BRICS

1. Context

2. BRICS

- The BRICS alliance, composed of Brazil, Russia, India, China, and South Africa, has evolved from an economic consortium to a multifaceted geopolitical force.

- Emerging economies with considerable potential, these countries together form a collective that challenges traditional power dynamics and fosters cooperation in an increasingly interconnected world.

3. Formation and Evolution

- BRICS was officially established in 2006, with the objective of fostering economic growth, development, and cooperation among member nations.

- Over time, it has transformed into a platform for addressing a broader spectrum of global challenges, encompassing political, security, and social concerns alongside economic issues.

4. Geopolitical Relevance

- Counterbalance to Western Influence: BRICS serves as a counterweight to the dominance of Western powers. The coalition's diverse representation from different regions empowers non-Western countries to assert their interests on the global stage.

- Global South Unity: BRICS resonates with many countries in the Global South that seek a voice in international affairs. It presents an alternative to the traditional Western-dominated institutions, offering a platform for collaboration and advocacy.

5. Economic Cooperation and Growth

- Economic Powerhouses: Collectively, BRICS nations account for a substantial portion of the world's population and GDP. Their economic potential has led to discussions on reforming global financial institutions to better reflect contemporary realities.

- Intra-BRICS Trade: Trade among BRICS members has grown significantly. Initiatives like the New Development Bank (NDB) and the Contingent Reserve Arrangement (CRA) bolster financial cooperation and stability within the group.

6. Geopolitical Challenges and Opportunities

- Diverse Interests: As BRICS expands and diversifies, differing geopolitical interests may arise, potentially leading to internal divisions. However, this diversity also presents opportunities for creative solutions to global challenges.

- Diplomatic Outreach: BRICS engages with other regional and international organizations, strengthening its influence. The expansion of the group's membership underscores its growing geopolitical relevance.

7. India's Role and Beyond

- India's Diplomacy: India has played an active role within BRICS, emphasizing issues such as counter-terrorism, cybersecurity, and climate change. Its strategic partnerships contribute to the coalition's expansion and its influence in shaping its direction.

- Global Impact: BRICS expansion into a broader coalition incorporating West Asian countries like Egypt, Iran, Saudi Arabia, and the UAE signifies a deliberate shift towards greater global political relevance. This expansion highlights BRICS' adaptability to changing geopolitical dynamics.

8. BRICS New Members Dynamics

- Unanimous Decisions: BRICS decisions require unanimous agreement, reflecting collective decision-making.

- Geopolitical Partnerships: While Russia and China confront West-related challenges, Brazil, South Africa, and India maintain significant partnerships with the US and Europe.

- China's Expansion Drive: China spearheads BRICS expansion, prioritizing membership growth.

- Inclusion of Iran: China and Russia's influence is seen in Iran's inclusion, showcasing their collaboration.

- Mediation Efforts: China's role reconciles rivals Saudi Arabia and Iran within the alliance.

- Saudi Arabia's Shift: Saudi Arabia's entry signifies a move towards an independent foreign policy, diverging from the US alliance.

- Global Significance for Russia and Iran: BRICS membership elevates Russia and Iran's global partnerships, challenging Western dominance.

9. Implications for India

- Strategic Role: India played a lead role in drafting BRICS membership criteria, demonstrating its strategic influence within the alliance.

- Expanded Influence: The inclusion of new members who are strategic partners of India enhances its influence within BRICS.

- Geopolitical Balancing: BRICS expansion allows India to navigate between its ties with the West and its position within this non-Western coalition.

- Global Advocacy: With more representation and diverse members, India can push for UN reforms and increased Global South representation.

- Diplomatic Challenges: India might need to exert more effort to assert its influence in an alliance with a wider range of members and potential competing interests.

- Economic Opportunities: Collaboration with economically strong members like China can lead to enhanced trade and investment prospects for India.

|

For Prelims: BRICS, Global South Unity, Western Influence, New Development Bank (NDB), and Contingent Reserve Arrangement (CRA).

For Mains: 1. Discuss the Implications of BRICS' Expansion for India's Geopolitical Positioning and Influence within the Alliance.

2. Analyze India's Role in Shaping BRICS' Membership Criteria and Its Strategic Significance in the Expanded Coalition.

|

Previous year Questions1. With reference to a grouping of countries known as BRICS, consider the following statements: (UPSC 2014)

1. The First Summit of BRICS was held in Rio de Janeiro in 2009.

2. South Africa was the last to join the BRICS grouping.

Which of the statements given above is/are correct?

A. 1 only

B. 2 only

C. Both 1 and 2

D. Neither 1 nor 2

Answer: B

2. With reference to BRIC countries, consider the following statements: (UPSC 2010)

1. At present, China's GDP is more than the combined GDP of all three other countries.

2. China's population is more than the combined population of any two other countries.

Which of the statements given above is/are correct?

A. 1 only

B. 2 only

C. Both 1 and 2

D. Neither 1 nor 2

Answer: A

3. The 'Fortaleza Declaration', recently in the news, is related to the affairs of (UPSC 2015)

A. ASEAN

B. BRICS

C. OECD

D. WTO

Answer: B

|

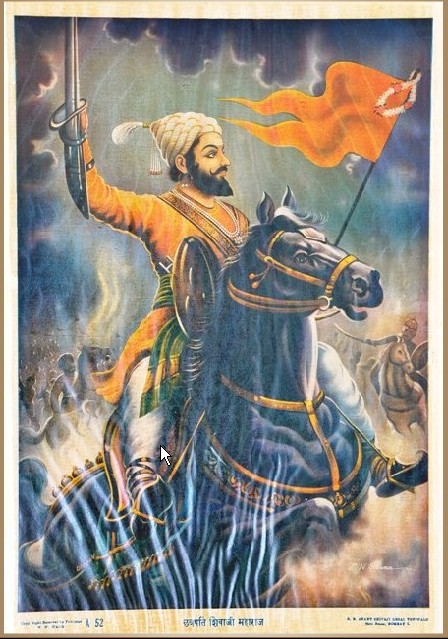

CHATRAPATI SHIVAJI

1. Context

2. Key points

- For a long time in history, before air power took centre stage in military tactics and strategy, forts were crucial to the defence of any country.

- They acted as a force multiplier for the defender and a safe refuge for civilians often the first casualties of war.

- Nowhere is this more apparent than in the Maratha Countryside forts of all sizes and shapes dot the landscape.

- In their heyday, control of these forts translated into control of the territory.

- Chhatrapati Shivaji Maharaj, at the time of his death, is said to have control of over 200 forts across his territories with some estimates putting the number over 300.

- In many ways, the Marathas took fort-building to its zenith, not only building forts capable of surviving long sieges and battles but putting special attention to their placement and locations.

- Grant Duff, a soldier of the East India Company and the first comprehensive historian of the Marathas wrote: "There is probably no stronger country in the world than the Deccan from the military defence point of view".

3. The terrain of the Maratha Country

- Unlike the plains of Northern India, suited to conventional battle with large standing armies, the terrain of the Maratha country was different.

- With the Arabian Sea on one side, the Konkan plains in the centre and the Western Ghats overlooking the plains, in the 17th century much of the region was covered in thick jungles.

- Warfare in such terrain is qualitatively different, with large conventional armies prone to getting bogged down.

- Thus, as Shivaji began to consolidate and expand his influence in the region, his strategies evolved to be significantly different from the common military doctrine of the time.

- Crucial to his military strategy were hill forts.

4. A native of hill forts

- Historian Gunakar Muley called Shivaji "a fort-native".

- The Maratha icon was born and raised in the hill fort of Shivneri (around 100km from Pune), given to his grandfather by the Sultan of Ahmadnagar instead of his services as a military commander.

- Shivneri is a typical hill fort found in the Western Ghats a small but strong fortification, a top hill overlooking the surrounding terrain.

- It had a permanent source of water inside in the form of two freshwater springs and according to some accounts (to be taken with a pinch of salt), the fort was well-stocked to feed its residents for seven years.

| In "Sivaji and the Rise of the Mahrattas" by Richard Temple, M.G. Ranade, G.S. Sardesai, R.M. Netham and James Douglas and Shivneri is described as the following: "You will see what a rugged precipitous place this is and what a fitting spot it was for a hero to be born!". |

- Thus, growing up in the hills and valleys around Pune, Shivaji understood the salience of hill forts in controlling the land.

- Over his storied life, he captured multiple such forts, including Torna (When he was only 16), Rajgadh, Sinhagadh and Purandar.

5. Shivaji's guerilla tactics

- Shivaji's armed forces had some major limitations.

- First, he did not have the man or horsepower compared to most of his enemies, especially during the early stages of his life.

- Second, he was heavily reliant on obtaining supplies such as muskets and gunpowder from the Europeans, mainly the Portuguese.

- This meant that in conventional battle, he would have seldom stood a chance against his foes.

- Thus, Shivaji adopted guerilla tactics: his men would travel in small, highly mobile and heavily armed attachments, wreak havoc in the often sluggish Mughal or Adil Shahi armies, loot supplies and treasure and quickly retreat.

- Crucial to such plans were hill forts. Marathas forces would strike quickly and retreat to the many hill forts of the region.

- These forts were designed such that the approach to them was tricky, often treacherous, to large groups of men.

- Consequently, these were perfect defensive positions where either the bigger armies would not bother to attack or would have to sacrifice their strength in numbers if they did choose to attack.

| Hill forts also were constructed such that they were perfect vantage points to keep a lookout for any threat. "There should not be a higher point near the fort amongst the surrounding hills," wrote Ramchandrra Pant Amatya, Shivaji's Finance Minister. |

- Often, if there were higher points nearby, smaller forts would be constructed there.

- This can be seen in the case of the Purandar fort, which is flanked by the smaller Vajragad fort.

- What hill forts effectively allowed Shivaji to do was project his power, beyond what would have been possible through conventional means.

- The relative safety of his forts allowed him to successfully carry his lighting tactics while fighting formidable enemies.

- As his territories grew, these forts became all the more important, as local strongholds and seats of local administration.

- From forts nestled atop great heights, he could govern the land around. They also became symbols that projected his power and presence.

- The Maratha Empire emerged from humble beginnings. While a variety of factors, concerning both the Marathas and their rivals, contributed to their rise, the significance of hill forts cannot be overlooked.

|

For Prelims: Chhatrapati Shivaji, Maratha Empire, Guerilla Tactics, Mughal Empire

For Mains:

1. Why were forts so important for the consolidation of the Maratha Empire? discuss the uniqueness of these forts. (250 Words)

|

INDIAN JUDICIARY

- On January 28, 1950, two days after India became a sovereign democratic republic, the Supreme Court of India came into being.

- The inauguration took place in the Chamber of Princes in the Parliament building which was the home to the Federal Court of India for 12 years preceding the Supreme Court's establishment.

- The Parliament House was to be the home of the Supreme Court for years that were to follow until the court acquired its present building with lofty domes and its signature spacious collonaded verandas in 1958.

- The inaugural proceedings on the 28th began at 9.45 a.m. when the Judges of the Federal Court Chief Justice Harilal J.Kania and Justices Saiyid Fazl Ali, M. Patanjali Sastri, Mehr Chand Mahajan, Bijan Kumar Mukherjea and S.R. Das took their seats.

- The inaugural proceedings ensured that the rules of the court were published and the names of all the advocates and agents of the Federal Court were brought on the rolls of the Supreme Court.

Evolution of the Supreme Court

- In 1958, when the court shifted its premises, the building was shaped to project the image of scales of justice, in the central wing.

- In 1979, two new wings the East wing and the West wing were added to the complex.

- In all, there are 19 Courtrooms in the various wings of the building.

- The Chief Justice's Court is the largest of the Courts at the Central Wing's Centre.

- The original Constitution of 1950 envisaged a Supreme Court with a Chief Justice and 7 puisne judges leaving it to Parliament to increase this number.

- In the early years, all the judges of the Supreme Court sat together to hear the cases presented before them.

- As the work of the Court increased and arrears of cases began to accumulate, Parliament increased the number of Judges from 8 in 1950 to 11 in 1956, 14 in 1960, 18 in 1978, 26 in 1986, 31 in 2009 and 34 in 2019 (Current Strength).

- As the number of Judges has increased, they sit in smaller benches of two and three coming together in larger benches of 5 and more only when required to do so or to settle a difference of opinion or controversy.

- Article 124 establishes the Supreme Court of India, consisting of a Chief Justice and other judges. It outlines the composition and jurisdiction of the Supreme Court.

- Article 125 empowers Parliament to determine the salaries, allowances, and other conditions of service for the judges of the Supreme Court.

- Article 126 allows the President to appoint an acting Chief Justice when the office of the Chief Justice is vacant or when the Chief Justice is unable to perform duties.

- Article 127 The President has the authority to appoint a person who has been a judge of the Supreme Court or High Court as an ad hoc judge for a temporary period.

- Article 128 Retired judges may be requested by the Chief Justice of India to sit and act as judges of the Supreme Court, emphasizing the importance of their experience.

- Article 129 Declares the Supreme Court as a court of record with the power to punish for contempt of itself, highlighting its authority.

- Article 130 The Supreme Court shall sit in Delhi, or in such other place or places as the Chief Justice of India may, with the approval of the President, appoint.

- Article 131 Grants the Supreme Court original jurisdiction in disputes between the Government of India and States or between different States.

- Article 131A Originally provided exclusive jurisdiction to the Supreme Court in constitutional matters related to Central laws; however, it has been repealed.

- Article 132 Details the appellate jurisdiction of the Supreme Court in certain cases coming from High Courts.

- Article 133 Specifies the appellate jurisdiction of the Supreme Court in civil matters.

- Article 134 Outlines the Supreme Court's appellate jurisdiction in criminal matters.

- Article 134A Deals with the certification required for an appeal to the Supreme Court in certain cases.

- Article 135 Confers the jurisdiction and powers of the former Federal Court on the Supreme Court.

- Article 136 Grants the Supreme Court the discretionary power to grant special leave to appeal from any judgment or order.

- Article 137 Empowers the Supreme Court to review its own judgments or orders.

- Article 138 Allows Parliament to extend the jurisdiction of the Supreme Court.

- Article 139 Grants the Supreme Court the power to issue writs for the enforcement of fundamental rights.

- Article 139A Provides for the transfer of certain cases from one High Court to another or from a High Court to the Supreme Court.

- Article 140 Empowers the Supreme Court to exercise ancillary powers necessary for the effective discharge of its jurisdiction.

- Article 141 Declares that the law declared by the Supreme Court is binding on all courts within the territory of India.

- Article 142 Grants the Supreme Court the power to pass decrees and orders necessary for doing complete justice in any cause or matter.

- Article 143 Allows the President to refer questions of law or fact to the Supreme Court for its opinion.

- Article 144 Requires all authorities to act in aid of the Supreme Court.

- Article 144A Originally provided special provisions for the disposal of questions regarding the constitutional validity of laws but has been repealed.

- Article 145 Grants the Supreme Court the authority to make rules regulating the practice and procedure of the court.

- Article 146 Deals with the appointment of officers and servants of the Supreme Court and the expenses associated with it.

- Article 147 Provides for the interpretation of the expression "existing law" about the jurisdiction, powers, and authority of the Supreme Court under this chapter.

The Supreme Court of India has a well-defined organizational structure, which includes the Chief Justice of India, other judges, and various administrative and supporting staff.

Chief Justice of India (CJI)

- The Chief Justice of India is the head of the Supreme Court.

- The CJI is appointed by the President of India and is responsible for the overall functioning of the court.

- The CJI presides over important matters, assigns cases to other judges, and represents the judiciary in various capacities.

Judges

- The Supreme Court can have a maximum strength of 34 judges, including the Chief Justice.

- Judges are appointed by the President of India based on recommendations from the collegium (a group of top judges).

- Judges of the Supreme Court hear and decide cases, contribute to the formulation of legal principles, and may also be involved in administrative responsibilities.

- Registry: The Registry is the administrative wing of the Supreme Court responsible for handling administrative and procedural aspects. It is headed by the Secretary-General, who is an officer appointed by the Chief Justice of India.

- Court Officers and Staff: Various court officers and staff assist in the day-to-day functioning of the Supreme Court. This includes Registrars, Deputy Registrars, Assistant Registrars, and other administrative staff who manage the filing of cases, scheduling, and other administrative tasks.

- Advocates and Legal Professionals: Advocates and legal professionals, including Senior Advocates and Advocates-on-Record, play a crucial role in presenting cases before the Supreme Court. Advocates-on-Record are registered practitioners who are eligible to file cases and plead on behalf of litigants.

- Library and Research Staff: The Supreme Court library is an integral part of the institution, providing extensive legal resources to judges and legal professionals. Research staff may assist judges in legal research and analysis.

- Security and Support Staff: The Supreme Court has security personnel to ensure the safety of the premises and those present. Support staff includes personnel responsible for maintenance, cleaning, and other logistical aspects.

- Committees and Commissions: Various committees and commissions may be constituted by the Chief Justice or the Supreme Court for specific purposes, such as judicial reforms, ethics, or other administrative matters.

- Supreme Court Bar Association (SCBA) is an association of lawyers who are authorized to practice in the Supreme Court. It plays a role in addressing the concerns of lawyers practising in the Supreme Court.

- Legal Aid and Pro Bono Services: The Supreme Court may have mechanisms in place to provide legal aid to those who cannot afford legal representation.

- Judicial Committees and Panels: Special committees or panels may be formed for specific tasks, inquiries, or recommendations related to the functioning of the judiciary.

.png)

Collegium System

- The Collegium system is not rooted in the Constitution. Instead, it has evolved through judgments of the Supreme Court.

- Under the system, the Chief Justice of India along with four senior-most Supreme Court judges recommend appointments and transfers of judges.

- A High Court Collegium, meanwhile, is led by the incumbent Chief Justice and the two senior-most judges of that court.

- In this system, the government’s role is limited to getting an inquiry conducted by the Intelligence Bureau (IB) if a lawyer is to be elevated as a judge in a High Court or the Supreme Court.

- The government can also raise objections and seek clarifications regarding the Collegium’s choices, but, if the Collegium reiterates the same names, the government is bound, under Constitution Bench judgments, to appoint them to the post.

Evolution of Collegium System

- In the First Judges case, the court held that the consultation with the CJI should be "full and effective".

- The Second Judges Case introduced the collegium system in 1993, as they ordered the CJI to consult a collegium of his two senior judges in the apex court on judicial appointments, such a "collective opinion" of the collegium would have primacy over the government.

- The Third Judges case in 1998, expanded the judicial collegium to its present composition of the CJI and four of its senior-most judges.

Procedure for replacement of Collegium System

- Replacing the Collegium system calls for a Constitutional Amendment Bill.

- It requires a majority of not less than two-thirds of MPs (Members of Parliament) present and voting in Lok Sabha as well as Rajya Sabha.

- It also needs the ratification of legislatures of not less than one-half of the states.

The concerns associated with the Collegium system

- Constitutional Status: The Collegium is not prescribed in the Constitution. Article 124 mentions consultation, which the SC interpreted as ‘concurrence’ in the Second Judges Case (1993). During the hearing against the NJAC, the then SC Bar President had argued that the Constituent Assembly had considered a proposal for making Judges’ appointment ‘in concurrence’ with the CJI but had eventually rejected it.

- Transparency: There is no official procedure for selection or any written manual for the functioning of the Collegium. The parameters considered for selection (or rejection) are not available in the public domain.

- Accountability: The selection of Judges by the Judges is considered undemocratic. Judges are not accountable to the people or any other organ of the State (Legislature or Executive). It can add an element of arbitrariness in functioning.

- Criticism by Judges: Many retired Judges have criticized the working of the Collegium, especially the lack of transparency. Several controversial appointments have been made despite objections by the members of the Collegium.

- No Checks: There are no checks on the process. Nor has there been any review regarding the effectiveness of the process. Critics of the system argue the phenomena of ‘Uncle Judges’ wherein near relatives, kith, and kin of sitting Judges are appointed to the higher judiciary leading to nepotism. Law Commission in its 230th Report (2012) recommended that the Judges, whose kith and kin are practising in a High Court, should not be appointed in the same High Court. The absence of transparency, accountability, and external checks creates space for subjectivity and individual bias in appointments. In some cases, the principle of seniority has been ignored.

- No Reforms: The Supreme Court did not amend the contentious provisions of the NJAC Act or add safeguards to the Act. Instead, it struck down the whole Act. The Supreme Court reverted to the old Collegium System. However, the Court did not take any steps to address the concerns associated with the Collegium System.

6. About the National Judicial Appointments Commission (NJAC)

- The Constitution (99th Amendment) Act, which established the NJAC and the NJAC Act, was passed by Parliament in 2014 to set up a commission for appointing judges,

replacing the Collegium system. - This would essentially increase the government’s role in the appointment of judges.

- The laws were repealed in October 2015 after the Supreme Court struck them down.

Composition of NJAC

- The Chief Justice of India as the ex officio Chairperson.

- Two senior-most Supreme Court Judges as ex officio members.

- The Union Minister of Law and Justice as ex officio members.

- Two eminent persons from civil society (one of whom would be nominated by a committee consisting of the CJI, Prime Minster, and the Leader of Opposition in the Lok Sabha, and the other would be nominated from the SC/ST/OBC/minority communities or women.

| Article 124A created the NJAC, a constitutional body to replace the collegium system, Article 124B conferred the NJAC with the power to make appointments to Courts and Article 124C accorded express authority to Parliament to make laws regulating the manner of the NJAC's functioning. |

Recommendations

- Under the NJAC Act, the Chief Justice of India and Chief Justices of the HCs were recommended by the NJAC on seniority while SC and HC judges were recommended based on ability, merit and "other criteria specified in the regulations".

- Notably, the Act empowered any two members of the NJAC to veto a recommendation if they did not agree with it.

- In the collegium system, senior judges make appointments to the higher judiciary.

NJAC challenged

- In early 2015, the Supreme Court Advocates-on-Record Association (SCAORA) fled a plea challenging the provisions which had by then become laws.

- The SCAORA Contended in its petition that both the Acts were "Unconstitutional" and "invalid".

| It argued that the 99th Amendment which provided for the creation of the NJAC took away the "Primacy of the collective opinion of the Chief Justice of India and the two Senior-most Judges of the Supreme Court of India" as their collective recommendation could be vetoed or "suspended by a majority of three non-Judge members". |

- It invoked the Second Judge Case to say that CJI primacy had to be protected.

- It also stated that the amendment "severely" damaged the basic structure of the Constitution, of which the independence of the judiciary in appointing judges was an integral part.

|

For Prelims: Collegium system, National Judicial Appointments Commission (NJAC), Supreme court, Article 124, 99th Constitutional Amendment Act

For Mains:

1. Discuss the evolution of the Supreme Court of India from its inauguration in 1950 to the present day. How has its structure and capacity evolved to meet the changing demands of the legal landscape? (250 Words)

2. Examine the constitutional provisions that govern the Supreme Court of India. How do these provisions delineate the powers, jurisdiction, and composition of the Supreme Court? (250 Words)

3. What are the key features of the National Judicial Appointments Commission (NJAC) Act, and how did it differ from the Collegium system? (250 Words)

4. How does the appointment process of judges in the Supreme Court of India, emphasise the role of the Collegium system? What are the concerns associated with this system, and do you believe reforms are necessary? (250 Words)

|

|

Previous Year Questions

1. With reference to the Indian judiciary, consider the following statements: (UPSC 2021)

1. Any retired judge of the Supreme Court of India can be called back to sit and act as a Supreme Court judge by the Chief Justice of India with the prior permission of the President of India.

2. A High Court in India has the power to review its own judgment as the Supreme Court does.

Which of the statements given above is/are correct?

A. 1 only B. 2 only C. Both 1 and 2 D. Neither 1 nor 2

2. In India, Judicial Review implies (UPSC 2017)

A. the power of the Judiciary to pronounce upon the constitutionality of laws and executive orders

B. the power of the Judiciary to question the wisdom of the laws enacted by the Legislatures

C. the power of the Judiciary to review all the legislative enactments before they are assented to by the President

D. the power of the Judiciary to review its own judgments given earlier in similar or different cases

3. Consider the following statements:

1. The motion to impeach a Judge of the Supreme Court of India cannot be rejected by the Speaker of the Lok Sabha as per the Judges (Inquiry) Act, 1968.

2. The Constitution of India defines and gives details of what constitutes 'incapacity and proved misbehaviour' of the Judges of the Supreme Court of India

3. The details of the process of impeachment of the Judges of the Supreme Court of India are given in the Judges (Inquiry) Act, of 1968.

4. If the motion for the impeachment of a Judge is taken up for voting, the law requires the motion to be backed by each House of the Parliament and supported by a majority of the total membership of that House and by not less than two-thirds of total members of that House present and voting.

Which of the statements given above is/are correct?

A. 1 and 2 B. 3 only C. 3 and 4 only D. 1, 3 and 4

4.The power to increase the number of judges in the Supreme Court of India is vested in (UPSC 2014)

A. the President of India B. the Parliament C. the Chief Justice of India D. the Law Commission 5.The power of the Supreme Court of India to decide disputes between the Centre and the States falls under its (UPSC P 2014)

A. advisory jurisdiction B. appellate jurisdiction. C. original jurisdiction D. writ jurisdiction Answers: 1-A, 2-A, 3-C, 4-B, 5-C

|

DIRECT TAXES

A direct tax is one that is levied directly on an individual or organization's income, wealth, or property. The taxpayer bears the burden of the tax and cannot easily shift it to someone else. In contrast, an indirect tax is levied on a transaction, such as a sale of goods or services, and often gets passed on to the consumer in the final price.

Here are some common examples of direct taxes:

- Income tax: This is a tax on the income earned by individuals and businesses.

- Property tax: This is a tax on the value of real estate or other property.

- Wealth tax: This is a tax on the total value of a person's assets. (Less common than income and property tax)

- Inheritance tax: This is a tax on the value of assets that are inherited from a deceased person.

| Subject | Direct Tax | Indirect Tax |

|---|---|---|

| Definition | Taxes imposed directly on individuals or entities. | Taxes imposed on goods and services rather than on individuals or entities directly. |

| Burden | Cannot be shifted; borne by the taxpayer. | Initially borne by the seller or producer, but can be shifted to the end consumer through higher prices. |

| Examples | Income tax, property tax, wealth tax, capital gains tax. | Sales tax, value-added tax (VAT), excise duty, customs duty, goods and services tax (GST). |

| Progressivity | Usually progressive; tax rate increases as taxable amount increases. | Not inherently progressive; applied uniformly regardless of income level. |

Direct taxes typically consist of several components, each targeting different sources of income or assets.

The main components of direct taxes include:

-

Income Tax: This is the tax imposed on an individual's or entity's income, including wages, salaries, interest, dividends, rental income, and other sources of income. Income tax rates may vary depending on the level of income and other factors.

-

Corporate Tax: Corporations are subject to corporate income tax on their profits. This tax is levied on the earnings of corporations and business entities.

-

Capital Gains Tax: This tax is levied on the profit earned from the sale of assets such as stocks, bonds, real estate, and other investments. The tax rate may vary depending on how long the asset was held before being sold.

-

Property Tax: Property tax is imposed on the value of real estate properties owned by individuals or entities. It is typically assessed annually by local governments based on the assessed value of the property.

-

Wealth Tax: Some countries levy a tax on the net wealth or assets owned by individuals or entities above a certain threshold. This tax is often based on the total value of assets such as real estate, investments, cash, and other valuables.

-

Inheritance Tax (Estate Tax): This tax is imposed on the transfer of assets from a deceased person to their heirs or beneficiaries. It is based on the value of the inherited assets and may vary depending on the relationship between the deceased and the heir, as well as the size of the estate

|

Income tax is part of direct tax or indirect tax?

Income tax is a component of direct tax. It is imposed directly on individuals or entities based on their income. The burden of income tax cannot be shifted to someone else; it is the responsibility of the taxpayer to pay the tax on their earnings. Therefore, income tax falls under the category of direct taxes

|

India's tax structure has three tiers: central government, state governments, and local municipal bodies. Each tier levies specific taxes. Here's a breakdown:

| Level | Taxes Levied |

|---|---|

| Central Government | * Income Tax * Corporation Tax * Goods and Services Tax (CGST) * Customs Duty * Central Excise Duty (phased out with GST) |

| State Governments | * Value Added Tax (VAT) (replaced by GST for most goods and services) * State Excise Duty * Professional Tax * Land Revenue * Stamp Duty * Income tax on agricultural income (rare) |

| Local Municipal Bodies | * Property Tax * Octroi (mostly abolished) * Entertainment Tax (varies by state) * Local service taxes |

Key Components:

- Direct Taxes: Income tax, corporate tax, wealth tax (not very common).

- Indirect Taxes: Goods and Services Tax (GST), customs duty, excise duty (mostly replaced by GST), VAT (mostly replaced by GST), sales tax (varies by state).

GST (Goods and Services Tax): Introduced in 2017, GST is a major reform that applies a single tax on the supply of goods and services across the country. It has replaced a multitude of indirect taxes, simplifying the tax system. GST has three components:

- CGST: Central Goods and Services Tax (collected by central government)

- SGST: State Goods and Services Tax (collected by state government)

- IGST: Integrated Goods and Services Tax (levied on inter-state transactions, collected by central government)

|

Net direct tax collections had stood at Rs 16.64 lakh crore in the preceding financial year 2022-23. Refunds stood at Rs 3.79 lakh crore in FY24, an increase of 22.74 per cent over the refunds of Rs 3.09 lakh crore issued in FY23

Income tax collections continued to be higher than corporate tax collections. Gross corporate tax collection (provisional) in FY24 was Rs 11.32 lakh crore, a growth of 13.06 per cent over Rs 10 lakh crore collected in the preceding year, while the net corporate tax collection stood at Rs 9.11 lakh crore, up 10.26 per cent from Rs 8.26 lakh crore in the previous financial year

|

"Net direct tax" typically refers to the total amount of direct taxes collected by a government after accounting for any refunds or rebates.

To calculate the net direct tax, you would start with the gross direct tax collections, which is the total amount of direct taxes collected from individuals and entities. Then, any refunds or rebates issued to taxpayers would be subtracted from the gross collections to arrive at the net direct tax.

The net direct tax collection is an important indicator of a government's revenue from direct taxes and its effectiveness in tax administration. It reflects the actual amount of revenue that the government receives from direct taxes after adjusting for any refunds or adjustments made to taxpayers

7. Major tax reforms in India

India has undergone several major tax reforms over the years to simplify the tax structure, improve compliance, and boost economic growth.

Some of the significant tax reforms in India include:

-

Goods and Services Tax (GST): One of the most significant tax reforms in India, GST was introduced on July 1, 2017, replacing a complex system of indirect taxes including VAT, service tax, excise duty, and others. GST is a destination-based tax levied on the supply of goods and services, aimed at creating a unified national market, eliminating cascading effects of taxes, and streamlining tax administration.

-

Direct Tax Code (DTC): The Direct Tax Code was proposed to replace the existing Income Tax Act, 1961, with a simplified, modernized, and taxpayer-friendly direct tax regime. Although the DTC has not been implemented in its entirety, certain provisions and reforms proposed in the code have been incorporated into the existing tax laws to improve efficiency and reduce litigation.

-

Reduction in Corporate Tax Rates: In September 2019, the Indian government announced significant cuts in corporate tax rates to boost investment, promote economic growth, and make Indian industry globally competitive. The corporate tax rate for domestic companies was reduced from 30% to 22%, and for new manufacturing companies incorporated after October 1, 2019, the tax rate was further reduced to 15%.

-

Benami Transactions (Prohibition) Act: The Benami Transactions (Prohibition) Act was enacted in 1988 to prohibit benami transactions and provide for confiscation of benami properties. In 2016, the government amended the Act to make it more stringent and effective in curbing black money and undisclosed income.

-

Demonetization: In November 2016, the Indian government announced the demonetization of high-denomination currency notes (Rs. 500 and Rs. 1,000) to curb black money, corruption, and counterfeiting. The demonetization move was accompanied by various measures to promote digital transactions and increase tax compliance.

-

Introduction of Insolvency and Bankruptcy Code (IBC): The Insolvency and Bankruptcy Code was introduced in 2016 to provide a comprehensive framework for the resolution of insolvency and bankruptcy cases in a time-bound manner. The IBC aims to promote ease of doing business, protect the interests of creditors and investors, and facilitate the resolution of stressed assets

|

For Prelims: Economic and Social Development-Sustainable Development, Poverty, Inclusion, Demographics, Social Sector Initiatives, etc.

For Mains: GSIII: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment

|

|

Previous Year Questions

1.Enumerate the indirect taxes which have been subsumed in the Goods and Services Tax (GST) in India. Also, comment on the revenue implications of the GST introduced in India since July 2017. (UPC CSE GS III 2019)

|

MARINE HEATWAVES

A marine heat wave is an extreme weather event. It occurs when the surface

temperature of a particular region of the sea rises to 3 or 4 degrees Celsius above the

average temperature for at least five days. MHWs can last for weeks, months or

even years.

- Marine heatwaves (MHWs) have significant and often devastating impacts on ocean life. Despite seemingly minor temperature increases of 3 or 4 degrees Celsius, these events can have catastrophic consequences for marine ecosystems.

- For example, along the Western Australian coast in the summers of 2010 and 2011, MHWs resulted in devastating fish kills, where large numbers of fish and aquatic animals died suddenly and unexpectedly within a short period and were confined to specific areas.

- Moreover, studies have shown that MHWs can lead to the destruction of kelp forests, which play a crucial role in marine ecosystems by providing habitat and food for many marine animals. The increased water temperatures associated with MHWs are detrimental to kelp, which typically thrive in cooler waters.

- Another significant impact of MHWs is coral bleaching, as seen in the tropical Atlantic and Caribbean in 2005.

- During this event, high ocean temperatures caused more than 80 per cent of surveyed corals to bleach, with over 40 per cent ultimately dying.

- Coral bleaching occurs when corals expel the algae living in their tissues, turning them completely white. This phenomenon severely stresses corals, reducing their reproductive capacity and increasing their vulnerability to fatal diseases.

- Since many marine animals rely on coral reefs for survival, damage to corals threatens their existence as well.

- MHWs also contribute to the growth of invasive alien species, which can disrupt marine food webs.

- Additionally, these events force species to alter their behaviour in ways that increase their risk of harm.

- For instance, MHWs have been linked to incidents of whale entanglements in fishing gear, further highlighting the far-reaching consequences of these heatwaves on marine wildlife.

- Marine heatwaves (MHWs) not only affect marine life but also have significant impacts on humans.

- As ocean temperatures rise during MHWs, storms such as hurricanes and tropical cyclones can become more intense.

- Warmer temperatures lead to increased evaporation and heat transfer from the oceans to the air.

- Consequently, storms travelling across warm oceans gather more water vapour and heat, resulting in stronger winds, heavier rainfall, and more flooding when these storms make landfall.

- This heightened intensity of storms can lead to devastating consequences for human communities in affected areas.

- Furthermore, coral reefs, which are adversely affected by MHWs, are not only essential for marine wildlife but also for human populations.

- According to NOAA, approximately half a billion people rely on reefs for food, income, and protection. When MHWs destroy coral reefs, these human populations are also significantly impacted, facing disruptions to their food sources, livelihoods, and coastal protection.

- The socio-economic impacts of MHWs extend to coastal communities as well. For instance, an MHW over the northwest Atlantic Ocean in 2012 caused marine species accustomed to warmer waters to migrate northward and alter their migration patterns earlier than usual.

- This shift affected fisheries targeting these species in the United States, resulting in economic losses and disruptions to local communities.

- As global temperatures continue to rise, MHWs are projected to become more frequent, intense, and prolonged, exacerbating their adverse effects on both marine ecosystems and human societies.

- Global warming, driven by the increase in greenhouse gas emissions, is profoundly affecting marine heatwaves (MHWs) and the overall health of oceans. Studies, including one published in the journal Nature in 2018 titled 'Marine heatwaves under global warming,' reveal alarming trends.

- Over recent decades, MHWs have become longer-lasting, more frequent, and more intense due to soaring global temperatures. Between 1982 and 2016, the study found a doubling in the number of MHW days, with projections indicating a further increase by a significant factor under various warming scenarios.

- Crucially, the study attributes 87 per cent of MHWs to human-induced warming, emphasizing the direct link between anthropogenic activities and the intensification of marine heatwaves. This intensification is exacerbated by the oceans' role in absorbing approximately 90 per cent of the additional heat generated by greenhouse gas emissions since the Industrial Revolution.

- As a result, global mean sea surface temperatures have risen by nearly 0.9 degrees Celsius since 1850, with a notable increase of around 0.6 degrees Celsius over the last four decades alone.

- With global air temperatures on the rise, ocean temperatures are also increasing, leading to the escalation of MHWs. Compounding this issue, the onset of El Nino conditions, characterized by abnormal warming of surface waters in the equatorial Pacific Ocean, is further exacerbating heat extremes.

- Scientists warn that El Nino events are likely to intensify extreme heat events and could potentially break temperature records in various regions worldwide.

- The unprecedented impact of concurrent phenomena such as soaring global air and ocean temperatures, increased MHWs, and record-low Antarctic sea ice levels. The uncertainties regarding the future consequences of these trends, emphasise the urgent need for proactive measures to mitigate the escalating risks posed by climate change on marine ecosystems and human societies.

|

For Prelims: Marine Heatwaves, Coral Reefs, El Nino, Climate Change,

For Mains:

1. Explain the relationship between global warming and the increasing frequency and intensity of Marine heat waves (MHWs). Assess the potential socio-economic and ecological repercussions of this phenomenon in the Arctic region. (250 words)

2. Discuss the ethical implications of human activities contributing to Marine heat waves (MHWs) and the disproportionate impact they have on vulnerable coastal communities. (250 words)

3. Imagine you are heading a national task force responsible for developing a comprehensive strategy to address Marine heat waves (MHWs). Outline your key priorities and action plan, taking into account scientific evidence, public participation, and sustainable solutions. (250 words)

|

|

Previous Year Questions

1. Consider the following statements: (UPSC 2022)

1. High clouds primarily reflect solar radiation and cool the surface of the Earth.

2. Low clouds have a high absorption of infrared radiation emanating from the Earth's surface and thus cause a warming effect.

Which of the statements given above is/are correct?

A. 1 only B. 2 only C. Both 1 and 2 D. Neither 1 nor 2

2. What are the possible limitations of India in mitigating global warming at present and in the immediate future? (UPSC 2010)

1. Appropriate alternate technologies are not sufficiently available.

2. India cannot invest huge funds in research and development.

3. Many developed countries have already set up their polluting industries in India.

Which of the statements given above is/are correct?

A. 1 and 2 only B. 2 only C. 1 and 3 only D. 1, 2 and 3

Answers: 1-D, 2-A

|