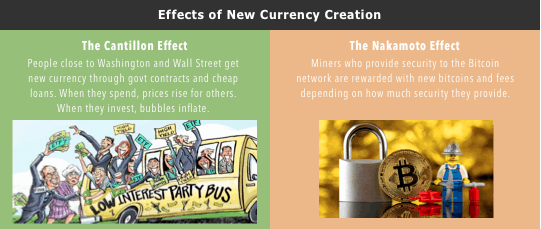

CANTILLON EFFECT

About Cantillon Effect

Cantillon effect refers to the idea that changes in the money supply in an economy cause redistribution of purchasing power among people, disturb the relative prices of goods and services and lead to the misallocation of scarce resources.

The Cantillon effect is named after the 18 th century French economists Richard Cantillon who published his ideas in the 1755 book Essay on the Nature of Trade in General.

QUANTITY THEORY OF MONEY

An increase in the overall money supply in an economy causes a proportionate rise in the prices of goods and services over the long run.

The total amount of money in an economy plays a crucial role in determining the general price level.

CANTILLON:

- When the money supply is expanded, the fresh money does not get evenly distributed across the economy all at once

- The fresh money is injected into particular sections of the economy first and thus people in these sections of the economy are enriched when compared to people in the rest of the economy

- In other words, when the money supply is expanded, the purchasing power of people who first receive the freshly created money is enhanced at the cost of the rest of society.

- When the first recipients of freshly created money spend their money on certain goods and services, the prices of these goods and services begin to rise before the prices of other goods and services.

- This is because the freshly created money takes time to percolate through the wider economy and causes the prices of all goods and services to rise proportionately.

- Thus there is a disturbance in relative prices of goods as fresh money is injected into the economy and contrary to what economists have traditionally assumed.

IMPACT OF RELATIVE PRICES

- Relative prices play a crucial role in the allocation of scarce resources in an economy.

- Prices act as important signals to entrepreneurs in the allocation of scarce resources towards various ends of society and changes in relative prices can thus affect how scarce resources are allocated.

- Changes in money supply can also lead to the misallocation of savings in the credit market as investors may allocate savings based on the signals sent by relative prices that are outdated and false.

- The Cantillon effect has been widely cited by economists who are critical of expansionary central bank policy to tackle economic downturns.

- Mainstream economists believe that recessions are the result of a drop in aggregate spending, which can be sorted out by expansionary monetary policy that compensates for the drop in aggregate demand.

- Critics argue that when a central bank increases the money supply, it can have a real effect on the economy

- Cantillon’s contributions to monetary theory encouraged economists to see that changes in money supply even by central banks can have real effects on the economy.