application, saw a total collection of ₹8,077 crores between 1996-97 and 2017-18 but only ₹779 crore (or 9.6%) was transferred to the Fund, as noted in a CAG report in 2019.

- The Swachh Bharat Cess, earmarked for the Rashtriya Swachhata Kosh, experienced a shortfall of ₹4,891 crore between 2015–16 and 2017–18. Additionally, the Road Cess and Clean Energy Cess saw shortfalls of ₹72,726 crore and ₹44,505 crore, respectively, between 2010–11 and 2017–18.

- The non-transfers and short transfers of cesses undermine the rationale behind their collection. It also reinforces the perception that cesses and surcharges are merely a mechanism to divert funds away from the divisible pool to meet other financial needs of the Union government.

5. Deviations from Finance Commission Recommendations

- The Union Finance Minister's assertion in Parliament on February 8, 2024, that they strictly adhere to the recommendations of the Finance Commission (FC) raises questions about its robustness.

- While retaining a significant portion of gross tax revenue as cesses and surcharges may have constitutional backing, what about the FC recommendations regarding the sharing of net proceeds with all States? The 13th FC (2010 to 2015) recommended a 32% share, the 14th FC (2015 to 2020) recommended 42%, and the 15th FC (2020 to 2025) recommended 41%.

- Comparing annual estimates of net proceeds with the "States’ share of central taxes" reveals that the Union government has consistently failed to share even the FC-recommended percentages. The shortfall was particularly pronounced during the ongoing period of the 15th FC.

- Taking cesses and surcharges into account to create a revised divisible pool further diminishes the share of devolution. This shortfall vis-a-vis FC recommendations translates into substantial sums. Between 2009-10 and 2024-25 (BE), the cumulative amount not devolved to States amounted to ₹5.61 lakh crore. Specifically, during the 13th FC period, ₹44,922 crore was not devolved, during the 14th FC period, it was ₹1.36 lakh crore, and during the ongoing 15th FC period (including 2024-25 BE), it reached a staggering ₹3.69 lakh crore.

- The failure to devolve these funds to States represents a significant constitutional impropriety that warrants attention.

- The sharing of resources from the divisible pool and the proliferation of cesses and surcharges are critical issues that the 16th Finance Commission (FC) must address.

- The FC should take the lead in rectifying historical imbalances in vertical devolution by compensating States for past shortfalls. It should also mandate the Union government to provide accurate estimates of "net proceeds" in budget documents and arrange to provide the shortfalls in devolution over the last decade as a lump sum untied grant to States.

- Furthermore, the Union government must take legislative action to impose strict limits on the collection of cesses and surcharges. These levies should automatically expire after a short period and should not be rebranded under another name.

- In addition to addressing legitimate grievances regarding horizontal devolution, the stance of the 16th FC on vertical devolution will be crucial for the preservation of fiscal federalism in India.

|

For Prelims: fiscal federalism, vertical devolution, Finance Commission, CAG, Chess, Surcharges

For Mains:

1. Explain the concept of vertical devolution in the context of fiscal federalism in India. Discuss two disturbing trends within vertical devolution that need urgent redressal. (250 Words)

2. Analyze the implications of cesses and surcharges on fiscal federalism in India, considering their growth, conflicting government data, and the cumulative amount collected by the Union government. (250 Words)

|

|

Previous Year Questions

1. With reference to the Finance Commission of India, which of the following statements is correct? (UPSC 2011)

A. It encourages the inflow of foreign capital for infrastructure development.

B. It facilitates the proper distribution of finances among the Public Sector Undertaking.

C. It ensures transparency in financial administration.

D. None of the statements (a), (b), and (c) given above is correct in this context.

2. With reference to the Fourteenth Finance Commission, which of the following statements is/are correct? (UPSC 2015)

1. It has increased the share of States in the central divisible pool from 32 percent to 42 percent.

2. It has made recommendations concerning sector-specific grants.

Select the correct answer using the code given below.

A. 1 only

B. 2 only

C. Both 1 and 2

D. Neither 1 nor 2

3. Which of the following is/are among the noticeable features of the recommendations of the Thirteenth Finance Commission? (UPSC 2012)

1. A design for the Goods and Services Tax, and a compensation package linked to adherence to the proposed design.

2. A design for the creation of lakhs of jobs in the next ten years in consonance with India's demographic dividend.

3. Devolution of a specified share of central taxes to local bodies as grants

Select the correct answer using the codes given below:

A. 1 only

B. 2 and 3 only

C. 1 and 3 only

D. 1, 2 and 3

4. Which one of the following is not correct in respect of Directorate of Enforcement? (CDS 2021)

A. It is a specialized financial investigation agency under the Department of Revenue, Ministry of Finance.

B. It enforces the Foreign Exchange Management Act, 1999.

C. It enforces the Prevention of Money Laundering Act, 2002.

D. It enforces the Prohibition of Benami Property Transaction Act, 1988.

5. The Comptroller and Auditor-General (CAG) of India can be removed from office only by the: (UPSC CAPF 2015)

A. President on the advice of the Union Cabinet.

B. Chief justice of the Supreme Court.

C. President of India after an address in both Houses of Parliament.

D. President on the advice of Chief Justice of India.

6. With reference to the Union Government, consider the following statements: (UPSC 2015)

1. The Department of Revenue responsible for the preparation of Union Budget that is presented to the Parliament.

2. No amount can be withdrawn from the Consolidated Fund of India without the authorization from the Parliament of India

3. All the disbursements made from Public Account also need authorization from the Parliament of India.

Which of the statements given above is/are correct?

A. 1 and 2 only B. 2 and 3 only C. 2 only D. 1, 2 and 3

7. The Contingency Fund of India is placed at whose disposal? (SSC CGL 2017)

A. The Prime Minister

B. Judge of Supreme Court

C. The President

D. The Finance Minister

8. In India, other than ensuring that public funds are used efficiently and for their intended purpose, what is the importance of the office of the Comptroller and Auditor General (CAG)? (UPSC 2012)

1. CAG exercises exchequer control on behalf of the Parliament when the President of India declares a national emergency/financial emergency.

2. CAG reports on the execution of projects or programs by the ministers are discussed by the Public Accounts Committee.

3. Information from CAG reports can be used by investigating agencies to press charges against those who have violated the law while managing public finances.

4. While dealing with the audit and accounting of government companies, CAG has certain judicial powers for prosecuting those who violate the law.

Which of the statements given above is/are correct?

A. 1, 3 and 4 only B. 2 only C. 2 and 3 only D. 1, 2, 3 and 4

Answers: 1-D, 2-A, 3- C, 4-D, 5-C, 6-C, 7-C, 8-C

|

FILM CERTIFICATION

- The Central Board of Film Certification (CBFC) is led by a Chairperson and consists of up to 25 members and 60 advisory panel members from various parts of India, all appointed by the I&B Ministry.

- While the board members are typically professionals from the film and television industry, the advisory panel members often come from outside the industry.

- Both the chairperson and board members serve for three years, while advisory panel members serve for two years.

- The CEO is primarily responsible for administrative functions, and regional officers are part of Examining Committees that certify films.

- When a filmmaker applies for certification, an Examining Committee is formed by the Regional Officer.

- For short films, the committee includes a member of the advisory panel and an examining officer, with at least one being a woman.

- For other films, the committee consists of four members from the advisory panel and an examining officer, with at least two being women.

3. Film Certification Process and Criteria

The Central Board of Film Certification (CBFC) certifies films based on their content, categorizing them as follows:

- Unrestricted Public Exhibition (U): Suitable for all ages.

- Parental Guidance for children below age 12 (U/A): May contain scenes or content unsuitable for young children.

- Adult (A): Restricted to adult audiences.

- Viewing by specialized groups (S): Intended for specific groups, such as educational or cultural organizations.

- The certification decision is made by the Regional Officer, who considers reports from the Examining Committee members. If the committee has a unanimous or majority opinion, the decision is made accordingly. However, in cases of a divided opinion, the matter is referred to the chairperson for a final decision.

- In the recent case of Chidiakhana, the film received a U/A certificate due to its portrayal of scenes involving murder and attempts to murder, violence, abusive language, bullying in school, children watching adult content, a mother slapping a child, a suicide attempt, teasing of a child, and discrimination against North Indians in Mumbai. This decision was consistent with other children's films, such as The Jungle Book, which also received a U/A certification, sparking controversy in 2016.

- If an applicant is dissatisfied with the certification or the suggested changes provided by the CBFC, they can appeal to the Revising Committee. This committee consists of the Chairperson and up to nine members from both the board and the advisory panel.

- However, no member of the advisory panel who has already viewed the film can be part of this committee.

- The Revising Committee follows a similar process, with the final decision resting with the Chairperson.

- The next level of appeal is the Appellate Tribunal, an independent body whose members are appointed by the ministry for three-year terms. If the dispute remains unresolved, it can be taken to a court for further adjudication.

- Under the Cinematograph Act, 1952, the CBFC has the authority to "direct the applicant to carry out such excisions or modifications in the film as it deems necessary before sanctioning the film for public exhibition… or refuse to sanction the film for public exhibition."

- The CBFC is a certification board, not a censorship board, and its role is to certify films based on fairly broad guidelines. This approach is consistent with Article 19 of the Constitution and Section 5(b) of the Cinematograph Act.

- The cinema reflects different aspects of life, and as society evolves, so does cinema. The legal precedents set by cases such as Udta Punjab, Padmaavat, and Raj Kapoor's Satyam Shivam Sundaram.

- Section 5(b) of the Cinematograph Act, of 1952 outlines the criteria for film certification. It states that "a film shall not be certified if any part of it is against the interest of the sovereignty and integrity of India, the security of the State, friendly relations with foreign States, public order, decency, or involves defamation or contempt of court or is likely to incite the commission of any offence."

- The interpretation of this guideline can vary from one CBFC member to another. Certification decisions are often influenced by individual inclinations in the Examining Committee, whose members come from various walks of life.

|

For Prelims: CBFC, Cinematograph Act, of 1952, Bombay High Court, Article 19

For Mains:

1. Discuss the role of the CBFC as a certification board and its responsibilities in certifying films for public exhibition. How can the CBFC ensure transparency, fairness, and adherence to guidelines in the film certification process? (250 Words)

|

|

Previous Year Questions

1. Which of the following is the correct full form of CBFC in the context of Indian films? (MH SET 2018)

A. Central Board of Film Certification

B. Censor Board of Film Content

C. Central Board for Film Censorship

D. Central Board for Film Classification

2. Which of the following statements are incorrect? (HPSC HCS 2022)

1. Central Board of Film Certification (CBFC) is a statutory body regulating the public exhibition of films.

2. The film ‘Raja Harishchandra’ produced by Dadasaheb Phalke was released after the passing of the Indian Cinematograph Act, 1920.

3. CBFC launched its online portal ‘e-cinepramaan’ in 2015 to modernize and digitize film certification process.

4. The Advisory Panels which assist the regional offices of CBFC in examination of film comprise of members who have been nominated by the Central Govt. for a period of two years.

A. 1 and 2 only B. 2 and 3 only C. 3 and 4 only D. 1 and 4 only

3. Article 19(1) of the Constitution of India, as it stands amended, includes which of the following? (CDS 01/2022)

1. Freedom of speech and expression

2. Assemble peaceably and without arms

3. To acquire and dispose property

4. To move freely throughout the territory of India

Select the correct answer using the code given below

A. 1 and 2 only B. 1, 2, 3 and 4 C. 4 only D. 1, 2 and 4 only

4. Article 19 of the Indian Constitution includes which of the following right? (DSSSB LDC 2019)

A. Right to Constitutional Remedies

B. Right against exploitation

C. Right to freedom of speech and expression

D. Right to freedom of Religion

Answers: 1-A, 2-B, 3-D, 4- C

|

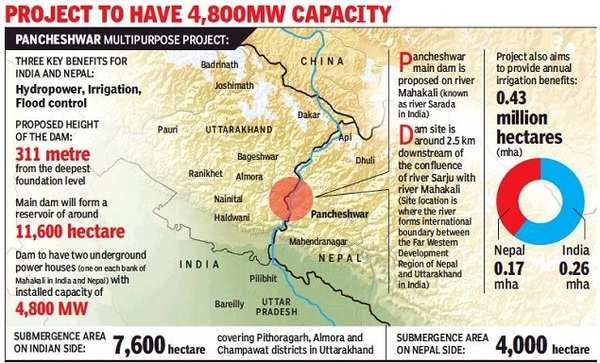

PANCHESHWAR MULTIPURPOSE PROJECT

The Pancheshwar Multipurpose Project (PMP) is a significant infrastructure initiative proposed for development in the Mahakali River basin, situated in the Far Western Development Region of Nepal. Here are key details about the project:

-

Location: The project is located upstream from the proposed Pancheshwar High Dam site, covering parts of Darchula, Baitadi, and Dadeldhura districts in Nepal. The geographical coordinates range from 29° 07' 30" to 29° 48' North latitude and 79° 55' to 80° 35' East longitude.

-

Drainage Area: The Mahakali River basin, where the project is situated, has a drainage area of 12,100 square kilometers.

-

Power Generation: The primary objective of the Pancheshwar Multipurpose Project is to harness the hydropower potential of the Mahakali River. The project aims to generate a substantial peak power capacity of 6,720 MW. This includes 6,480 MW from the Pancheshwar High Dam and an additional 240 MW from the Rupali Gad Re-regulating Dam.

-

Annual Energy Production: The project anticipates an annual average energy production of 12,333 gigawatt-hours (GWh), contributing significantly to the region's power supply.

-

Alternative Power Generation: The Poornagiri re-regulating dam is identified as an alternative to the Rupali Gad Re-regulating Dam within the project. This alternative is expected to generate an additional 1,000 MW of power.

-

Geopolitical Context: The project area is strategically positioned along the Nepal-India border, and at present, the site can be accessed primarily through India. However, an alternative access route through Nepal involves a two-day trek from Patan, Baitadi

The Pancheshwar Multipurpose Project (PMP) holds significant importance for various reasons:

- One of the primary objectives of the PMP is to harness the hydropower potential of the Mahakali River. With a proposed peak power capacity of 6,720 MW, including the Pancheshwar High Dam and associated structures, the project contributes significantly to addressing the energy needs of the region. This electricity generation is crucial for meeting the increasing demand for power in Nepal and potentially supporting the energy requirements of neighboring regions

- The generation of electricity from the PMP is expected to stimulate economic development in the Far Western Development Region of Nepal. Access to a reliable and abundant power supply can attract industries, create job opportunities, and boost overall economic growth in the region

- The project involves the construction of dams and reservoirs, allowing for better management of water resources in the Mahakali River basin. The multipurpose nature of the project facilitates water storage, flood control, and irrigation, thereby enhancing agricultural productivity and supporting water-dependent sectors

- The project is situated along the Nepal-India border, and its development involves collaboration between the two countries. This cross-border cooperation fosters diplomatic and economic ties, promoting shared benefits and mutual interests

- The construction of dams, powerhouses, and associated infrastructure for the PMP contributes to the overall development of critical infrastructure in the region. This includes roads, transmission lines, and other facilities necessary for the project, which can also be utilized for broader connectivity and development initiatives

- Hydropower projects like PMP are considered cleaner and more environmentally friendly compared to fossil fuel-based power generation. By promoting the use of renewable energy, the project contributes to efforts aimed at mitigating the impact of climate change

- The project's reservoirs and dams play a role in managing water flow, providing flood control benefits to downstream areas. Additionally, controlled release of water can be utilized for irrigation purposes, enhancing agricultural activities and food security in the region

4.Mahakali River

The Mahakali River, also known as the Kali River, is a transboundary river flowing through India and Nepal.

Here are some key details about the Mahakali River:

- The Mahakali River originates in the high mountains of the Himalayas in the Pithoragarh district of Uttarakhand, India. It then flows through the western part of Nepal, forming a natural boundary between India and Nepal

- The Mahakali River serves as a natural boundary between India and Nepal for a significant stretch of its course. It is an essential part of the geopolitical landscape between the two countries

- The river is fed by numerous tributaries as it flows through the Himalayan region. Some of the major tributaries include the Dhauliganga, Kuthi Yankti, Saryu, and Ramganga rivers

- The Mahakali River is the proposed site for the Pancheshwar Multipurpose Project (PMP), a significant hydropower project aimed at harnessing the river's water resources for electricity generation, flood control, and irrigation

- The Mahakali River basin is known for its significant hydropower potential. The Pancheshwar Multipurpose Project, with its planned capacity of 6,720 MW, is one of the initiatives aimed at tapping into this potential to meet the growing energy demands of the region

- The river holds cultural and historical significance in the region. It is mentioned in ancient Hindu scriptures, and the areas along its course have historical and cultural connections with local communities

- The Mahakali River basin is characterized by rich biodiversity, with diverse flora and fauna. The river and its surroundings support various ecosystems and provide habitats for numerous species

- The river plays a crucial role in supporting local economies through fishing and agriculture. Communities along its banks often rely on the river's resources for their livelihoods

- The scenic beauty of the Mahakali River and its surroundings attracts tourists and adventure enthusiasts. The river offers opportunities for activities like white-water rafting and trekking in the picturesque Himalayan landscape