INCOME TAX DAY

2.History of Income tax Day

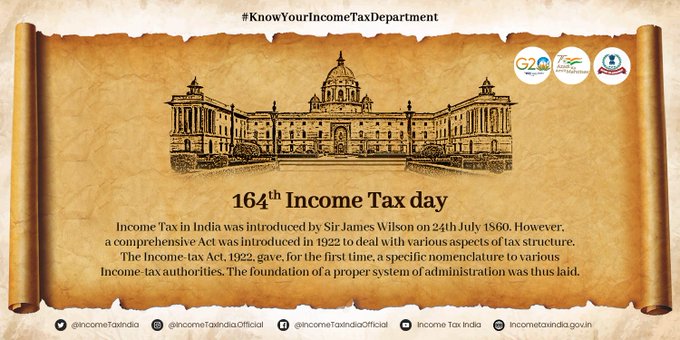

- Income Tax Day is celebrated in India on July 24 every year to commemorate the introduction of income tax in the country. The first income tax law in India was the Income Tax Act of 1860, which was introduced by Sir James Wilson, the then Finance Minister of India.

- The law was enacted to raise revenue to compensate for the losses incurred by the British government during the First War of Independence in 1857

- The Income Tax Day is celebrated by the Income Tax Department (ITD) every year with a series of events and activities.

- These events aim to raise awareness about the importance of income tax and to encourage people to file their income tax returns.

- The ITD also organizes workshops and seminars on tax compliance and taxpayer rights.

- The history of income tax in India is a long and complex one.

- The first income tax law was introduced in 1860, but it was not until the early 20th century that income tax became a major source of revenue for the government.

- The introduction of the Income Tax Act of 1922 was a major turning point in the history of income tax in India.

- This law introduced a number of new features, including the concept of slab taxation, which is still in use today.

- In the years since 1922, the income tax laws in India have been amended many times. These amendments have been made in response to changing economic and social conditions.

- The latest major amendment to the income tax laws was the Income Tax Act of 1961.

- This law is still in force today, and it has been amended several times since its enactment.

-

Introduction of Income Tax: The Income Tax Act of 1860 was introduced by James Wilson, who was the British India's first finance member and later became the Finance Minister of India. The main purpose of implementing income tax was to raise revenue to support the expenses of the government.

-

First Step Towards Modern Taxation: The introduction of income tax in India was a significant step towards modern taxation. Prior to this, revenue for the government was primarily raised through customs duties and other indirect taxes.

-

Evolution of Taxation System: Over the years, the income tax laws evolved, and various amendments and reforms were introduced to adapt to the changing economic and social conditions of the country.

-

Role in Nation Building: Income tax has played a crucial role in building the nation's infrastructure, funding welfare schemes, and financing developmental projects.

-

Source of Government Revenue: Income tax remains one of the major sources of revenue for the Indian government, along with other taxes such as GST (Goods and Services Tax) and corporate taxes.

-

Annual Compliance Deadline: July 24th, Income Tax Day, serves as a reminder to taxpayers to file their income tax returns within the stipulated deadline, which is usually July 31st for individual taxpayers in India.

-

Taxpayer Awareness: The day is also used as an opportunity by the government and tax authorities to raise awareness about the importance of paying taxes and to promote tax compliance among citizens.

-

Celebratory Events: On Income Tax Day, various events and seminars may be organized by the Income Tax Department to educate taxpayers about new tax laws, digital initiatives, and other relevant information.