ORGANISED CRIME AND CORRUPTION REPORTING PROJECT (OCCRP)

After Hindenburg, the Organised Crime and Corruption Reporting Project (OCCRP) has made fresh allegations of stock manipulation against the Adani Group.

OCCRP’s report, published earlier today (August 31, 2023), claims that exclusive documents obtained by it show that “in at least two cases … [supposedly public] investors turn out to have widely reported ties to the group’s majority shareholders, the Adani family”, and helped manipulate Adani companies’ stock prices

2.Rule 19A of the Securities Contracts (Regulation ) Rules 1957

Rule 19A of the Securities Contracts (Regulation) Rules, 1957 (SCRR) requires listed companies to maintain a minimum public shareholding of at least 25%.

This rule is intended to ensure that there is a wider distribution of shares among the public and to prevent the concentration of control in a few hands

The rule applies to all listed companies, except for public sector companies. Public sector companies are those that are owned or controlled by the government.

There are a few exceptions to the 25% minimum public shareholding requirement. These exceptions include:

- Companies that are listed on a foreign stock exchange and have a minimum public shareholding of at least 25% in that exchange.

- Companies that are in the process of delisting their shares from the stock exchange.

- Companies that are undergoing a merger or acquisition

The 25% minimum public shareholding requirement is an important regulation that helps to protect the interests of investors and promote a more equitable distribution of wealth. It also helps to ensure that listed companies are accountable to a wider range of stakeholders.

Here are some of the key provisions of Rule 19A of the SCRR:

- Every listed company (other than a public sector company) shall maintain public shareholding of at least 25%.

- The company shall achieve the minimum public shareholding within a period of three years from the date of its listing.

- The company shall make a public announcement if its public shareholding falls below 25%.

- The company shall take steps to increase its public shareholding within a period of six months from the date of the public announcement.

- If the company fails to maintain the minimum public shareholding requirement, it shall be subject to penalties imposed by SEBI.

- The Organized Crime and Corruption Reporting Project (OCCRP) has published a new report alleging that the Adani Group, a conglomerate controlled by Indian billionaire Gautam Adani, used opaque offshore funds to buy shares of its own companies.

- The report, titled "The Adani Leaks," is based on a trove of leaked documents that detail the financial dealings of the Adani Group.

- The documents show that the group used a network of offshore shell companies to buy shares of its own companies, both in India and abroad.

- The report alleges that this practice allowed the Adani Group to artificially inflate the value of its shares and to gain control of strategic assets.

- It also alleges that the group used the offshore funds to avoid paying taxes and to conceal its financial dealings from regulators.

4. SBI and DRI on Allegations of OCCRP

The Securities and Exchange Board of India (SEBI) and the Directorate of Revenue Intelligence (DRI) have both said that they are investigating the allegations made by the Organized Crime and Corruption Reporting Project (OCCRP) against the Adani Group

SEBI said in a statement that it is "looking into the matter" and that it will "take appropriate action" if any wrongdoing is found. The DRI said that it is "conducting a preliminary inquiry" into the allegations and that it will "take further action as warranted".

5. Security Exchange Board of India (SEBI)

- The Securities and Exchange Board of India (SEBI) is the regulatory body responsible for overseeing and regulating the securities market in India.

- It was established on April 12, 1992, as an autonomous statutory body under the SEBI Act, 1992.

- SEBI's primary objective is to protect the interests of investors in securities and promote the development and regulation of the securities market.

- SEBI regulates various aspects of the securities market, including stock exchanges, intermediaries such as brokers and investment advisers, and listed companies.

- It formulates regulations and guidelines to govern market activities and operations.

- One of SEBI's primary goals is to safeguard the interests of investors.

- It works to enhance transparency, provide accurate information, and prevent fraudulent and unfair trade practices

- SEBI encourages research and education related to the securities market. It provides resources and information to help investors make informed decisions.

6. Director of Revenue Intelligence (DRI)

The Directorate of Revenue Intelligence (DRI) is a premier intelligence and enforcement agency of the Government of India on anti-smuggling matters. It is under the Central Board of Indirect Taxes and Customs (CBIC), Department of Revenue, Ministry of Finance, Government of India.

The DRI was established in 1957 to combat smuggling and related economic crimes. It has a wide range of powers and functions, including:

- Collecting intelligence on smuggling and related economic crimes.

- Conducting investigations into smuggling and related economic crimes.

- Apprehending smugglers and seizing smuggled goods.

- Prosecuting smugglers in court.

- Undertaking preventive measures to curb smuggling.

|

For Prelims: SEBI, DRI, Rule 19A of the Securities Contracts (Regulation) Rules, 1957 (SCRR)

For Mains: 1.Discuss the role and functions of the Securities and Exchange Board of India (SEBI) in regulating the securities market. How has SEBI contributed to investor protection and market development in India?

2.Examine the regulatory measures implemented by SEBI to prevent insider trading and market manipulation in the Indian securities market. How do these measures contribute to market integrity?

|

Source: The Hindu

SUPER BLUE MOON

Rakhi is celebrated on the Purnima of the month of Shravan — on August 30-31 will be unusual: it will be both a “blue moon” and a “super moon” and therefore, a “Super Blue Moon”, a rare trifecta of astronomical events.

This special moon will rise at 6.35 pm in Delhi on August 30, a little later in Mumbai, and about an hour earlier in Kolkata.

2. What is a Super moon?

- The orbit of the moon around the earth is not circular; it is elliptical, that is, an elongated or stretched-out circle. It takes the moon 27.3 days to orbit the earth

- It is 29.5 days from new moon to new moon, though. This is because while the moon is orbiting the earth, both the earth and the moon are also moving around the sun and it takes additional time for the sun to light up the moon in the same way as it does at the beginning of every revolution around the earth

- The new moon is the opposite of the full moon it is the darkest part of the moon’s invisible phase, when its illuminated side is facing away from the earth

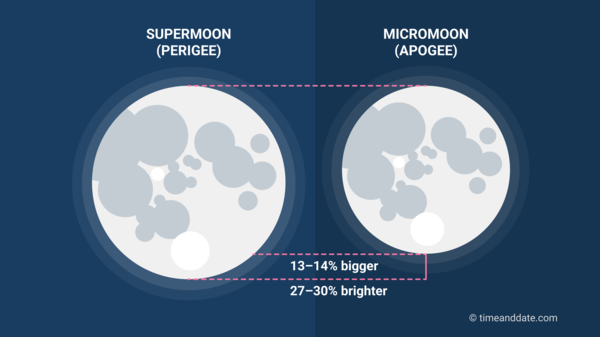

- The point closest to earth in the moon’s elliptical orbit is called perigee, and the point that is farthest is called apogee.

- A super moon happens when the moon is passing through or is close to its perigee, and is also a full moon

- A full moon occurs when the moon is directly opposite the sun (as seen from earth), and therefore, has its entire day side lit up.

- The full moon appears as a brilliant circle in the sky that rises around sunset and sets around sunrise.

- The moon appears ‘full’ not just on Purnima, but also on the night before and after the full moon night

- The term "blue moon" has two meanings. It can refer to a second full moon in a single calendar month, which is a rare occurrence. It can also refer to the third full moon in a season that has four full moons, which happens about every 2.7 years

- The second definition is the more common one, and it is the one that is used in the phrase "once in a blue moon". This phrase means that something happens very rarely.

- The moon does not actually turn blue during a blue moon. The name comes from the way that the Old English word "belewe" (meaning "betrayer") was sometimes used to refer to a second full moon in a month.

- This is because the second full moon would "betray" the farmers who were using the lunar cycle to plant their crops

- A true blue moon, when the moon actually appears blue, is a very rare occurrence. It can happen when the moon passes through dust particles from a volcanic eruption or forest fire.

- The dust particles scatter red light, making the moon appear blue.

- The next blue moon will occur on August 19, 2024. It will be a seasonal blue moon, which means that it will be the third full moon in the summer season

- Sometimes, smoke or dust in the air can scatter red wavelengths of light, as a result of which the moon may, in certain places, appear more blue than usual. But this has nothing to do with the name “blue” moon

- Speaking of colours, you may have noticed that the moon appears more yellow/ orange when it is lower in the sky (closer to the horizon)

- This is because moonlight travels for longer through the atmosphere at this stage, and along the way, more of the shorter, bluer wavelengths of light are scattered, leaving more of the longer, redder wavelengths.

- The NASA explainer points out that dust or pollution can end up deepening the reddish colour of the moon

- According to NASA, a full moon at perigee (super moon) is about 14% bigger and 30% brighter than a full moon at apogee (called a “micro moon”).

- However, it is unlikely the difference in size will be noticeable by most people.

- The moon could appear somewhat brighter, though but whether you are able to make out the difference will depend on factors such as the so-called ‘Moon illusion’, and how cloudy or polluted it is at your location

RESTRICTIONS ON PERSONAL COMPUTERS/LAPTOP IMPORTS

- Import of laptops, tablets, all-in-one personal computers, and ‘ultra small form factor’ computers and servers falling under HSN 8741 will be ‘restricted’ and their import would be allowed against a valid licence for restricted imports, the notification said.

- Also, exemption from import licencing requirements has been given for import of one laptop, tablet, all-in-one personal computer or ultra small form factor computer, including those purchased from e-commerce portals through post or courier. Imports will attract payment of duty as applicable

- The government has also exempted laptops, tablets, all-in-one personal computers, and ultra small form factor computers from import licencing requirements if they are essential part of capital goods.

- For the purpose of R&D (research and development), testing, benchmarking and evaluation repair and re-export, and product development purposes, the government has given exemption from import licence for imports up to 20 items per consignment.

- The condition, however, would be that these imports will be allowed only for use for the stated purposes and not for sale. “Further, after the intended purpose, the products would either be destroyed beyond use or re-exported,”

- The move is being seen as a direct boost to the Centre’s recently renewed production-linked incentive (PLI) scheme for IT hardware.

- A senior government official said that the measure is to push companies to manufacture locally in India, as the country looks to strengthen its domestic production prowess in the electronics sector

- The scheme was revised in May with an outlay of Rs 17,000 crore, more than doubling the budget for the scheme that was first cleared in 2021.

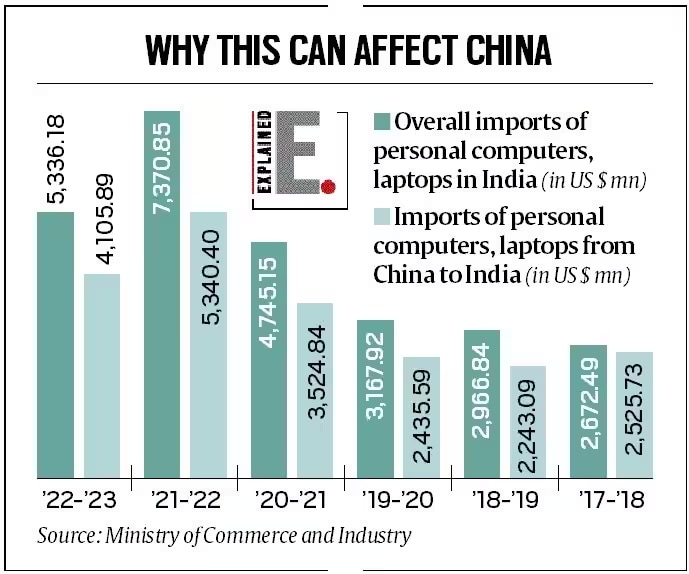

- The push is aimed at makers of laptops, servers and personal computers among others – since a majority of the imports in these segments are from China.

- India has seen an increase in imports of electronic goods and laptops/computers in the last few years.

- During April-June this year, the import of electronic goods increased to $6.96 billion from $4.73 billion in the year-ago period, with a share of 4-7 per cent in overall imports.

- Of the seven categories restricted for imports by India, the majority share of imports is from China

- The Production Linked Incentive (PLI) scheme is a government incentive program launched by the Ministry of Commerce and Industry, Government of India, to boost domestic manufacturing and attract investments in select sectors.

- The scheme offers incentives to companies on incremental sales of goods manufactured in India

- The PLI scheme was first launched in April 2020 for the large scale electronics manufacturing sector.

- It has since been extended to 14 sectors, including automobiles, textiles, food processing, and pharmaceuticals

- The incentive under the PLI scheme is typically a percentage of the incremental sales of the manufactured goods.

- The percentage varies depending on the sector and the product. For example, the PLI for the mobile phone manufacturing sector is 4% to 6% of the incremental sales

- The PLI scheme is a performance-linked incentive, which means that the companies only receive the incentive if they meet certain production and export targets.

- This helps to ensure that the incentives are used effectively and that they actually lead to increased production and exports.

- The PLI scheme has been a major success. It has attracted billions of dollars of investment in the manufacturing sector and has led to significant increases in production and exports. The scheme has also created millions of jobs.

- The PLI scheme is a key part of the government's efforts to make India a manufacturing hub. It is expected to play a major role in the country's economic growth in the coming years

The highest share of imports is in the category of personal computers including laptops, and palmtops, under which imports from China stood at $558.36 million in April-May this year as against $618.26 million in the year-ago period. China accounts for roughly 70-80 per cent of the share of India’s imports of personal computers, laptops.

|

For Prelims: Imports, Exports, Production Linked Incentive (PLI) scheme

For Mains: 1.Discuss the impact of import restrictions on electronic goods and laptops on India's domestic manufacturing sector

2.Examine the reasons behind the Indian government's decision to impose restrictions on electronic and laptop imports. What implications does this decision have for the country's trade relations?

|

|

Previous Year Questions

1.With reference to the international trade of India at present, which of the following statements is/are correct? (UPSC CSE , 2020)

(1) India’s merchandise exports are less than its merchandise imports. (2) India’s imports of iron and steel, chemicals, fertilisers and machinery have decreased in recent years. (3) India’s exports of services are more than its imports of services. (4) India suffers from an overall trade/current account deficit. Select the correct answer using the code given below: (a) 1 and 2 only (b) 2 and 4 only (c) 3 only (d) 1, 3 and 4 only Answer (d)

2.Which of the following best describes the term ‘import cover’, sometimes seen in the news? (UPSC CSE, 2016) (a) It is the ratio of value of imports to the Gross Domestic Product of a country (b) It is the total value of imports of a country in a year (c) It is the ratio between the value of exports and that of imports between two countries (d) It is the number of months of imports that could be paid for by a country’s international reserves Answer (d)

Previous year UPSC Mains Questions 1.How would the recent phenomena of protectionism and currency manipulations in world trade effect macroeconomic stability of India? (GS3, 2018) |

GROSS DOMESTIC PRODUCT (GDP)

There are three primary ways to calculate GDP:

-

Production Approach (GDP by Production): This approach calculates GDP by adding up the value-added at each stage of production. It involves summing up the value of all final goods and services produced in an economy.

-

Income Approach (GDP by Income): This approach calculates GDP by summing up all the incomes earned in an economy, including wages, rents, interests, and profits. The idea is that all the income generated in an economy must ultimately be spent on purchasing goods and services.

-

Expenditure Approach (GDP by Expenditure): This approach calculates GDP by summing up all the expenditures made on final goods and services. It includes consumption by households, investments by businesses, government spending, and net exports (exports minus imports).

3. Measuring GDP

GDP can be measured in three different ways:

-

Nominal GDP: This is the raw GDP figure without adjusting for inflation. It reflects the total value of goods and services produced at current prices.

-

Real GDP: Real GDP adjusts the nominal GDP for inflation, allowing for a more accurate comparison of economic performance over time. It represents the value of goods and services produced using constant prices from a specific base year.

-

GDP per capita: This is the GDP divided by the population of a country. It provides a per-person measure of economic output and can be useful for comparing the relative economic well-being of different countries.

The GDP is a useful measure of economic health, but it has some limitations. For example, it does not take into account the distribution of income in an economy. It also does not take into account the quality of goods and services produced.

Despite its limitations, the GDP is a widely used measure of economic health. It is used by economists, policymakers, and businesses to track the performance of an economy and to make decisions about economic policy

4. Gross Value Added (GVA)

Gross Value Added (GVA) is a closely related concept to Gross Domestic Product (GDP) and is used to measure the economic value generated by various economic activities within a country. GVA represents the value of goods and services produced in an economy minus the value of inputs (such as raw materials and intermediate goods) used in production. It's a way to measure the contribution of each individual sector or industry to the overall economy.

GVA can be calculated using the production approach, similar to one of the methods used to calculate GDP. The formula for calculating GVA is as follows:

GVA = Output Value - Intermediate Consumption

Where:

- Output Value: The total value of goods and services produced by an industry or sector.

- Intermediate Consumption: The value of inputs used in the production process, including raw materials, energy, and other intermediate goods.

Gross Domestic Product (GDP) and Gross National Product (GNP) are both important economic indicators used to measure the size and health of an economy, but they focus on slightly different aspects of economic activity and include different factors. Here are the key differences between GDP and GNP:

-

Definition and Scope:

- GDP: GDP measures the total value of all goods and services produced within a country's borders, regardless of whether the production is done by domestic or foreign entities. It only considers economic activities that take place within the country.

- GNP: GNP measures the total value of all goods and services produced by a country's residents, whether they are located within the country's borders or abroad. It takes into account the production of residents, both domestically and internationally.

-

Foreign Income and Payments:

- GDP: GDP does not consider the income earned by residents of a country from their economic activities abroad, nor does it account for payments made to foreigners working within the country.

- GNP: GNP includes the income earned by a country's residents from their investments and activities abroad, minus the income earned by foreign residents from their investments within the country.

-

Net Factor Income from Abroad:

- GDP: GDP does not account for net factor income from abroad, which is the difference between income earned by domestic residents abroad and income earned by foreign residents domestically.

- GNP: GNP includes net factor income from abroad as part of its calculation.

-

Foreign Direct Investment:

- GDP: GDP does not directly consider foreign direct investment (FDI) flowing into or out of a country.

- GNP: GNP considers the impact of FDI on the income of a country's residents, both from investments made within the country and from investments made by residents abroad.

-

Measurement Approach:

- GDP: GDP can be calculated using three different approaches: production, income, and expenditure approaches.

- GNP: GNP is primarily calculated using the income approach, as it focuses on the income earned by residents from their economic activities.

|

For Prelims: GDP, GVA, FDI, GNP

For Mains: 1.Discuss the recent trends and challenges in India's GDP growth

2.Examine the role of the service sector in India's GDP growth

3.Compare and contrast the growth trajectories of India's GDP and GNP

|

|

Previous Year Questions

1.With reference to Indian economy, consider the following statements: (UPSC CSE, 2015)

1. The rate of growth of Real Gross Domestic Product has steadily increased in the last decade. 2. The Gross Domestic Product at market prices (in rupees) has steadily increased in the last decade. Which of the statements given above is/are correct? (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 Answer (b)

2.A decrease in tax to GDP ratio of a country indicates which of the following? (UPSC CSE, 2015) 1. Slowing economic growth rate 2. Less equitable distribution of national income Select the correct answer using the code given below: (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 Answer (a)

Previous year UPSC Mains Question Covering similar theme: Define potential GDP and explain its determinants. What are the factors that have been inhibiting India from realizing its potential GDP? (UPSC CSE GS3, 2020) Explain the difference between computing methodology of India’s Gross Domestic Product (GDP) before the year 2015 and after the year 2015. (UPSC CSE GS3, 2021) |

DIGITAL SERVICES ACT

1. Context

As Europe’s sweeping rules to regulate the ways in which big tech uses algorithms to target users kick in, a number of companies including Meta, Google, and Snap, have been forced to make changes to their platforms including more disclosures on how they use artificial intelligence (AI) to offer “personalised” content to users, and allowing them the option to opt out of being subjected to digital surveillance by these platforms

2.Key features of the Digital Services Act

- Faster removals and provisions to challenge: As part of the overhaul, social media companies will have to add “new procedures for faster removal” of content deemed illegal or harmful. They will also have to explain to users how their content takedown policy works.

- The DSA also allows users to challenge takedown decisions taken by platforms and seek out-of-court settlements

- Bigger platforms have greater responsibility: One of the most crucial features of the legislation is that it avoids a one-size fits all approach and places increased accountability on the Big Tech companies.

- Under the DSA, ‘Very Large Online Platforms’ (VLOPs) and ‘Very Large Online Search Engines’ (VLOSEs), that is platforms, having more than 45 million users in the EU, will have more stringent requirements

- Direct supervision by European Commission: More importantly, these requirements and their enforcement will be centrally supervised by the European Commission itself which is a key way to ensure that companies do not sidestep the legislation at the member-state level

- More transparency on how algorithms work: VLOPs and VLOSEs will face transparency measures and scrutiny of how their algorithms work and will be required to conduct systemic risk analysis and reduction to drive accountability about the societal impacts of their products.

- VLOPs must allow regulators to access their data to assess compliance and let researchers access their data to identify systemic risks of illegal or harmful content

- Clearer identifiers for ads and who’s paying for them: Online platforms must ensure that users can easily identify advertisements and understand who presents or pays for the advertisement.

- They must not display personalised advertising directed towards minors or based on sensitive personal data, according to the DSA

3.Indian Digital Laws vs European Digital Laws

- In February 2021, India had notified extensive changes to its social media regulations in the form of the Information Technology Rules, 2021 (IT Rules) which placed significant due diligence requirements on large social media platforms such as Meta and Twitter

- These included appointing key personnel to handle law enforcement requests and user grievances, enabling identification of the first originator of the information on its platform under certain conditions, and deploying technology-based measures on a best-effort basis to identify certain types of content

- Social media companies have objected to some of the provisions in the IT Rules, and WhatsApp has filed a case against a requirement which mandates it to trace the first originator of a message. One of the reasons that the platform may be required to trace the originator is if a user has shared child sexual abuse material on its platform.

- WhatsApp has, however, alleged that the requirement will dilute the encryption security on its platform and could compromise the personal messages of millions of Indians

- India is also working on a complete overhaul of its technology policies and is expected to soon come out with a replacement for its IT Act, 2000, which is expected to look at ensuring net neutrality and algorithmic accountability of social media platforms, among other things