CAPITAL AND REVENUE EXPENDITURE

1. Context

The Department of Expenditure under the Finance Ministry has approved capital investment proposals of Rs 56,415 crore for 16 states in the current financial year 2023-24, a finance ministry statement said Monday

2. What is a Capital Investment?

A capital investment refers to the expenditure of financial resources (capital) in order to acquire, upgrade, or maintain physical assets or long-term assets that are expected to generate income or provide benefits over an extended period of time.

Capital investments are typically made by businesses, governments, or individuals to facilitate growth, enhance productivity, or achieve specific strategic goals. These investments are made with the expectation of generating a return on the invested capital

2.1. Examples of Capital Investments

- Purchasing or upgrading machinery and equipment to improve production processes or expand manufacturing capacity.

- Acquiring or developing real property such as land, buildings, or facilities for commercial, residential, or investment purposes

- Building or maintaining infrastructure projects like roads, bridges, airports, and utilities to support economic development.

- Investing in computer systems, software, and hardware to improve business operations and technological capabilities.

- Allocating funds for research and development projects to create new products, technologies, or processes

- Acquiring other businesses or merging with them to expand market presence or diversify operations

- Upgrading or renovating existing assets or making significant repairs to extend their useful life

- Purchasing stocks or bonds of other companies or government entities as an investment

3. Special Assistance to States for Capital Investment 2023-24

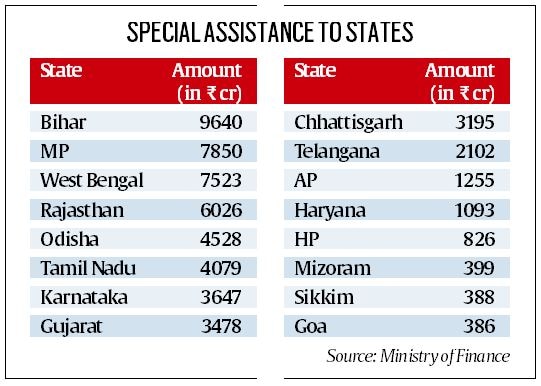

- With an intent to tap into a higher multiplier effect of capital expenditure by frontloading the spending by states, the amount has been approved for 16 states including Arunachal Pradesh, Bihar, Chhattisgarh, Goa, Gujarat, Haryana, Himachal Pradesh, Karnataka, Madhya Pradesh, Mizoram, Odisha, Rajasthan, Sikkim, Tamil Nadu, Telangana, and West Bengal

- The approval has been given under the scheme titled ‘Special Assistance to States for Capital Investment 2023-24’.

- The scheme, which was announced in the Budget for 2023-24 in continuation of a similar push for capex from the last three years, special assistance is being provided to the state governments in the form of 50-year interest-free loan up to an overall sum of Rs 1.3 lakh crore during the financial year 2023-24

- The scheme has eight parts, Part-I being the largest with grant-like special capex facility. In this part, the amount has been allocated amongst states in proportion to their share of central taxes and duties as per the award of the 15th Finance Commission, while other parts of the scheme are either linked to reforms or are for sector-specific projects

4. Capital Expenditure

- Capital expenditure, often abbreviated as CapEx, refers to the funds that a company or organization spends on acquiring, upgrading, or maintaining physical assets, infrastructure, or other long-term assets that are necessary for its ongoing operations or to support future growth.

- Capital expenditures are typically associated with investments in assets that have a useful life extending beyond the current accounting period. These assets are considered vital to the business and are expected to generate benefits and income over an extended period

- Capital expenditures are recorded on a company's balance sheet as assets, and their costs are typically depreciated over time.

- Depreciation is the accounting method used to allocate the cost of the asset over its estimated useful life, which helps match the expense with the revenue generated by the asset

5. What is Revenue Expenditure?

- Revenue expenditure, often referred to as "OpEx" (Operational Expenditure), represents the day-to-day or ongoing expenses that a company incurs in the normal course of its business operations.

- These expenditures are not meant to acquire long-term assets or provide future benefits; instead, they are necessary to sustain the company's current operations and generate immediate revenue.

- Revenue expenditures are typically fully expensed on the income statement in the period in which they are incurred.

- Revenue expenditures are distinct from capital expenditures (CapEx), which involve investing in long-term assets that are expected to provide benefits over multiple accounting periods.

- While capital expenditures are capitalized and depreciated over time, revenue expenditures are fully expensed immediately.

- Properly distinguishing between these two types of expenditures is important for accurate financial reporting and tax considerations.

- Revenue expenditures are considered necessary to maintain the company's ongoing operations and are essential for generating revenue in the short term.

6. Capital Expenditure vs Revenue Expenditure

| Subject | Capital Expenditure | Revenue Expenditure (OpEX) |

| Purpose | CapEx involves spending on assets that provide long-term benefits and are expected to generate revenue or provide value over an extended period. These expenditures are typically investments in the business's growth and expansion, such as acquiring new assets, upgrading existing ones, or building infrastructure | OpEx includes day-to-day operating expenses that are necessary to maintain the company's current operations and generate immediate revenue. These expenses are typically recurring and are incurred to sustain the normal business activities. |

| Treatment on Financial Statements | CapEx is recorded as an asset on the balance sheet and is typically depreciated over the asset's estimated useful life. This spreads the cost of the asset over multiple accounting periods. The depreciation expense is then recognized on the income statement. | OpEx is fully expensed in the period in which it is incurred. It is recorded as an expense on the income statement, reducing the company's net income for that period |

| Tax Implications | Depending on tax regulations and the jurisdiction, capital expenditures may be eligible for tax benefits, such as depreciation deductions or investment tax credits. These tax benefits can help reduce the company's taxable income and, therefore, its tax liability | Revenue expenditures are typically fully deductible in the year they are incurred for tax purposes, which can help reduce the company's taxable income in that specific tax year |

| Long-Term vs. Short-Term Impact | CapEx has a long-term impact on a company's financial position. It represents investments in assets that are expected to provide value and benefits over an extended period, contributing to the company's growth and profitability | OpEx has a short-term impact and is necessary to maintain the company's day-to-day operations. While important for generating immediate revenue, these expenses do not typically result in long-term assets or lasting benefits. |

7. Way forward

The Centre has released two instalments of tax devolution totalling Rs 1.18 trillion for June instead of the normal monthly devolution of Rs 59,140 crore

Capex of government has been considered to be the prime driver of capex in the economy in the last few years

|

For Prelims: Capital Expenditure, Revenue Expenditure, Revenue receipts

For Mains: Special Assistance to States for Capital Investment 2023-24

|

Source: indianexpress